KEY TAKEAWAYS

MoonPay is safe and regulated, with major licenses across the EU and U.S., including New York.

It offers fast, non-custodial crypto purchases, though card payments can be costly.

Best for beginners and small buys, but frequent traders may prefer lower-fee alternatives.

MoonPay Review 2025: MoonPay is a regulated, non-custodial crypto on-ramp trusted by millions. It holds licenses across the EU and USA, including New York. With strong security certifications and fast fiat processing, MoonPay is safe for small to medium crypto purchases, though some payment methods carry higher fees.

However, MoonPay comes with higher card fees, occasional KYC friction.

In this MoonPay review, we look at what the service is, how it works, fees, risks, alternatives, and whether it’s truly safe.

What is MoonPay?

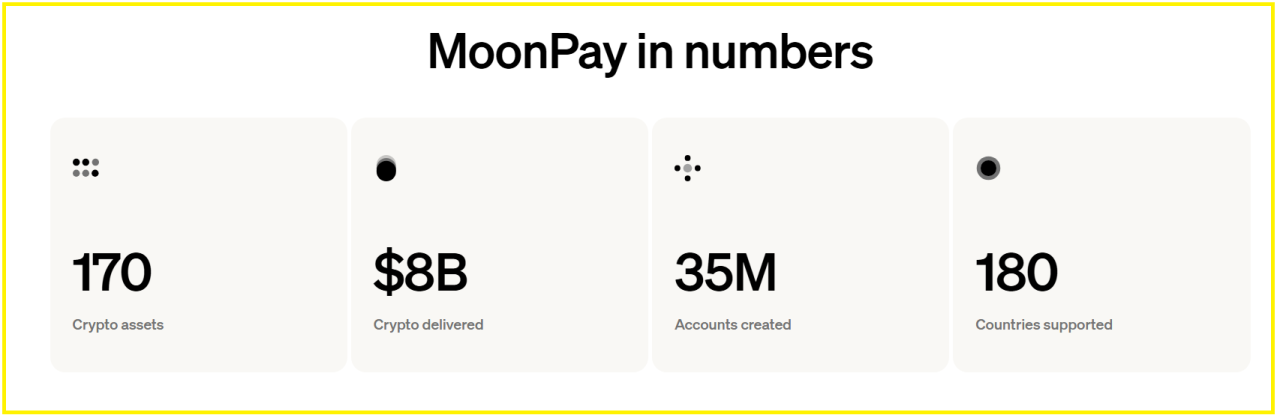

MoonPay launched in 2019 and markets itself as a fiat-to-crypto on-ramp available in many countries. The company reports more than 30 million accounts and processes billions in cumulative volume.

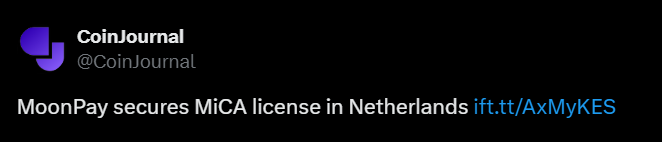

It supports cards, Apple Pay, Google Pay, PayPal, and many bank rails, plus a merchant API. Recent milestones include a MiCA authorization in the Netherlands on Dec 30, 2024 and a New York BitLicense in June 2025, moves that expanded its legal reach in the EU and U.S. markets.

How MoonPay Works

You can Buy crypto with MoonPay in three simple steps:

- Create a MoonPay account here and complete any necessary identity checks

- You pick a crypto asset and enter the wallet address where you want it sent.

- MoonPay accepts your payment and then tokens are sent to the address you provide.

Note that MoonPay is non-custodial so you keep control of private keys when you use your own wallet. Integration partners embed MoonPay’s widget into wallets, marketplaces, and NFT platforms so users can buy without leaving those sites.

For payments, card and mobile-pay methods are instant but cost more, while bank transfers take longer and usually cost less. MoonPay also offers a top-up balance in certain regions for faster, lower-fee buys.

Check supported rails for your country before you buy, because availability varies by region.

Security: Is MoonPay Safe?

MoonPay holds several industry certifications that matter for payment safety. It earned PCI DSS 4.0 certification, which addresses card data security and confirms PCI Level 1 practices.

It also lists SOC 2 Type 2 and ISO 27001 and ISO 27018 certifications, which prove ongoing controls for data and operational security.

Those audits do not make systems immune to every risk, but they do mean MoonPay follows recognized security processes and independent testing making it safe to use.

Regulation: Is MoonPay Legit?

