Our readers vividly remember how we released this market call last year: A China Stock Market Crash In 2017? Not Really!

In it, we explained in great detail why and how we strongly believed China’s stock market would be moving higher in 2017 and 2018, even if most were forecasting a bear market in Chinese stocks.

We recently followed up with this exceptional China stock market chart which confirms China is indeed going higher. Moreover, along the same lines, we wrote how China’s stock market is in a perfect but silent uptrend.

All our indicators are bullish.

To get an idea of how high China can go in the coming years, investors should check China’s long term stock market chart. Interestingly, we observe several interesting insights on that chart.

The 7 most appealing insights on China’s long term stock market chart

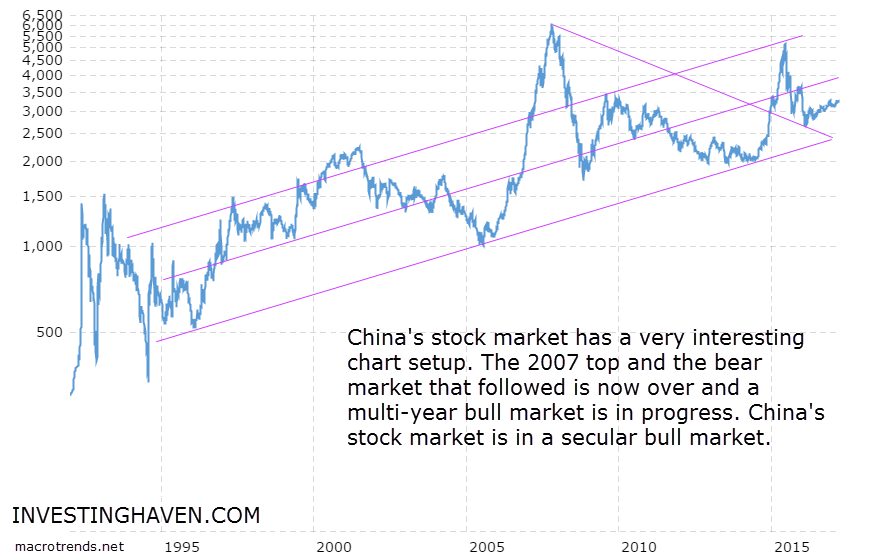

Below is the 25-year stock market chart of the Shanghai Exchange (SSEC), the leading stock market in China.

First, the stock market in China moves in a very long term trend channel since early 90ies, as seen on the chart.

Second, Shanghai Exchange (SSEC) went through a very important bull market test last year, and successfully passed the test, see 2800 points. That was the ultimate confirmation that the bull market would continue.

Third, the bull market will remain silent as long as SSEC trades below the middle trend line within the channel. Once above it, the bull will become violent.

Fourth, China has a strong reputation of moving in a very aggressive way once a bull market starts heating up. Expect fireworks somewhere in the coming years, similar to 2015.

Fifth, the longer the silent uptrend, the higher the upside potential, as the channel is moving higher.

Sixth, the dotted lines on the chart show why 3500 points is in a way a breakout point, once above 3500 things are very bullish.

Last but not least, the risk reward ratio is high at this point, given the position of the market (lower area with the trending channel).