In this short update we focus on global stock markets, and why the could become very bullish in 2018 though later in the year.

First, let’s go back to our latest analysis Dow Theory Confirms US Stock Markets Still Bullish, Profit Potential Ahead

For Now, we believe that if anything, the Dow theory is pointing to a continuation in the Bullish direction for the US Stock markets that we are monitoring closely. We are also aware that things can move fast and in a different direction anytime so we are watching what we refer to as the “danger zone” in our leading indicators very closely and will be updating our readers and subscribers as new trends unfold.

Overall, U.S. stocks look poised to go higher in 2018.

But what about non-U.S. stocks? Global stock markets are mostly following the U.S. but may move stronger or weaker.

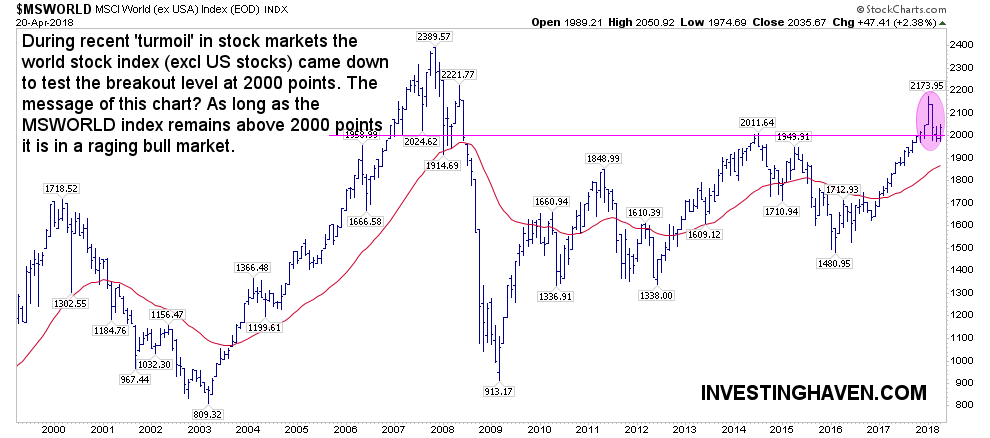

Looking at stocks ex U.S., represented by the MSCI World Index, chart embedded below, we see a potentially very interesting pattern. Earlier this year stock market volatility caused a mini crash after a mega-breakout (purple horizontal line) exactly at 2000 points.

The mini crash braught the index back to 2000 points, the breakout level.

As long as this level holds strong we know for sure that global stock markets ex U.S. will go higher this year.

As said many times in the past we are very bullish on emerging markets, and potentially European stocks could be very well.