After having peaked early this year, emerging markets are currently retracing. We want to emphasize that this is a retrace and not a crash for emerging markets as some news outlets try to sell. As said many time 99% of news is noise, here is another great example to illustrate our point. So far, InvestingHaven’s research team is maintaining a positive outlook for these markets as we are about to start the 2nd half of 2018.

Readers can find the details of InvestingHaven’s outlook for Emerging markets in 2018 in the following article. 3 months ago, we signaled an important opportunity in Emerging markets. Today, as the iShares MSCI Emerging Markets ETF (EEM) is retracing, we want to update our readers on the current state in these markets.

Emerging Markets are retracing but continue to look Bullish

The chart below covers the performance of Emerging markets since 1995 (EEM ETF). We want to highlight the following key points from this chart:

- 42, as stated clearly in our Emerging markets outlook forecast, is the breakout point. As long as EEM trades above, we consider emerging markets Bullish.

- After reaching a high of 52.08, the price is currently attempting to back test the breakout level. Investors want to see the backtest happen and succeed. The more backtests, the better it is for the performance of EEMs long term.

- The ascending trendline provides secular support that spans over an extremely long period. It was tested with success multiple times as shown in the chart below.

- EEM is approaching what could be a interesting entry level at 42.49 assuming the breakout level of 42 holds. If not, 37.50 is another entry level that would represent an exceptional opportunity for investors to enter this market. We believe however that the 42 level will likely hold, and could make the point that, once EEM ETF goes higher from here, the lows are already in.

Now the question top of mind is with the strength of the US Dollar and markets, how can we still be bullish on Emerging markets? Granted most of these countries have high debt levels and the strength in the US Dollar adds pressure for these countries. But the key in our opinion is to invest in the select few emerging markets that are likely to show strength should the dollar maintain around current levels, therefore have the potential to explode upwards if the US dollar weakens.

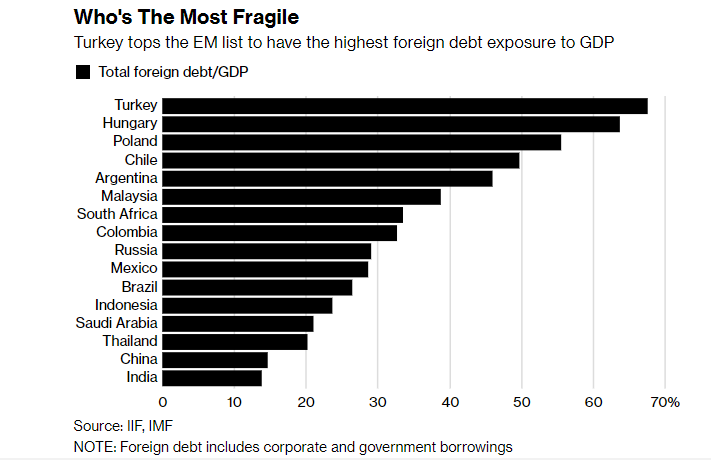

We provided our select top emerging markets to invest in back in 2017 and still consider them our top selection. They also happen to be the least “fragile” to US Strength as they have the lowest foreign debt exposure to GDP as show by the chart below, with the exception of Chile, which we’ve mentioned in the article above has a unique setup.

Source: Bloomberg.