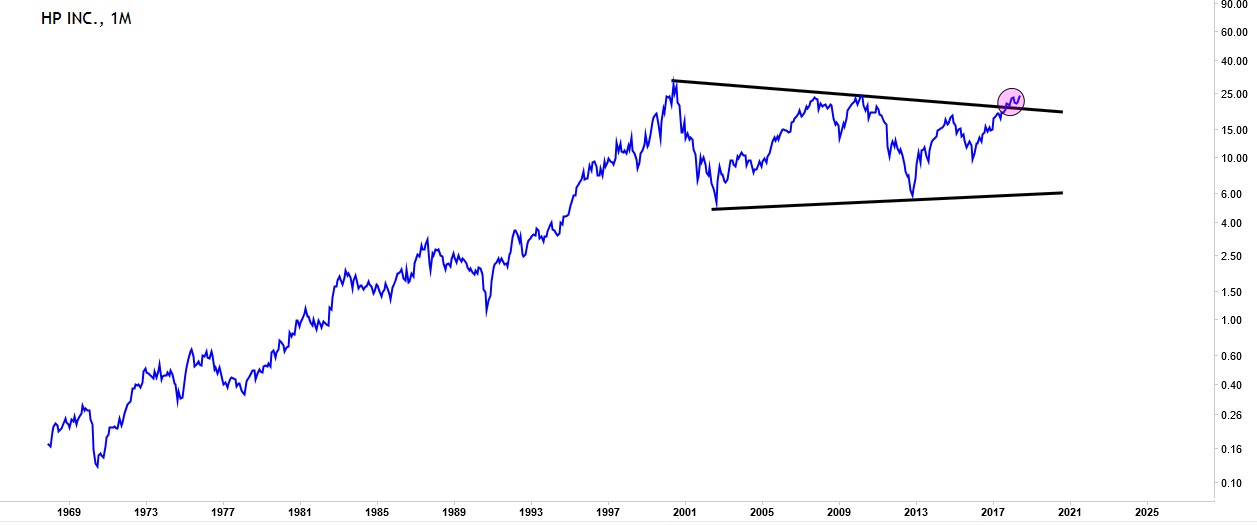

This is breaking news in the tech sector: Hewlett Packard is breaking above its 2000-dotcom peak. After 18 years of crashing, rallying, struggling, this giant tech stock broke out of its gigantic triangle pattern which is in the making since the dotcom bubble in 2000 as indicated on the chart. So that is a double confirmation of a very bullish 2018 outlook for tech stock Hewlett Packard.

According to the current chart setup InvestingHaven’s research team believes that this stock can go up to 60 dollar in the next 4 to 5 years, provided that economic growth continues and the company is profitable. That is a 160% increase from today’s price level.

Of course there will be retracements along the way but the medium to long term outlook of Hewlett Packard is bullish.

Hewlett Packard bullish outlook based on 35 year chart as well as fundamentals

The very long term chart of Hewlett Packard shows price action over the last 50 years. The very long term uptrend is visible on the chart until it peaked in 2000. Since then, we see a combination of two phenomenons: higher lows and lower highs, both combined. That is a texbook triangle pattern setup.

This type of pattern tends to resolve to the upside, at least for healthy companies. Hewlett Packard may have gone through some tough times but it proves to be a strong company, based on its fundamentals, as outlined below.

Not only the chart of Hewlett Packard suggests a bullish outlook, also its fundamentals:

- a healthy P/E ratio of 18x with a future P/E of 11x;

- EPS of 1.28;

- a healthy top line revenue and earnings growth in the last 24 months.

And, as always, financial media tend to focus on the negative or hot news, like the layoffs which were announced last week, but Mr. Market knows better, and ignores this type of news, because the chart looks gorgeous and fundamentals are healthy.

This article serves as an educational piece based on our research insights.