Cryptocurrencies are crashing, and so is the price of Ethereum (ETH). Ethereum peaked at $400 on September 1st. Today, two weeks later, it trades at $230, an impressive (but painful) decline of more than 40 percent. This is the 2nd Ethereum price crash of 2017. What’s next, is the question top of mind of investors.

Before looking into that question we should note that many are attributing this cryptocurrency and Ethereum price crash to the Bitcoin ban of the Chinese government. Because of that ban one leading Bitcoin exchange in China, BTCChina, announced today that they will stop their activities on September 30th.

China is certainly an important country for Bitcoin. But is it that important that it can trigger such a steep fall in Bitcoin and, consequently, in all other cryptocurrencies? That is the most fundamental question, and the most likely answer is that it could be “justified” in the short run but that it will not lead to the absolute top on the long run. Cryptocurrencies and blockchain have a tremendous potential, we only saw the tip of the iceberg, so far, when it comes to real-life applications. That is why we believe this is a temporary phenomenon.

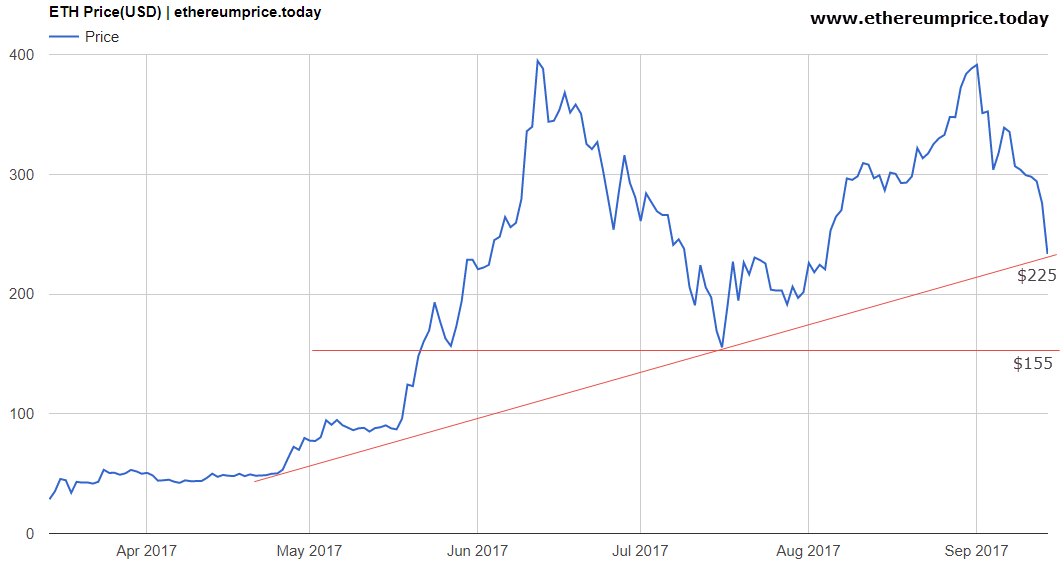

Ethereum price crash on the chart

When it comes to Ethereum we see that it arrived at an important support level.

When Ethereum was crashing in July of this year we identified 125 USD as the critical price level for Ethereum’s Bull Market because it was the ultimate support in a rising (bull market) trend line. Interestingly, Ether is now inches away from that same rising trendline. Support kicks in at $225 which is 2 percent below today’s lows.

Given the negativity we see in cryptocurrencies right now there is a fair chance that $225 will not hold. So the next major support is $155.

If $225 does not hold it would, for the first time, introduce a bearish energy because the rising trend will get broken to the downside. That could introduce a tactical bear market in Ethereum. We would not be surprised, given this aggressive decline, to see several months of consolidation before the bearishness will fade away.

On the other hand, if $155 would hold, we would see a new trading range on the chart, with $155 as support and $400 as resistance. That would not necessarily be a bad thing for Ethereum, it would just suggest that Ethereum needs to get to the next level, not only in price but also in terms of usage and real-life applications.

Our long term Ethereum Price Forecast Of $1000 is still valid, but, as said in the article, this is the forecast between now and 2020.

Full disclosure: we own Ethereum and we are NOT selling any of them because of this decline.