A few weeks ago, we published that the Dow Theory Confirms US Stock Markets Still Bullish, With Profit Potentials Ahead in the US Stock Market. Our article today will provide our readers with an updated outlook for the US Stock market based on the recent performance of both the DJ Industrial (DJI) and DJ Transportation.

Back then, we published the following:

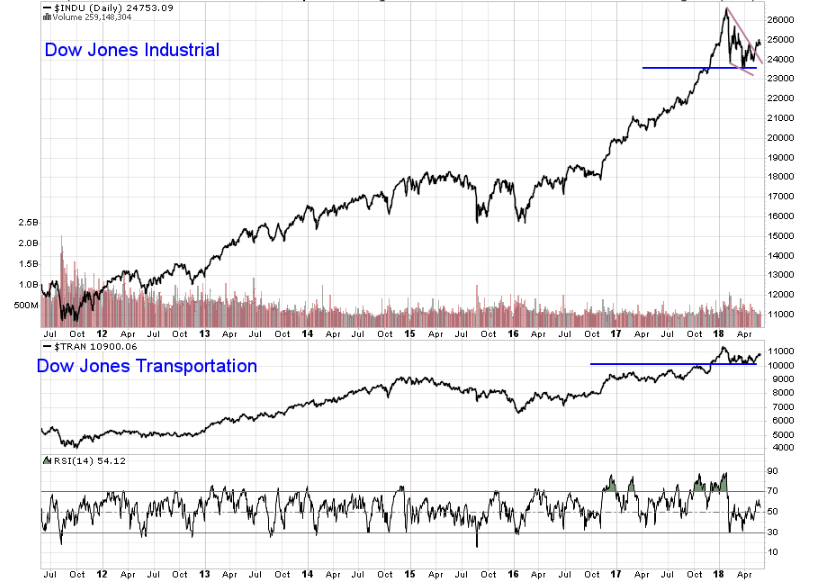

When we look at the performance of both the DJ Industrial and transportation, both are at a major support area, both seem likely to take an upwards direction (path of the least resistance seems upwards). The Dow Jones industrial is even showing a strong continuation pattern: A Bullish Falling Wedge that will likely resolve with a breakout to the upside especially considering the strong support level annotated in Blue (see chart below).

The Dow Jones Transportation looks poised for upside as well. The chart below shows a double bottom, a strong support and a likely strong upwards move in store.

DOW Theory Confirms The US Stock Market Strength

The updated chart below shows clearly the breakout happening currently in the Dow Jones Industrial. The falling wedge resolution is clearly to the upside, and that’s very Bullish for US Stock markets, especially considering that it’s paired with a solid support forming for DJ Transportation and the strong performance US Small caps are demonstrating.

Both DJ Transportation and DJ industrial are showing also more upside potential and if both continue moving in tandem, it is a strong Buy signal for US equities.

The question that might be asked at this point is how can we be Bullish on US equities as well as precious metals and Gold and Silver miners at the same time? Shouldn’t they have a negative correlation?

The answer, as usual is in the charts: Gold and Silver’s multi-year chart patterns indicates potential for a massive Breakout. Patterns that take years to develop are usually very telling. With inflation picking up, 2018 might be a year where we actually see both Gold and US equities trend up.

Again we will have to monitor charts closely, as there is always possibility that the resolution of the triangle patterns in Gold and Silver is to the downside. One thing is clear for now: The Dow theory combined with our Intermarket analysis is pointing towards risk on period for the US Stock markets.