KEY TAKEAWAYS

- Silver traded between $100 and $109 in volatile intraday sessions.

- Silver ETFs attracted about $922M in new money in one month.

- Low inventories and strong demand raised supply pressure.

Silver surged into triple digits after weeks of intense buying pressure. Record ETF inflows and shrinking inventories pushed volatility to extreme levels.

Silver crossed the $100 mark on Jan 23, 2026, during one of the most volatile trading sessions in its history.

Prices briefly surged into the $100–$109 range as global demand collided with limited physical supply.

The metal is now up about 40% YTD after gaining roughly 147% in 2025, while COMEX inventories slipped to about 418 million ounces, leaving little room for error.

RECOMMENDED: Silver Shortage Looms As EVs And AI Chips Consume Supply

Silver Crosses $100: How The Breakout Happened

On Jan 23, prices jumped more than 6% in one session and briefly traded above $100. At the peak, some contracts reached as high as $109.

Following this, sIlver hit a new all time high of $117 on Jan 26.

Trading activity surged. Futures volume climbed sharply, and bid-ask spreads widened as brokers adjusted to fast price changes. Some traders faced margin calls as volatility increased.

The rally followed an exceptional run in 2025, when silver gained about 147%.

Early 2026 added another 40%, showing that momentum had already built before the breakout.

With COMEX inventories at about 418 million ounces, the market had little buffer when demand accelerated.

ALSO READ: Why Silver and Platinum Are the New Strategic Metals of 2026

Who Is Buying Silver And Why Demand Is Surging

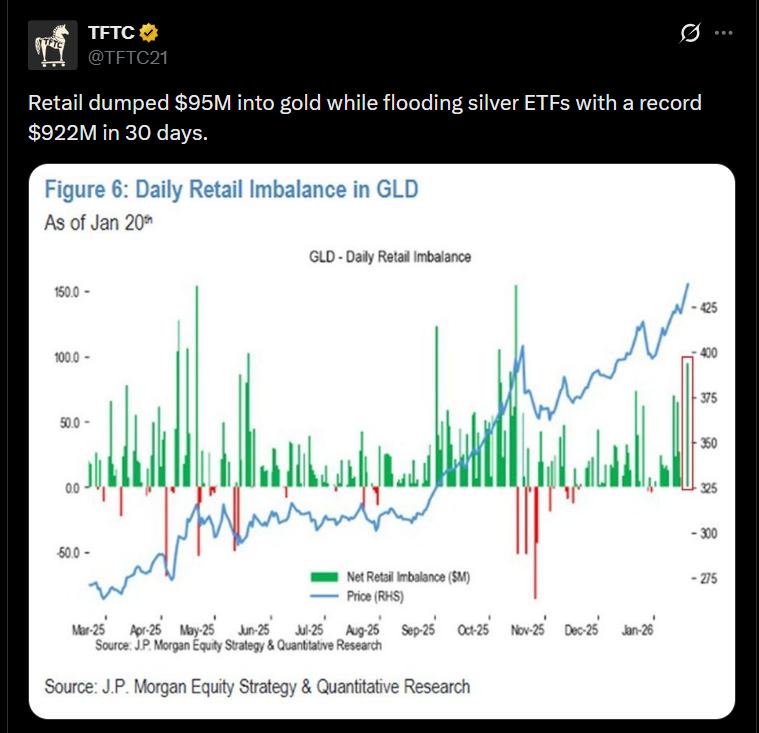

Retail investors have been at the center of the rally. Over the past 30 days, silver-linked ETFs attracted about $922M in net inflows.

On one peak trading day alone, the largest silver fund recorded $69.2M in retail purchases, showing how quickly small investors rushed into the market.

Institutional funds followed closely behind, increasing their exposure and adding steady daily demand.

At the same time, manufacturers in the electronics and solar sectors moved quickly to lock in supplies before prices rose further, intensifying competition for available metal.

Supply chains are struggling to keep up.

Refiners and recyclers could not expand output fast enough, while physical dealers reported longer delivery times and higher premiums for coins and bars.

These shortages pushed more buyers into financial markets, placing even more pressure on spot prices.

RECOMMENDED: Silver Becomes The Most Crowded Commodity Trade Ever As $922 Million Floods In

What Comes Next For Silver Prices

Short-term risks are rising. After such sharp gains, many investors may lock in profits.

Exchanges could raise margin requirements, which would reduce trading activity and trigger pullbacks.

High prices may also encourage some industrial users to test cheaper substitutes. Over time, this could soften demand.

Analysts now see wide price scenarios. Conservative estimates place fair value between $50 and $70, while momentum models suggest further spikes if ETF inflows remain strong.

Conclusion

Silver’s jump above $100 reflects intense demand meeting limited supply. Volatility will remain high, and future moves will depend on investor flows and inventory levels.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

Turning-point forecasting across multi-timeframe charts.

Actionable insights on GDX, GDXJ, SIL, and SILJ.

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.

Read our latest premium alerts: