The U.S. stock market remains inches away from all-time highs. Stock indexes Dow Jones Industrials, S&P 500 and Nasdaq are all less than 1 percent from their historic highs. The small cap index Russell 2000 showed weakness today and yesterday, and is now 2.4 percent from its highs.

Does this mean that stocks will keep on rising?

For now, that could definitely be the case. However, stocks cannot only rise (or decline). InvestingHaven’s recent forecast is that as of the coming months volatility will pick up according to its market barometer. This market barometer is based on a leading indicator. It is useful to also look at secondary indicators to get confirmation.

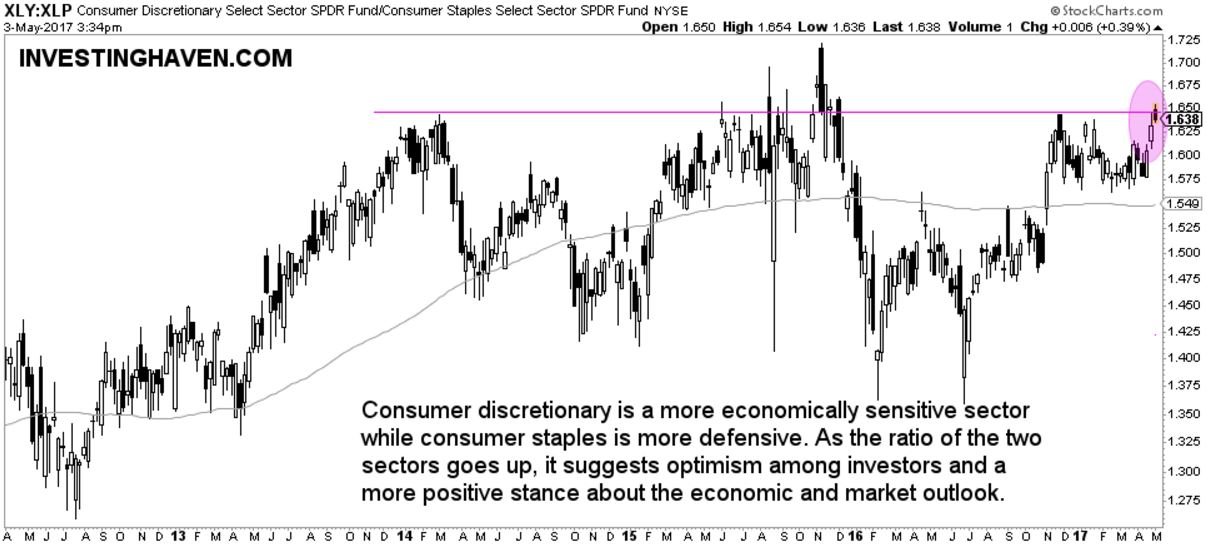

The secondary indicator, which means in plain simple terms that it is not leading, it can only be considered in combination with a leading indicator, is the ratio of economically sensitive vs defensive market sectors.

According to the research team at StockCharts, defensive parts of the market are starting to weaken. That includes consumer staples. At the same time, money is flowing back into more economically sensitive stock groups like consumer discretionary stocks. That’s normally a good sign for the market.

Consumer Discretionary Select (XLY) is surging to a new record. Note the sharp rise in the XLY/XLP ratio on below chart since mid-April. These more economically-sensitive stocks usually outperform when investors are more optimistic on the stock market and the economy.

Though this ratio is near all-time highs, it is clearly attempting to move higher. Investors should closely watch how this ratio (secondary indicator) unfolds in the weaks ahead, combined with the leading indicator (Russell 2000 and 20-year Yields).