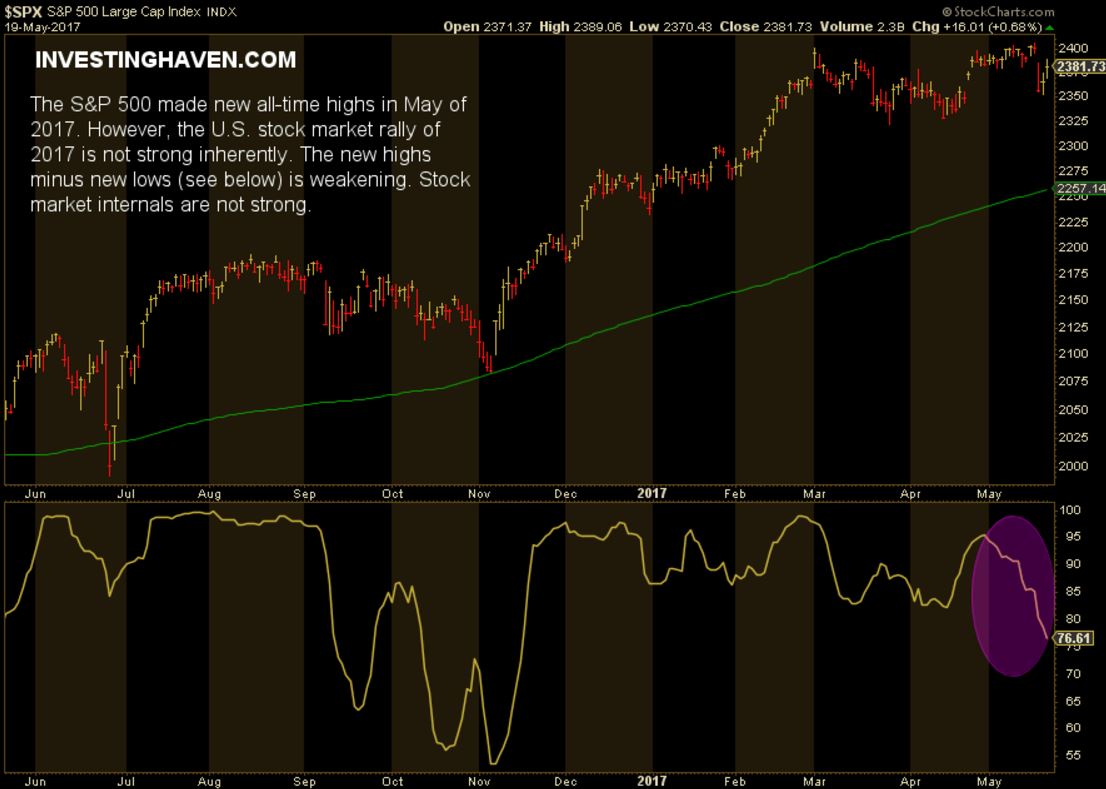

The stock market rally of 2017 is rather weak, says InvestingHaven’s research team. That is because stock market internals are weakening on the rally, and that is fundamentally not good.

Financial media hold different opinions on the stock market rally of 2017, and continuation thereof:

- Business Insider believes that the stock market rally of 2017 will continue until next year based on an Elliott wave analysis.

- CNBC believes there is limited upside potential in the 2017 stock market rally.

- CNN Money is pessimistic on the stock market rally of 2017.

- MarketWatch looks at seasonality and valuations to conclude in a bearish note on the stock market rally of 2017.

InvestingHaven’s research team looks at price analysis, sentiment analysis and market internals when analyzing markets.

The stock market internals are not great at this point. In particular, the number of stocks that make new highs minus the stocks that make new lows is weakening. Stock market bulls want that ratio to strengthen.

The combination of all-time highs in the stock market index S&P 500 with a weakening ratio of new highs minus new lows is a bearish combination.

This should not come as a surprise. Lately, we have noticed a totally different stock market indicator in 2017 which suggests that U.S. stocks are not as strong as they used to be. In the article Global Stock Markets Are Outperforming U.S. Stock Markets In 2017 we wrote how non-U.S. stocks are becoming stronger relative to U.S. stocks.

Moreover, banking stocks, the leaders of the stock market rally in 2017, are facing a breakdown risk.

Last but not least, seasonality in the stock market is not in favor of bulls, as the coming months are typically weaker than the rest of the year.

All in all, we stick to our viewpoint that a 2009 type market crash is not coming, so the U.S. stock market will not crash in 2017. But that does not mean that it cannot correct meaningfully in the coming months.

![[:en]stock market rally 2017[:nl]beursrally 2017[:]](https://investinghaven.com/wp-content/uploads/2017/05/US_stock_market_rally_2017.jpg)