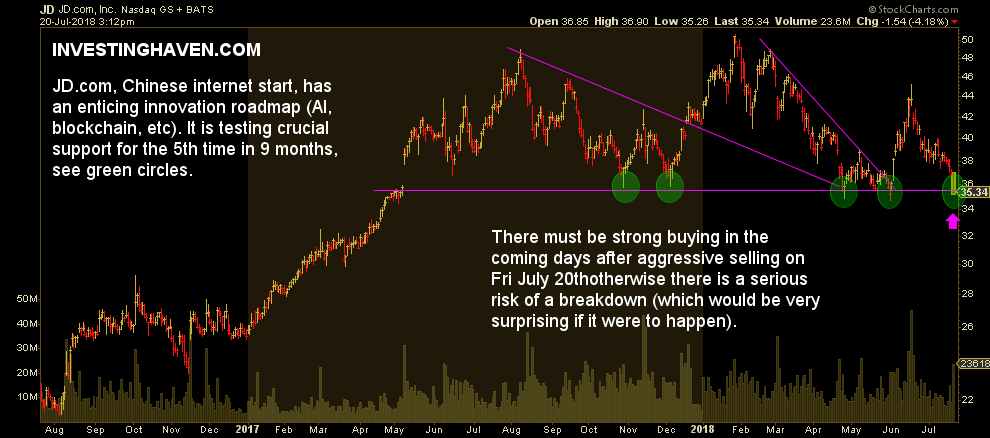

We covered JD (JD) quite extensively in 2018 as it went up and down as a yo-yo. At the close of Friday July 20th the price of JD was 3.7 pct in red. More importantly, though, JD closed the day and the week at $35.51 which is at the verge of a major breakdown as per our previous posts this year. So here is the million dollar question for investors: is JD a stock to buy or sell at it nears a breakdown?

This is what we said in chronological order this year:

2 Great Chinese Internet Stocks With Much Upside Potential

Four months ago Both Baidu (BIDU) as well as JD.com (JD) were reviewed, and both stocks looked quite well. For JD specifically it looked like there was a bullish as well as a bearish outcome though we favored the bullish resolution.

This is the JD chart we published 4 months ago so this is not today’s chart:

JD.com, Chinese Giant Internet Stock, May Be Firing A Buy Signal

Somehow later, JD went up only to retrace to $35.7. That is when we wrote that “it is clear that this is a buy opportunity more than anything else even if the chart of JD suggests this stock is trading at critical support right now.” This conclusion was based on an extensive analysis of JD’s fundamentals as it was trading at exactly the same price level as it is today.

Internet Stock Giant JD.com Shines Again

Somehow a month ago JD started rising strongly, and we observed that this stock may become very bullish in 2018 provided the Chinese stock market holds strong.

JD: stock to buy or sell now?

What is the key lesson here says Ralf Lai, analyst as part of InvestingHaven’s research team:

When it comes to investing, it is always best practice to have the “what if” in mind in case thing go against you. In professional terms this is what smart investors tend to call ‘risk management’. Hence, for each investment or trade taken it pays to review at least every month the potential of the opposite direction you forecasted because there is nothing certain in markets.

From the chart above, published 4 months ago, our bearish case for JD may materialize. That is because there is some sort of head-and-shoulders formation with a neckline at $35.

Should price break below the important support area we may see the following prices: $34.6, $32.5 to $33.5, ultimately $30.

Is this a call to sell? No, not yet, though we expect things to move fast from here, either up or down. Investors who bought above $37.5 and believe there is much more downside it is sensible to cut small losses once JD’s price breaks below $34.6.

Is this a call to short this stock? No, certainly not, this internet giant is doing too good to be shorted, it would be a very risk short trade and we certainly do not recommend this.

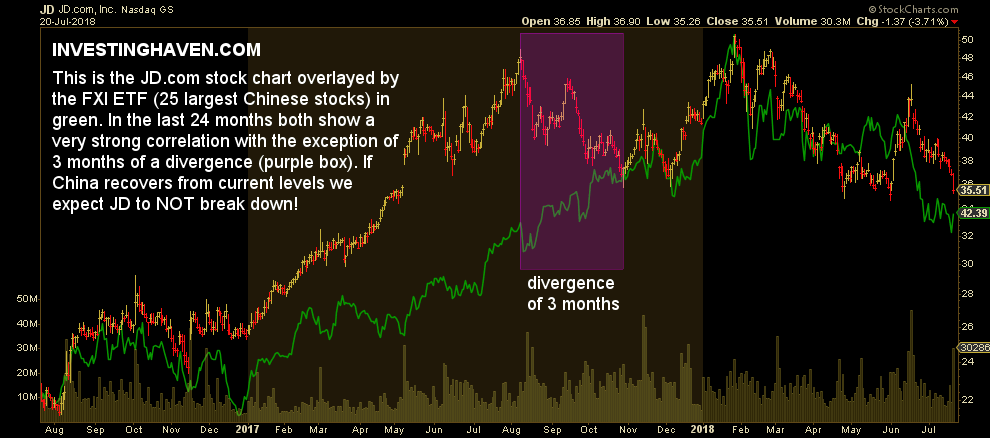

What does InvestingHaven’s research team believe? We believe JD will go up again, not only based on its fundamentals (we refer to the above mentioned article in which we concluded that its fundamentals look great) but also based on the correlation with large cap Chinese stocks which is shown below.

The last chart shows JD overlayed by the FXI ETF price (25 largest Chinese stocks). We believe the FXI ETF will hold because China’s Stock Market Which Trades At A Make-Or-Break Level will also hold. Hence we would conclude that JD, with its great fundamentals, will bounce from here, and not break down.

This is InvestingHaven’s forecast. We may be wrong in which case investors may cut some losses and in which case we believe the breakdown will be temporary. Long term, JD remains an excellent stock, unless it published disastrous results on August 7th which is very unlikely!