Regulatory approvals matter too. MiCA authorization in the Netherlands lets MoonPay operate across the EU under the Markets in Crypto-Assets framework, and a New York BitLicense adds to a stringent U.S. compliance layer that includes 47 state money transmitter licenses.

These licenses require KYC, anti-money laundering controls, and reporting. Licenses support users who want regulated on-ramps, though they do not eliminate fraud or user error.

Finally, MoonPay emphasizes a non-custodial model, which eliminates platform custody risk but increases the user’s responsibility to secure keys and recovery phrases.

MoonPay Fees And Limits

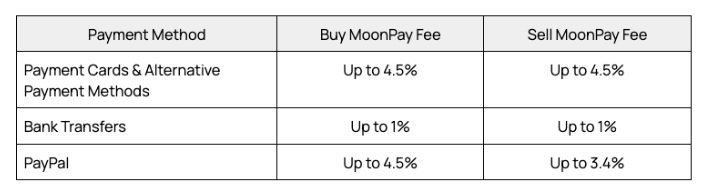

MoonPay’s pricing varies by payment method and region. Here is a quick rundown of MoonPay fees:

- Direct buys through MoonPay can carry fees up to 4.5%, with a minimum fee often around $3.99 or currency equivalent for small transactions.

- Bank transfers tend to cost about 1% or can be free when you use MoonPay Balance in supported regions.

- On-chain network or gas fees apply when tokens move on the blockchain.

For small purchases the fixed minimum makes card buys relatively expensive, so use bank rails or top up a balance when you can.

MoonPay displays final fees during checkout, so review that screen before you confirm. Transaction limits depend on KYC level, with higher verification unlocking larger monthly volumes.

MoonPay User Experience And Customer Support Patterns

Most users praise MoonPay for a smooth, fast checkout and easy wallet transfers. There are more than 100,000 Trustpilot MoonPay customer reviews with an average score near 4.1 out of 5, a sign that many customers find the product usable.

Common praise centers on speed and simplicity, especially for first-time buyers or NFT checkout flows. Common complaints include verification delays, card declines, and the time it takes to resolve refunds or disputes.

MoonPay offers in-app and email support and posts updates in a help center, but response times vary by region and issue complexity. If you value quick self-service, check the support articles before you contact the team, and keep documentation of payments and IDs handy to speed up any review.

MoonPay Pros, Cons, And Who It Works Best For

MoonPay’s strengths include:

- Broad payment rails

- Strong compliance credentials

- Easy integrations that make onboarding fast for new buyers

Drawbacks include:

- Relatively high card fees

- Occasional KYC friction

MoonPay is best for beginners, wallet users who need quick fiat on-ramps, and NFT buyers who want instant checkout. It is less ideal for frequent traders who need the lowest fees or for people who want custodial exchange services with fiat accounts.

MoonPay Alternatives

If you want lower fees, you might consider bank-transfer options on regulated exchanges like Coinbase or local bank rails on platforms such as Transak or Ramp, which trade off speed and coverage, and also may introduce custodial riskFor small, fast buys, you can use MoonPay’s card rails.Always run a test buy, enable 2FA, use bank transfers or MoonPay Balance to reduce fees, and consider storing large amounts in a hardware wallet.

Conclusion

MoonPay is a legitimate, well-audited on-ramp with wide coverage and strong compliance. Use it for easy, quick buys, but you may consider alternatives based on fees for certain purchases. As it is non-custodial, be sure to secure your own wallet keys.

Wondering which crypto to focus on right now?

Our premium members already know.

Since 2017, InvestingHaven’s blockchain research service has been guiding investors through both bull runs and crypto winters.

What makes it different?

Proprietary 15-indicator methodology developed over 15+ years of market research.

Proven track record of spotting major turning points before markets move.

Focused alerts on only the key crypto assets that matter — no noise, no distractions.

Thousands of readers rely on InvestingHaven to stay ahead of the crowd. Now it’s your turn.

👉 Act today and join the original crypto research service — still live and stronger than ever since 2017.

This is how we are guiding our premium members (log in required):

- ATH in BTC = Alt Season 2025 Catalyst? (Oct 5th)

- Crypto Consolidation: When Will Bullish Momentum Return? (Sept 28)

- Is Meme Season Underway? (Sept 19th)

- Alt Season Is Brewing, In Silence. These 3 Charts Tell The Crypto 2025 Story. (Sept 10th)

- Is A Trendless Crypto Market Good or Bad? The Current and Emerging Winners Look Awesome. (Sept 7th)

- BTC Testing Long Term Trendline. Here Is Short and Long Term Guidance. (Aug 26th)

- Crypto – To Break Out Or Not To Break Out? (Aug 23rd)