Emerging markets (EEM) peaked in January of 2018, and have been quite weak since then. The million dollar question is whether emerging markets are a buy or a sell for the second half of 2018?

First, before looking into this, question, let’s consider our previous viewpoints.

Early 2018, we considered that Emerging Markets Would Outperform US Markets. That is partly materialized, at least so far, as, in recent months, US broad markets showed a divergence: large cap stocks in the Dow Jones index are trading slightly lower than early this year, while small cap stocks in the Russell 2000 index are visibly higher. Emerging markets are lower than early this year.

We continued to believe that Emerging Markets were Bullish, and wrote about it in detail a couple of weeks ago, because of 2 reasons. First, from a fundamental perspective, emerging markets valuations are cheap. It is clear that emerging markets have underperformed for many years. That is great from the perspective that, the longer the underperformance lasts, the more profitable the opportunity. Second, emerging markets broke out to new highs, surpassing their 2007 peak.

Moreover, we also found a strong correlation with commodities, as explained in Emerging Markets And Commodities Very Bullish In 2018 and 2019. Both are still correlated, as, in recent weeks, both have been rather weak.

Given all this, what is still accurate, and what do we read in the charts?

Emerging markets: close to a buy opportunity in 2018

Let’s focus on the chart first. InvestingHaven’s method is based on the principle summarized as ‘start with the chart‘.

The point about reading charts is to find the right timeframe which reveals a clear and outspoken pattern which suggests a future direction. No compromise on this principle. There is no sense in trying to imagine a pattern, by almost faking it, if it’s not there.

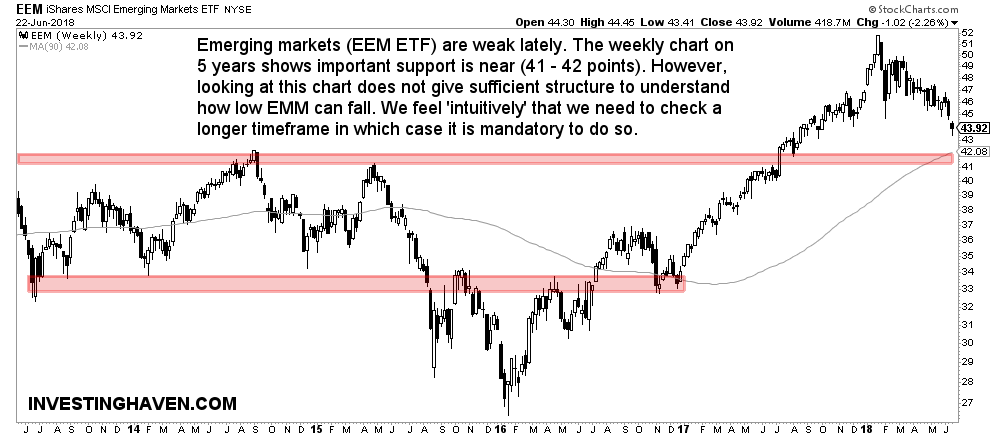

The weekly emerging markets chart on 5 years has some nice insights, first and foremost a longer term support zone in the 41 – 42 points area. However, there is visibly not sufficient info on this chart. What does this chart reveal in terms of longer term trends and forces at play? Intuitively, the answer is that not enough can be deducted from this chart.

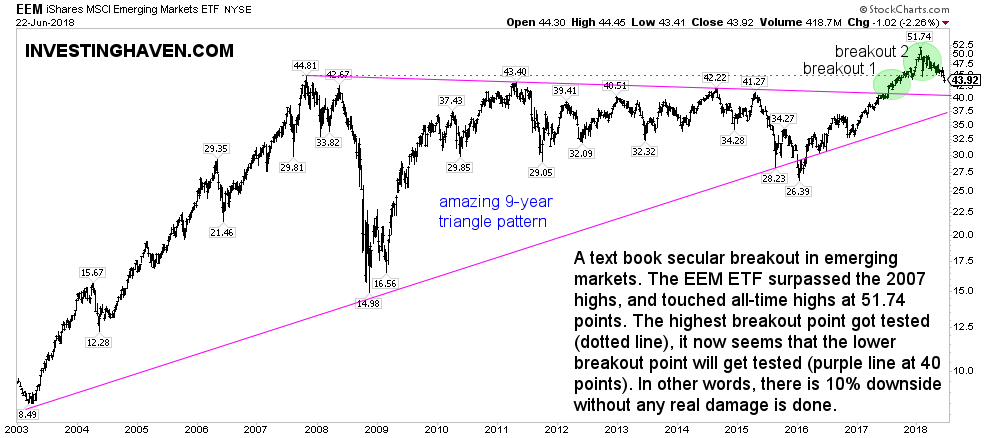

That’s why we have to zoom out, and look at the longer term timeframe. The 15-year timeframe shows a very clear trend, not possible to make it any clearer. This massive triangle pattern has a ‘pixel perfect’ setup, almost to the penny (with one exception which is the false breakdown shown in the first month of 2016). It implies this pattern is reliable in forecasting future price direction.

This long term chart shows two major breakout lines: the one at 44.81 points (the 2007 peak) as well as the trendline connecting all major peaks since 2007. The latter comes in at 40 points.

We highly suspect that the 40 points area of the emerging markets ETF EEM might be tested in the coming weeks and month(s). That is a 10 pct downside compared to current price levels.

We feel quite confident, given all data points outlined in this article, that there is maximum 10 pct downside in emerging markets. It implies that emerging markets might be very close to a very attractive entry point, so we likely flash another buy opportunity anytime soon!

![[:en]emerging stock markets[:nl]groeimarkten[:]](https://investinghaven.com/wp-content/uploads/2017/05/emerging_stock_markets.jpg)