Is a stock market bubble in the making? Yes, a stock market bubble is likely to develop in 2017 based on our risk model and proprietary market barometer. As seen several times before, a stock market collapse will likely follow after a stock market bubble.

As usual, we start with a spot-check in financial media to get a sense of sentiment. In general, we see the same analysts predicting a stock market crash, in a typical gloom-and-doom fashion. However, it is the same type of analysts talking about a stock market bubble … up until this week. Remarkably, several articles appeared in financial media on that topic. No coincidence, as stocks are trading at all-time highs.

Investing.com published an article with fundamental data suggesting a stock market bubble is now official. Business Insider points out that the P/E ratio of stocks entered bubble territory. While that is a good indicator, it is only part of the story.

We believe that our proprietary indicators provide much more relevant insights into the question whether a stock market bubble is developing in 2017.

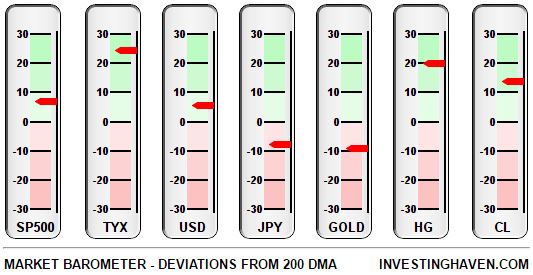

Let’s start with our market barometer. It clearly signals ‘risk on’. With risk assets in a long term uptrend, signaled by the deviation from their 200 day moving average, we are in a ‘risk on’ environment. Risk assets are stocks, yields, copper and crude. Fear assets gold and the Yen are bearish.

While our risk barometer provides important insights, it is only part of the story. The clue is to look at our market barometer in combination with chart structures of leading markets, in particular the Russell 2000 as the most risk sensitive stock index. That is how we read markets at Investing Haven.

‘Risk on’ suggests a stock market bubble in 2017 could be brewing

Interestingly, we observed that a new ‘risk on’ phase started only recently. Historically, we have seen that such a phase takes around 18 months before it reverses into ‘risk off’. That leaves stock markets with quite some upside potential from today’s levels. And that is exactly the underlying reason why we believe a stock market bubble could be brewing.

The next chart makes our point: the Russell 2000, which we consider a leading indicator for other stock indexes, is breaking to all-time highs only at the start of a new ‘risk on’ phase. Note that the different phases indicated on the chart are provided by our general risk model, based on our proprietary market barometer and the chart of 20 year Treasury Yields as a leading indicator for global markets. Read our market outlook 2017 for more insights about our model.

We see primarily upside potential in the small cap sector, but believe large caps in the Dow Jones Industrials (DJI) and the S&P 500 (SPY) will follow. Technology stocks (Nasdaq) are likely to follow as well, as they are quite risk sensitive, although we see much more upside potential in value stocks (financials, energy, industrials) than in growth stocks (technology) currently, as explained in Focus On Value vs Growth Stocks For Profits.