We wrote about the extremely enticing chart setup of copper only a week ago. Things evolved incredibly fast since then. In a week time the copper price has been surging through resistance on the daily chart, which implies bullish energy on the short term.

The key question is what this means for the longer term:

- Should investors enter a copper investment given the already strong copper price rally?

- Is this the start of a new copper bull market?

- Is the market overbought?

Before answering these questions, it is mandatory to get a sense of sentiment and listen to the voice of mainstream media. Interestingly, there is hardly any talk of copper’s price surge, which makes us extremely happy as, in general, every price surge that takes place ‘under the radar’ has the most potential. Otherwise stated, the less mass media and mass investments taking place at the start of a new bull market, the more upside potential. The only article we found today about the surging copper price was on Marketwatch:

Copper prices on Wednesday leapt to their highest since July 2015 after Trump, while addressing supporters after his stunning upset to win the U.S. presidential race, reiterated his plan to embark on upgrading infrastructure in the country. Improvement of roads, airports and ports are among the projects Trump has previously said he wants to tackle.

Fundamentally it makes sense that copper is anticipating increased demand. The question, however, is whether this is a sustainable long term anticipation or merely speculation.

It is a matter of days until we will get the answer to the above question. Why? Because copper arrived at a secular resistance point on its chart. The surging copper price is trading exactly at $2.5 which coincides with a trendline that connects all tops since copper’s all-time-high in 2011.

Copper’s price surge about to introduce a new copper bull market … and how to play it

A sustained break out above $2.6 (which means that the copper price would trade at least a week above that price point would suggest a new secular bull market has started, indeed ‘under the radar’ which makes it incredibly attractive.

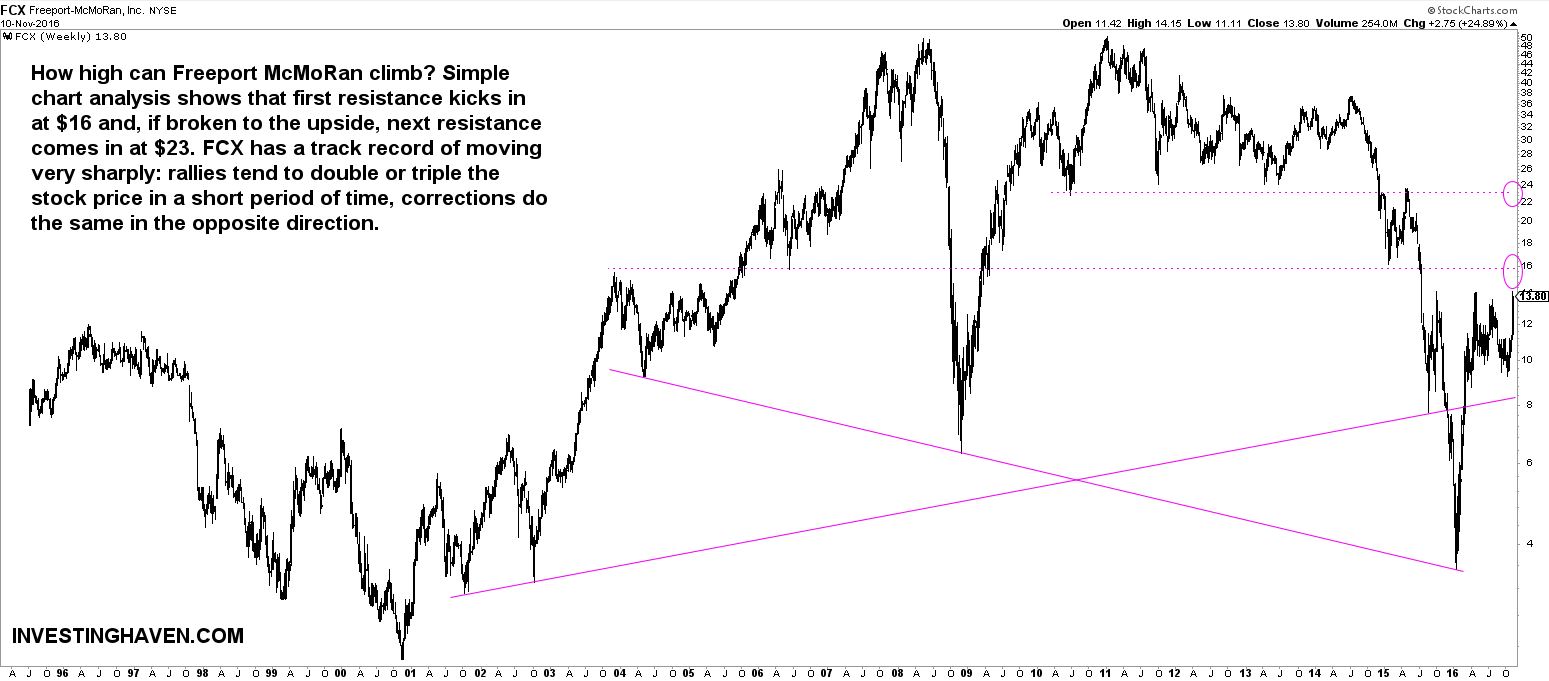

The easiest way to play a copper secular bull market is to invest in one of the major copper miners. Our preference goes to Freeport McMoran, symbol FCX, with a market cap of $18B. FCX can easily move to $16 from here, which is a rise of 15% . The real resistance level kicks in at $23 which is 72% below today’s price level. If (that’s a big IF) copper breaks out, then we would see $23 in FCX in 2017, without any doubt. It is a matter of days until the market will reveal the first signs of that scenario playing out or not.