Are markets inflationary in 2018? If so investors should be looking at commodities, and, in there, specific segments for the biggest profits in 2018. Understanding how to know whether markets are inflationary in 2018 is THE single most important objective for analysts. InvestingHaven’s research method has a very specific way to identify whether markets are inflationary, here is how to look at it.

Inflationary markets? Watch these 4 charts.

The key to understand whether markets are inflationary is to look at leading indicators. We have 5 specific indicators in our methodology to identify inflation in markets: the US Dollar, TIP ETF which is a financial instrument but more so a gauge for inflation expectations, the Aussie Dollar, the Commodities index, the small cap stock index Russell 2000.

An analysis of our 5 leading though dinstinct indicators, says InvestingHaven’s research team, suggests momentum is building in inflationary expectations. The odds favor strength in inflation, and, likewise, commodities, resulting in weakness in the US Dollar … or a neutral trend in the USD at best. We want to see a breakout in each of our inflationary indicators, first and foremost the TIP ETF and the Commodities index, underpinned by a rising Aussie Dollar.

First, the Russell 2000 index is breaking out as said recently here. This suggests RISK ON in markets, and that has an inflationary aspect though not stand-alone (must be considered in combination with other leading indicators).

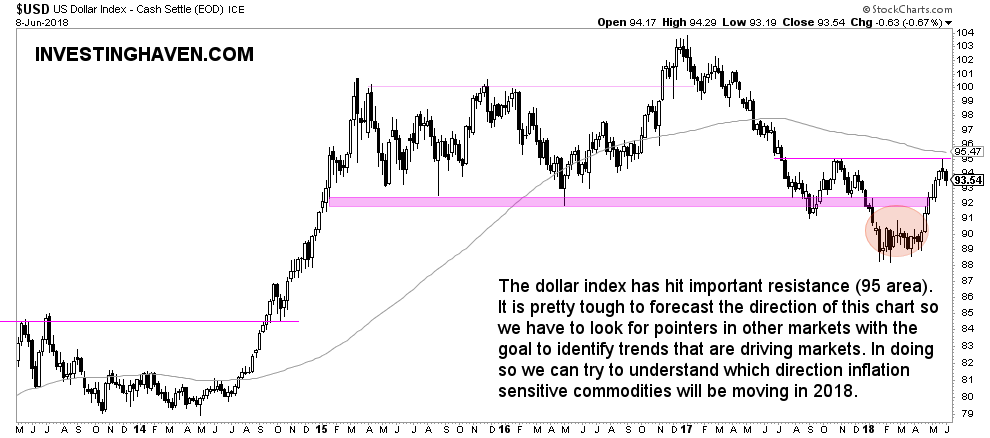

The second indicator is the USD. As the weekly chart below suggests the USD hit major resistance at 95 points. A bearish reversal took place as seen on the chart (peak between 94 and 95 points). For now, this is not a bullish chart, which suggests there is more inflationary than deflationary pressure.

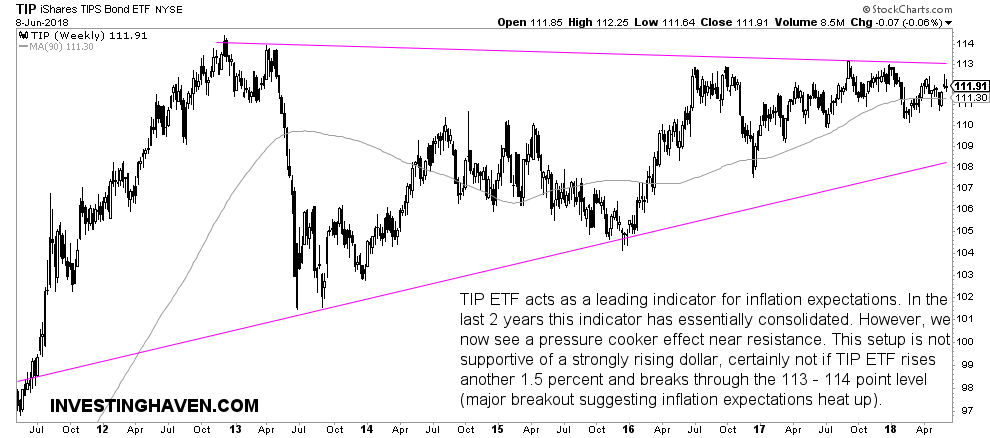

The other indicator is the TIP ETF. It is a gauge for inflation expectations. There is a huge triangle pattern with lots of momentum building around the resistance (breakout) level. A tiny 1.5 percent increase would lead this instrument to break out, suggesting inflation expectations are rising in a decisive way.

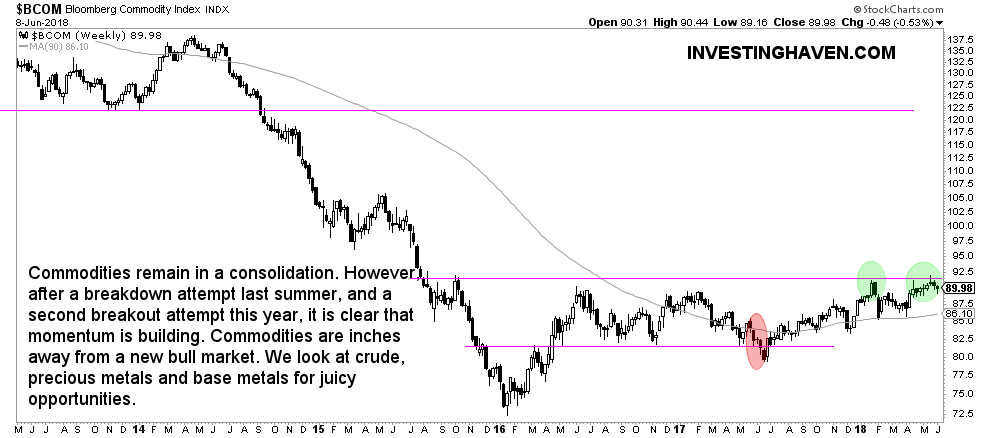

Next is the commodities index. As said many times, for instance in our Commodities Forecast For 2018, there is momentum building here. For now, similar to TIP, this instrument suggests a neutral trend in commodities, but a tiny 2 percent rise would suggest a breakout out of a 24 month consolidation period.

Last but not least, the Aussie Dollar index also hints at momentum in commodities. Small remark here is the recent breakdown, which, until confirmed, is not a major concern for commodities bulls. If the Aussie index rises above 0.77 points it will be in a long term pattern of higher lows, setting the stage for strength in commodities.