The Russian stock market lost 10 percent this week. That may or may not be called a crash. Regardless, it was all over the news. InvestingHaven is on record calling this a a long term buy opportunity.

Let’s face it. Who dares to buy this Russian market after doing some research which reveals the following articles:

Analyst Who Called Russia’s 1998 Crash Says Stock Outlook Is ‘Grim’ (Bloomberg)

No longer safe assets: Invest in Russia at your own risk after US sanctions, strategist says (CNBC)

Russia’s Ruble Catches a Break as Crude Surge Offsets Syria Woes (Bloomberg)

Russian markets are getting slammed as fresh sanctions take hold (Business Insider)

“Toxic Assets”: Ruble Crashes, Russian Stocks Plunge Most In 4 Years After US Sanctions (Tsarizm)

Here’s why big bank stocks are crashing (Yahoo! Finance)

MOSCOW BLOG: Planet Business crashes into Planet Politics (Intellinews)

So what do you do after all these headlines show up, and, even worse, you click on some of them and read the bearish statements? Of course, decide for yourself that you will not buy Russia for a long time. You swear to yourself you will even not consider it for a couple of years, until the dust settles.

This is one of those textbook examples of market crashes which offer a buy opportunity more than anything else. But how will you buy if you just sweared to yourself you will not touch this market, and even not look at it for a long time?

See what we meant in this article Why Investors Should Love Market Crashes, And How To Make Money From A Crash

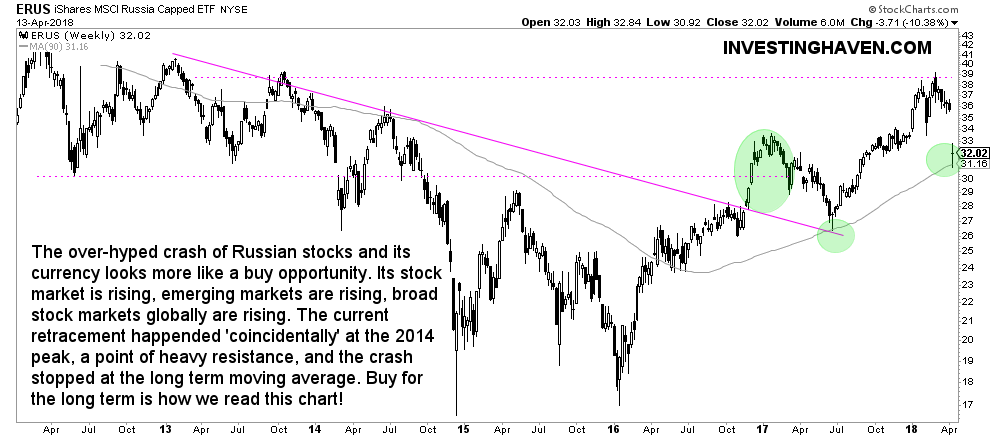

Looking at the ERUS ETF chart representing Russian stocks we can make the point that Russia is offering more of a buy opportunity rather than a reason to panic. Read our annotations on the chart.

As long as ERUS ETF trades above 31 points, it is a buy, simple as that. Oh, and yes, it’s very wise practice to ignore all those articles who are there to confuse you, and hold you back from making profits, and big money out of market crashes. Mark our words.