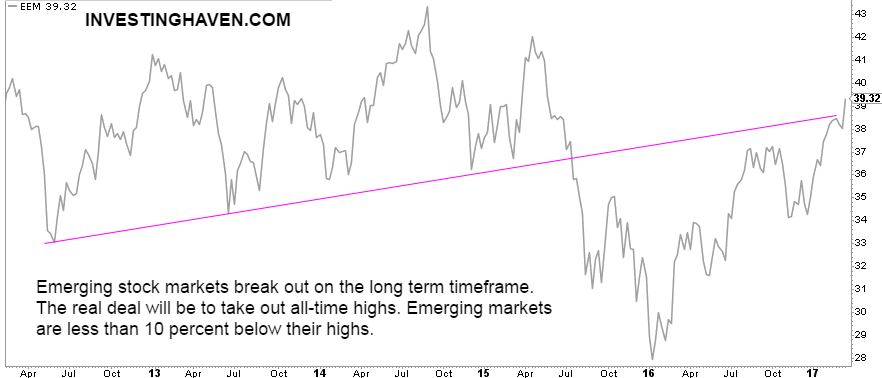

The U.S. Fed decided to hike rates with another 25 basis points. Markets were quite volatile after the announcement. Interestingly, there was a lot of fuzz on price changes in stocks, gold and currencies, but almost nobody was talking about the moves in what is becoming one of the most attractive markets: emerging stock markets. Today, emerging stock markets were able to break out which, as always, is an unusually important event.

That should not come as a surprise as InvestingHaven’s research team saw that coming a long time ago. Almost a year ago, we published this article: Will emerging stock markets become the investment of 2016 and 2017? Later in the year, we publised this emerging stock markets forecast for 2017, and that was another spot-on call. This is a quote from that article:

However, if the dollar weakens from here, and only rises moderately, we see EMM rise to its resistance line at 43 points. That is our bullish forecast Chances are high that EMM could break out. Such an event, given its long sideways trading, would be significant. Emerging markets will attract a lot of interest from the investment community, which will feed the bullishness. The line in the sand is 103 points in the U.S. dollar index.

This quote shows again how intermarket dynamics work. There is always this dominant trend, which is one specific market influencing other martets. Our take on emerging stock markets was that they could rise only if the U.S. dollar would not rise too fast, or, alternatively, weaken. And that is exactly what is happening right now: the dollar is not able to move into a raging bull market, leaving room for emerging stock markets to enter into a bull market.

Emerging stock markets are the clear winner after the U.S. Fed rate hike. The breakout is visible on the 5-year chart. Former resistance has given away today.

As always, a breakout needs to be confirmed. What that specifically means is that EEM ETF, representing emerging stock markets, needs to trade at least 3 consecutive weeks above the 39 level. Moreover, typically a breakout is followed by a retest of the breakout level; if that retest is successful, then it becomes a support area.

‘The real deal’, however, is the 42 level in EEM. As the very long term chart shows there is a huge triangle formation which is in the making for 15 years now. Once EEM breaks out of that chart pattern, it would be an incredibly important event. And, based on the current evolution, it seems that is what is about to happen. What closely the 42 to 46 level, as a sustained break above that would lit a fire on emerging stock markets.