Markets move in cycles. Even more important, markets influence each other permanently. If one market moves in such a strong way that it influences other markets, it creates a primary trend.

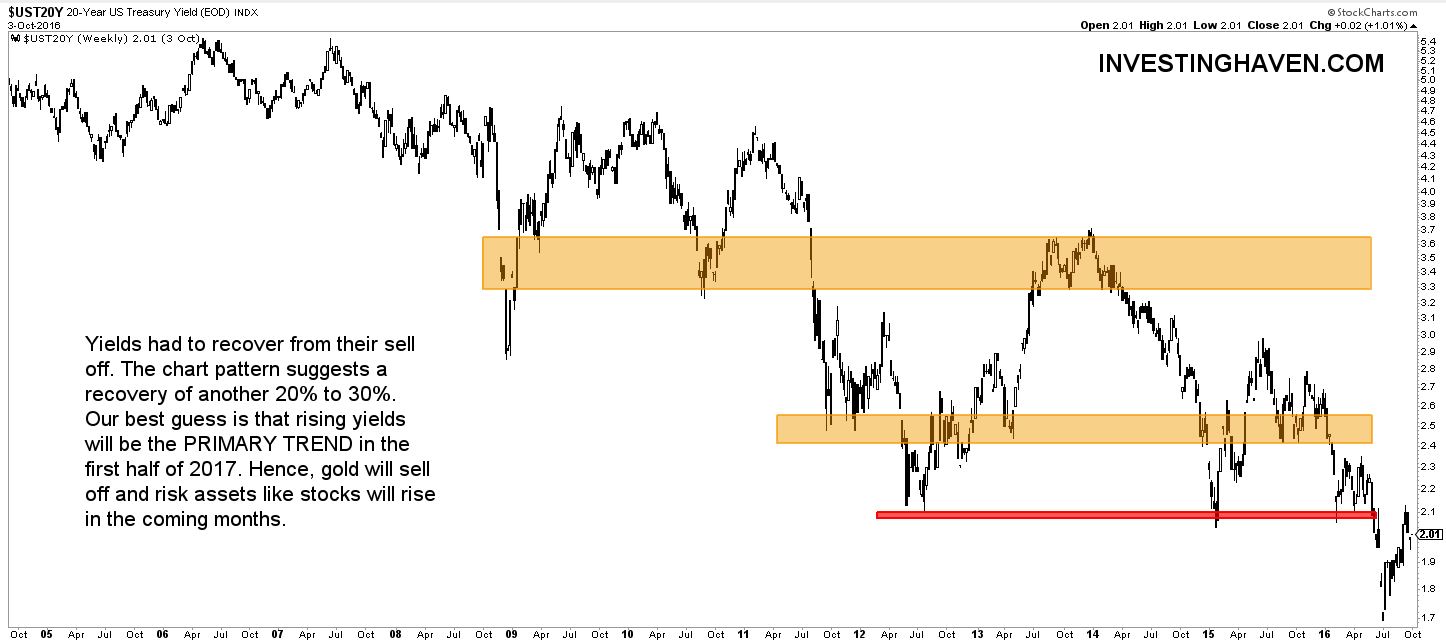

A primary market trend is important as it indicates in which direction all other markets are evolving, and at with strength. Right now, we see a new and strong primary market trend developing for 2017, i.e. rising interest rates.

Forbes rightfully suggested to Spot The Stock Market’s Trend Before It Is Obvious To All, which is indeed the key challenge and a prerequisite in order to become profitable. However, Forbes did not a great job in explaining how those dynamics work.

Before looking into this new primary market trend, let’s first look into the most recent one. Crude oil crashed between the summer of 2014 and February 2016; as crude collapsed, the dollar went through a monster rally and stocks got hit quite hard (though they did not really collapse). That is what we call intermarket analysis.

Note that market moves are mostly part of the same trend. Last year, investors would have similar yields when shorting crude oil, shorting stocks or going long the U.S. dollar as all these moves were part of one and the same primary trend.

Understanding those intermarket dynamics is a key part of our methodology, and we have written about it extensively this year (evidence in these articles: 2-Year Cycle Suggests U.S. Stocks Starting Powerful Rally, Financials Setting Up For Very Strong Rally In 2016 and ALL Markets Going Down Except The US Dollar).

Astute readers have noticed that we mention ‘markets’ but actually mean ‘assets’ which refers to the leading assets / key assets like stocks, commodities, gold, leading currencies, interest rates.

Right now, interest rates are rising, and, in doing so, are influencing several assets. This is intermarket analysis in action. Rising rates are obviously very bad for gold and dollar friendly, as rising rates stand for risk taking and lower real rates. We are convinced that today’s moves in markets will the primary market trend in 2017. Financials (banking stocks, insurances, etc) will benefit from that trend, and commodities will have a negative or neutral effect (except for gold, which we consider a separate asset type).

Below chart suggests that rates can still rise a bit, so from a timing perspective we this trend continuing into the first part of 2017.