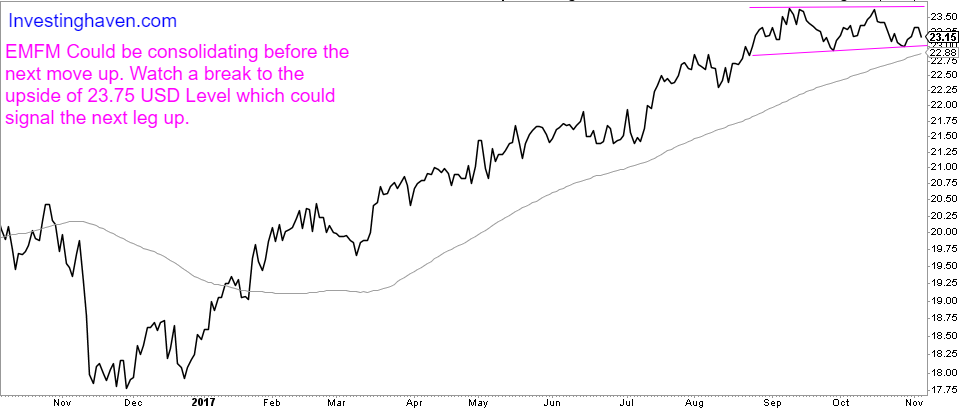

Frontier Markets, represented by the EMFM ETF from Global X are approaching an important price level as the price range seems to be getting tighter. The price seems to be making slightly higher and higher lows as well.

In our article today, we will provide price levels we believe investors need to watch as EMFM seems to be close to an interesting entry price, which might be interesting for our readers looking to get exposure to Next Emerging markets and Frontier markets.

As a reminder, Frontier Markets are riskier than Emerging markets since they are even less regulated and have more challenges to overcome than their emerging counter parts. The risk-reward ratio is interesting though and by using stop losses, it could be a way to manage the risk aspect.

Planning Your EMFM Entry is Key To both Profit and Manage Risk

As we can see from the chart below, EMFM was on a parabolic uptrend since the beginning of 2017. When trading or investing in such a setup, these are some important factors to consider:

- When the price moves up and retraces, it happens VERY fast. To make the most out of the trade you need to catch the move upwards early and exit with your profits before the sharp retrace.

- The pattern usually moves in a step-like formation, frequently testing breakout levels before the next leg up. A good example is Bitcoin price and we have a chart illustrating this in our recent article about Bitcoin Breaking All-time highs again.

- You do not chase a Top on these, because if the Breakout level doesn’t hold, you can expect a 50% retrace from panic selling.

Therefore, planning out entries is very important. Investors currently interested in exposure to Frontier Markets need to watch the following price levels very closely as EMFM might be approaching an interesting entry point:

A Breakout to the upside of 23.75 USD price level with Volume will signal the next leg up that investors and traders want to catch early for maximum profits. They can adjust their stop losses to either right below the buy price for minimal risks or 22.60 USD which would mean the purple support line didn’t hold.

If EMFM Price doesn’t Break 23.75 it needs to hold above 22.60 to continue on a consolidation pattern before choosing a direction. If the 22.60 USD level fails, expect a sharp retrace before resuming upwards move.