Global stock markets are outperforming U.S. stock markets in 2017. What’s more, it seems that a new era has started in the stock market, one in which U.S. stock markets are not leading any longer.

Let’s review 2 charts in this article which make the point that smart investors are putting their money increasingly into non-U.S. stock markets across the globe starting 2017.

The first chart shows the relative strength ratio of the MSCI World (ex USA) Index divided by the S&P 500 going back to 2007. After leading the world higher during the 1990s, the U.S. underperformed between 1999 and 2008 (not visible on the chart though). The U.S. started outperforming in 2008 and did so until this year (rising ratio, visible on the chart).

The U.S. did better than the rest of world from 2008 through 2016. After spending in almost 5 years in a rising trend channel, it seems that the ratio has broken its rising channel in 2017 (see circle).

That suggests that the decade of U.S. leadership that started in 2008 has probably come to an end.

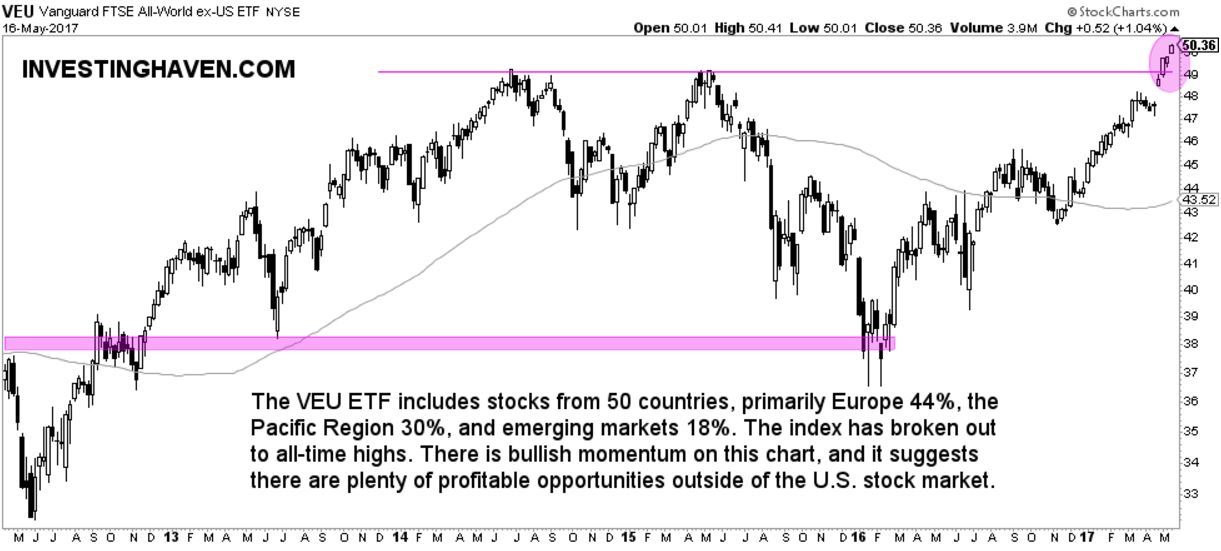

Another reason why money is flowing overseas is because foreign stocks are achieving upside breakouts. The next chart show the Vanguard FTSE All-World ex US ETF (VEU) breaking through its 2015 highs to reach the highest level in a decade. Like all foreign stock ETFs, the VEU is getting an additional lift from stronger foreign currencies. That includes Europe which is the biggest part of the VEU (44%).

Courtesy: StockCharts.com