Emerging markets were in great shape this year. We wrote repeatedly how excited we were, and even wrote several articles about emerging markets in 2018.

Emerging Markets: Which Prices To Watch In 2018

Emerging Markets Will Be Strongly Bullish In 2018

5 Emerging Markets To Buy In 2018

This article compares the setup of India with the one of China going into 2018.

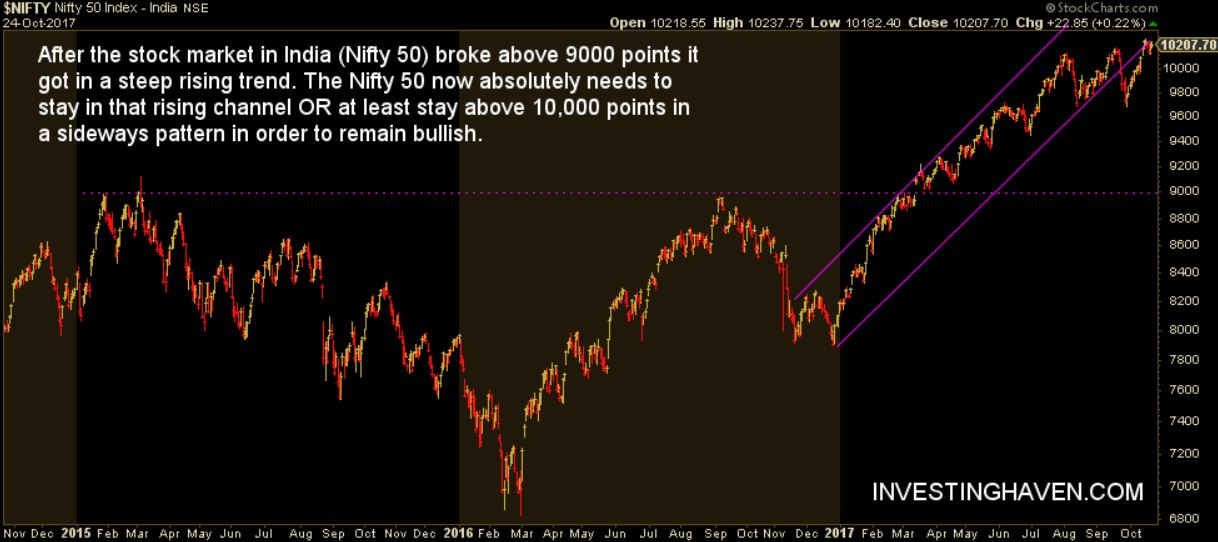

India’s stock market as one of the most bullish emerging markets in 2018 still looks bullish though a triple top could be forming right here right now. There is one level to watch this year and in 2018: 10,000 points in Nifty 50 (NIFTY). If that level gives away there is a fair chance that 9,000 points will act as major support which would offer a major buy opportunity. We still believe India will be bullish in 2018, but do not exclude a stiff correction to 9,000 points.

China has a totally different setup. In all honesty, this is a great chart, and we believe China has huge potential in 2018. What stands out, obviously, is the very long term consolidation pattern. Such a pattern is a great setup for a strong bullish move which we expect will happen in 2018.

One caveat is that the consolidation will continue for a while. It is hard to forecast how long a consolidation will last. Holding positions tight during a consolidation is one of the most challenging things. However it is also one of the most rewarding positions.

We believe China’s stock market (SSEC) could be hugely bullish in 2018, and propose investors to consider FXI ETF (FXI).