The health sector in the U.S. was a strong outperformer until last summer. As markets corrected, we observed clearly a segment rotation, with health and biotechnology in particular being the underperformers.

Times are changing though. We gave our readers a ‘heads up’ a couple of weeks ago when we wrote that Health and biotech sector turn from lagging to leading. Our analysis was spot-on, as health has outperformed most other sectors lately.

As seen on the first chart, the health sector, represented by XLV, is testing all-time highs in 2016. That is major news as the sector has respected support last year (see trendline) and is now close to breaking out.

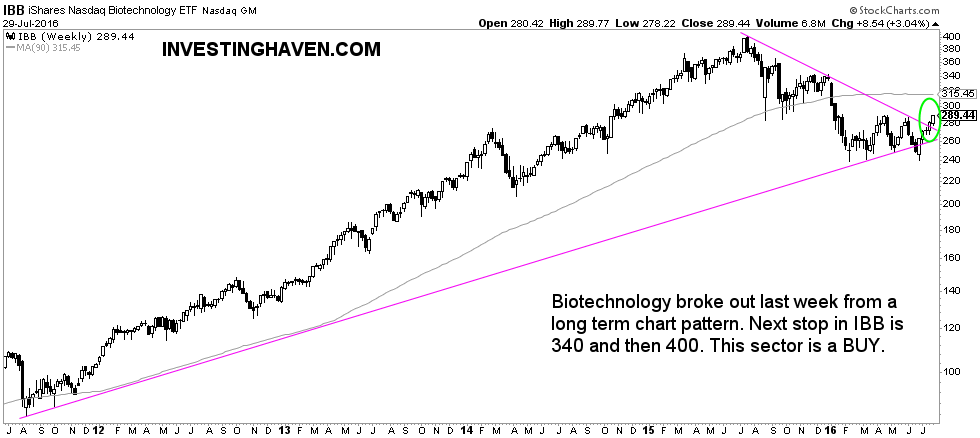

However, the ‘real deal’ is the biotech sector. Last week, it engaged in a huge breakout, one that will have lasting implications. Biotech was suffering strongly in 2016. The long term chart pattern (triangle) has now resolved to the upside, as shown on the IBB chart (representing the biotech sector).

We believe the health sector, and in particular biotech, is a BUY in 2016, current chart setup and for the reasons given outlined above.