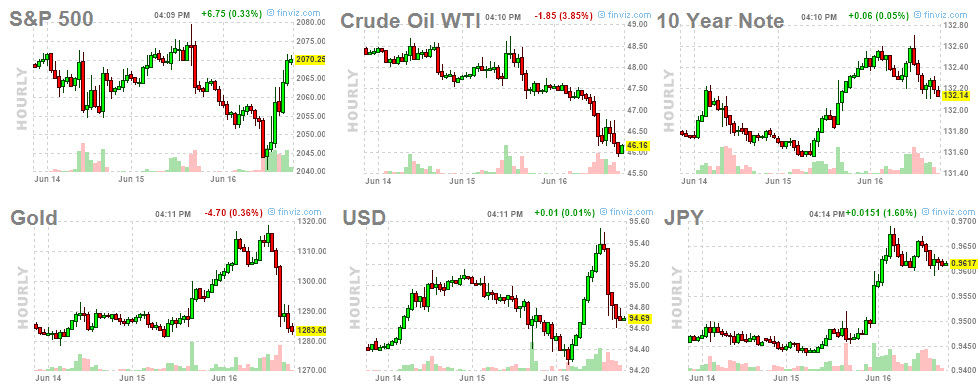

Ironically, this article appears in our section “Reading Markets”, but we have to admit that we have lost track on the message of the market, at least so far this week. As the U.S. Fed announced the result of their monetary policy (no interest rate hike in June, but probably two rate hikes in 2016), markets started swinging in all directions, which is not unusual. The unusual fact, however, is that there is no rational sense in what happened since yesterday.

On the one hand, stock markets, which are considered risk assets, initially went higher only to close the session in red. The stock market decline continued today, but then, unexpectedly, turned into a sharp rally. Crude oil did not follow that path, which is odd given the recent correlation between crude and stocks.

On the other hand, risk off assets like gold / Treasuries / the Japanese Yen went sharply higher yesterday, only to reverse their course today. The U.S. dollar, meantime, followed gold’s path today, which is very odd.

If we look at this from an inflation hedge perspective, we do not find a rational behavior neither as crude and gold would supposedly move in the same direction (which would be the same direction as Treasuries).

What to make out of this? Frankly, we have no idea at this point, as the messages from the market are not consistent, and do not make much sense.

In this type of case, there is one, and only one, advice: sit back and wait for a trend to unfold.

With this, we see another confirmation that markets have become much more difficult than ever before, as explained in our May webinar. We believe it will become even worse, as central bank intervention is the driver of today’s market and as we see a bubble is arising in central banking market impact. One tip we can share with readers: do not try to outsmart the market, nor central banks.