The U.S. stock market remains in a bullish mode. As the S&P 500 reaches all-time highs (again), trading above 2400 points, the Dow Jones Industrials goes over 21000 points. The technology index Nasdaq trades at all time highs. Only the Russell 2000, the small cap index, is just 1.5 pct away from its top. The fact of the matter is that, for now, the U.S. stock markets remain in a bullish mode.

Will U.S. stock markets remain bullish or is this the end of the long bull market? That is the million dollar question top of mind of every investor.

Barron’s admits that not many stocks push the stock bull market higher. It is mostly large caps that are driving the broad rally. Many argue that a correction is near because of the fact that the rally is going on for a long time.

Nothing seems further from the truth. In the past year, many fundamental and technical arguments have been offered to explain why the now eight-year-old bull market in U.S. stocks is due for at least a solid correction. But this article on Barron’s suggests U.S. stock markets will remain bullish, “even as news events suggest that pro-market measures such as tax reform might be imperiled – or at least delayed – haven’t hurt stock indexes that much.”

Furthermore, this CNBC article sums up 8 reasons why U.S. stock markets remain bullish. InvestingHaven’s perspective is that, whatever the ‘reason’, it is the outcome that is important. In reality, stocks can go up on good news, but can also go up on bad news. So news is relative as it can be, at least in 99 pct of the cases.

Another perspective is this one on SeekingAlpha, where a former bear became a bull, arguing that the U.S. stock market became bullish last year. While we agree that the chart in that article looks indeed bullish, we have to argue that this author did not take intermarket dynamics into account, first and foremost potential disruption in stock markets because of a long term trend change in yields.

Last, and certainly least, this article on MarketWatch is as vague as it can be. Is the U.S. stock market bullish or not? No idea.

InvestingHaven’s perspective: U.S. stock markets are bullish for now

At this point in time, we see sufficient confirmation of bullish conditions in U.S. stock markets. Particularly 3 charts make us conclude conditions are still bullish.

However, we still believe that a meaningful correction is coming, and that volatility could pick up as of this summer, given InvestingHaven’s proprietary stock market barometer.

First chart, the transportation index is recovering again after having tested important support. The transport sector is important as it tends to lead stock markets.

Second chart, U.S. 10-year Yields, our leading indicator for U.S. stock markets, are testing support. As long as they do not break down, and remain above 22 points, it is bullish for stocks.

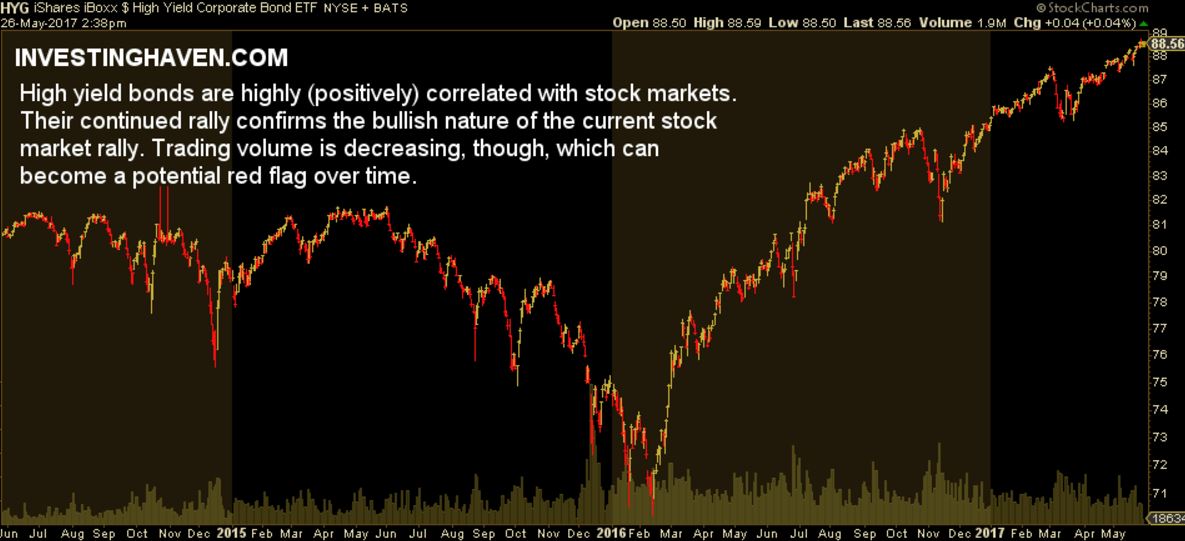

Third chart, high yield bonds remain bullish. High bond yields are positively correlated with stocks.