Not often do we really get excited at InvestingHaven. However, with the ultimate confirmation of the new secular bull market in emerging markets we are proud because we saw this coming more than a year ago. We continuously shared our observations and forecasts with our readers. We got many ‘thank you’ messages, and that is the ultimate appreciation for our hard work. It is not too late though as the emerging markets new bull market which got confirmed in the first week of 2018 has much more upside potential!

Let’s briefly go back in time, and verify what we observed and read into emerging markets charts:

- Already 2 years ago (February 2016) we signaled a high probability of emerging markets outperformance: Moment Of Truth In Emerging Markets Which Could Become A High Leverage Play. We concluded “If both crude and emerging markets succeed their current test, we would expect to see fireworks especially in the short to medium term in emerging markets” which was right at the time global stock markets were breaking down and the whole world was preparing for a 2008-alike collapse.

- We followed up one month later with Is It Time To Buy India Or Other Emerging Markets? in which we identified India as the top emerging market “We are excited by India’s outlook, and believe it will break out big time in 2016.”

- In our Emerging Markets Forecast for 2017 we recommended to watch the U.S. dollar for an assessment on emerging markets. As the dollar did not break out it implied green light for emerging markets. This is what we wrote more than a year ago: “For 2017, our emerging markets stocks forecast really depends on what the dollar will do at current price levels. The dollar is about to break out now. If strength continues in the dollar, we see EEM decline to 28, its support area. We cannot image EEM to fall lower, so 28 points is our worst case scenario.” What a great entry point was 28 points in EEM ETF which is now trading above 49 points (one year later).

- A little bit less than one year ago (April) we explained our strong belief that Emerging Markets Will Be Strongly Bullish In 2018. Note: this was 9 months before 2018 kicked off.

Note: all this analysis and forecasting happened at a time when nobody was interested in emerging markets, less than 1% of analysts and investors were bullish. Now that is a time when smart investors take positions. They are happy to be lonely voices because the big (big) profits are made when taking positions early on.

Even one of the most respected investors and analysts who is involved in investing for 4 decades got it wrong. We do not want to call any name here, it would not serve any purpose, but this person was still bearish two weeks ago.

We now see an increasing number of analysts and financial media becoming bullish. Although the secular bull market in emerging markets was brewing for a long time, only now this happens: CNBC becomes bullish: they expect a big rally in emerging markets in 2018.

Yes we are extremely pleased, first and foremost for our readers, who are benefiting from our analysis, way before financial mainstream media ‘gets it’.

Emerging markets new bull market started, it is now official

Already last summer we said that It’s Official: Emerging Markets Break Out Into New Secular Bull Market. So why are we * again * so bullish now, talking about the start of a new secular bull market, even if we said so 7 months ago?

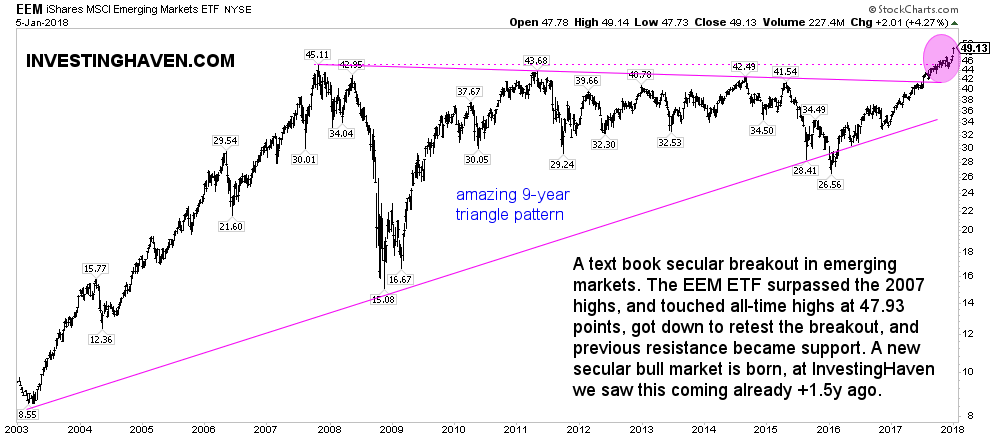

The reason is very simple. A secular breakout into a new secular bull market is not a moment in time. It is a process, and the process can unfold in several ways. The most obvious, and text-book alike pattern, is this: a market consolidates below a major peak (set many years before) for a long time, it sets a series of higher lows, tests at least once the major resistance price point, breaks above it at a certain point, comes down to test it, continues its march higher. The last step is the ultimate confirmation, a mandatory one, to know for sure that a new secular bull market has started.

In that article from last summer we wrote this:

The first chart shows EEM ETF on the very long term (20 years). The unusually long triangle on this chart is the outstanding feature. Try to look for a similar pattern on any other chart; it is close to impossible to find a 9-year long triangle formation. As indicated on this chart the breakout is taking place. The ultimate confirmation is 46 points in EEM. The downside is 35 points, just 18 percent below today’s level. The fact that the gap between breakout and breakdown is so small is very bullish!

Emerging markets bull market: too late to enter?

No it is not too late, but investors should not wait before the big profits are absorbed by that small group of smart investors. The fact that financial media are still not convinced, as they continue to publish warning and bearish signs of the emerging market bull market, makes us very convinced it is just the start of a great bull market.

How to participate?

Very simple, there are a couple of options:

- For defensive investors it is probably safest though not most profitable to get into the EEM ETF.

- For investors with a higher risk tolerance it pays off to choose 3 or 4 stocks across countries in the region. We have helped many investors with our favorite and highest risk/reward tips: 7 High Quality China Stock Tips For Long Term Portfolios. Apart from that we published Latin American Stocks. Brazil looks bullish as well, and India is very strong.