We believe the stock market correction is running its course. The seasonally weak month of September has only produced one significant down day. Our expectation was that the retracement would take stocks between 5% and 10% lower, as explained in ALL Markets Going Down Except The US Dollar.

However, it seems that the stock market is quite resilient. Two weeks after that strong down days, we have not seen any meaningful sign of a continuation of that retracement. That does bode well for an end of year rally, and, even more important, continued strength in the stock market into 2017.

So far, this evolution confirms our viewpoint that a new stock market cycle started this summer, as shown on the next chart. A new bullish cycle should take us well into 2017, and even 2018. In other words, we are quite bullish for stock market investors in 2017.

Furthermore, our viewpoint is confirmed by intermarket dynamics. Readers know that we believe the crude oil collapse has been the primary trend for ALL markets between the summer of 2014 and early 2016, creating volatility in stocks. That is how intermarket dynamics work. Right now, we do not see significant force in any market creating a primary trend which could stop stock markets from rising.

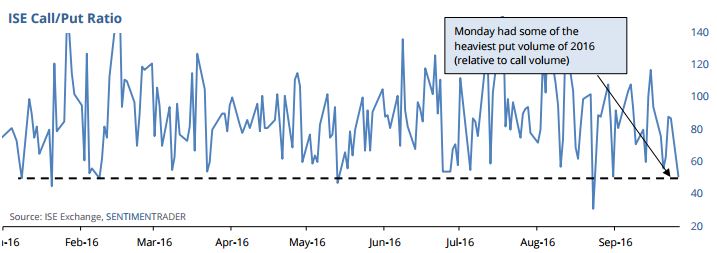

Moreover, our call to put option indicator, courtesy of Sentimentrader, confirms our viewpoint. “On the ISE exchange, traders bought almost 100 protective put options for every 50 speculative call options, one of the most pessimistic readings of 2016.” That is definitely suggesting that we are going through exhaustion selling. In the light of a very mild retracement, still above breakout levels, it suggests the stock market can only become bullish.