KEY TAKEAWAYS

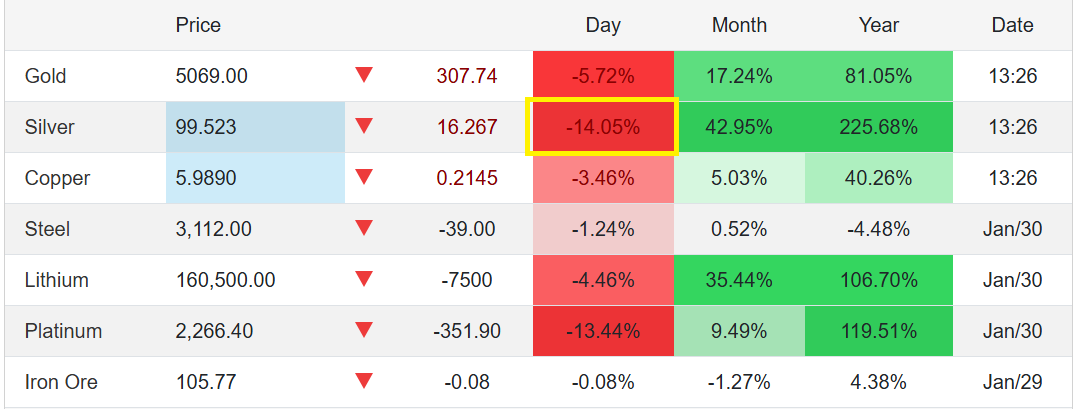

- Silver fell between 8% and 14% from recent highs, marking one of its sharpest daily reversals in years.

- ETF losses and leveraged liquidations accelerated the decline, with some funds losing up to 14% in value.

- A stronger dollar and heavy profit taking combined to trigger rapid selling across global markets.

- Should you invest in Silver right now?

Silver gave back a large share of its January gains in hours. Heavy profit taking, ETF sell-offs, and $120M in liquidations fueled extreme market swings.

Silver prices tumbled as much as 14% in a single session after climbing about 56% earlier in January.

Major silver ETFs dropped up to 15%, futures trading surged far above normal levels, and forced selling in leveraged products pushed reported liquidations close to $120M.

RECOMMENDED: Silver’s Price Explosion Triggers Bubble Fears Across Markets

How Much Did Silver Fall Today?

The sell-off began shortly after silver touched its latest monthly high.

Within hours, prices dropped between up to 14%, catching many traders off guard. Market data showed silver briefly sliding below $100 per ounce before finding limited support.

At the same time, exchange-traded funds that track silver saw sharp declines. Some large funds fell as much as 24% in one session.

Futures markets also saw unusually high activity, with trading volumes well above their recent averages.

These moves signaled panic-style selling rather than an orderly pullback.

ALSO READ: Silver Shortage Looms As EVs And AI Chips Consume Supply

Why Silver Prices Crashed So Quickly

Profit taking played the biggest role. After a 56% rise in just weeks, many investors rushed to secure gains once prices started slipping.

This wave of selling quickly gained speed.

Currency moves added more pressure. A stronger US dollar reduced demand for metals priced in dollars, making silver less attractive to overseas buyers. Policy uncertainty also made investors more cautious.

Leverage made the drop worse. Traders using borrowed money and tokenized metal products faced margin calls as prices fell.

This forced them to sell, adding to the downward momentum. Reports showed these liquidations totaled about $120M.

RECOMMENDED: Gold & Silver ETFs Crash After Record Rally – Time To Buy?

What To Watch In Silver Markets Next

Short-term direction now depends on whether selling pressure eases. Traders are watching ETF flows, margin rules, and dollar movements closely.

Technical charts show key support between $107 and $110 per ounce.

If forced liquidations slow and buyers return, prices could stabilize. If outflows continue, further swings remain likely.

YOU MIGHT LIKE: Silver Has Peaked – Is It Time To Sell?

Conclusion

Silver’s sharp reversal erased a major part of January’s gains but did not end investor interest.

Until liquidity improves and selling pressure fades, large price swings are likely to remain part of the market.

Should You Invest In Silver Right Now?

Before you invest in Silver, you’re going to want to read our latest Premium Gold & Silver Investing alert. We reveal our outlook for Silver in the short and long term.

We called the rally in Silver long before it happened, and earlier in the week we suggested Silver could be primed for profit taking.

Our premium members were ahead of the curve, not panic buying or selling.

- Gold to Silver Ratio at 50. Ready for Rotation? (Jan 25th)

- Time To Take Profits? (Jan 17th)