Despite silver’s recent price volatility, the intensifying silver shortage remains persistent. A silver supply squeeze is possible which may push the silver price beyond ATH.

In this article, we simplify the complexities of the silver market. We focus on the physical silver supply deficit, the silver price chart, and what it might mean for the silver market going forward.

RELATED – Silver prediction 2025

The silver shortage topic has been center stage in recent months, particularly after the Silver Institute released its latest physical silver market data. It evoked a lot of reactions as evidenced by social media post here and here.

October 6th, 2024 – The latest news updates include M&A activity in the silver mining space heating up (Coeur Mining buys SilverCrest) “as miners look to secure reserves amid surging demand for silver”. Moreover, the latest data confirm that industrial demand for silver is rapidly rising. These data points are consistent with all data we have published in this article, refreshed multiple times throughout 2024.

Ed note – The latest data points on this topic were updated on October 6th, 2024.

Understanding the silver market shifts

The Silver Institute’s update reveals a decrease in total silver supply due to production losses at major silver mines, notably the Penasquito mine.

On the demand side, industrial demand for physical silver continues to surge, reaching an all-time high, primarily driven by growing demand for silver in solar applications.

Despite slight dips in jewelry and silverware demand, the crux lies in the booming industrial demand, particularly for photovoltaic solar cells.

Global supply is roughly 1 billion Ounces annually, since a few years, while physical silver demand exceed supply by approximately 20% per year. Industrial demand, particularly, has grown significantly, from 588 billion Ounces to 654 billion Ounces.

Overall, silver demand exceeded silver supply in 2023 for the third consecutive year, resulting in a structural market deficit of 184.3 Moz.

The silver shortage story by the numbers

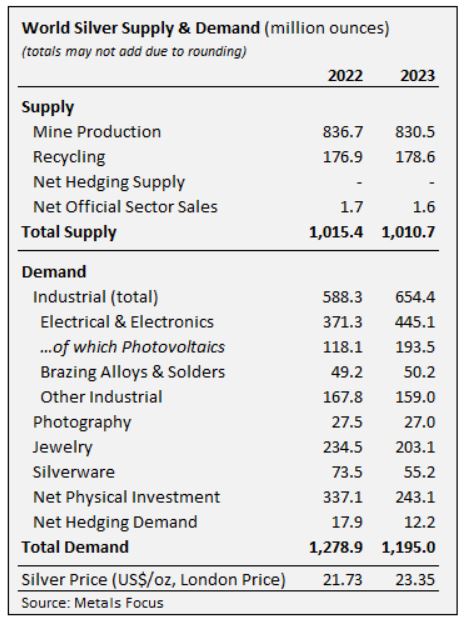

Specific numbers that were revealed in the study conducted by The Silver Institute, for 2023:

- In 2023, global silver demand reached a new record high of 654.4 million ounces (Moz), driven by increased usage in industrial applications, particularly in the green economy sector.

- Despite a 7 percent decline in total silver demand to 1,195 Moz compared to the previous year, industrial demand surged to another record high, led by the electrical and electronics sector.

- Silver mine production decreased slightly by 1 percent to 830.5 Moz, while silver recycling grew by 1 percent to 178.6 Moz, accounting for 18 percent of total supply.

A high level overview of the numbers, a comparison between 2023 and 2022:

Silver shortage: industrial demand rising

- Industrial demand for silver soared to a new peak of 445.1 Moz in 2023, primarily fueled by the electrical and electronics sector, which expanded by 20 percent.

- The photovoltaic (PV) market witnessed substantial growth, reaching 193.5 Moz, a remarkable 64 percent increase from the previous year.

- Despite the overall decline in total silver demand, industrial applications remained robust, indicating silver’s essential role in various technological advancements.

Global silver supply unchanged amplifying silver shortage story

- Global silver mine production dipped by 1 percent to 830.5 Moz in 2023, contributing to a structural market deficit for the third consecutive year.

- Silver recycling, comprising 18 percent of total supply, increased marginally by 1 percent to 178.6 Moz, supporting overall supply levels amid declining mine production.

Investor’s silver demand

Looking at supply and demand, we find a mere 123 million oz left for silver investors after accounting for non-investment demand.

RELATED – How To Invest In Silver in 2025

In a world where trillions circulate in investment markets, this limited silver pool, valued at less than $3 billion, raises eyebrows.

The reality is that the pool available for investors is a fraction of the total silver produced.

September 6th, 2024 – Declining inventories.

- Recent data highlights a sharp decline in silver inventories within major storage facilities, signaling a critical phase in the silver market’s supply dynamics. COMEX silver inventories have significantly decreased from over 400 million ounces in early 2021 to approximately 291 million ounces as of mid-2024.

- The London Bullion Market Association (LBMA) has also reported a substantial drop of over 300 million ounces from its inventory peak in 2021.

- These figures suggest that key silver stockpiles are depleting more rapidly than anticipated, reinforcing the argument for a looming silver supply crunch. This ongoing depletion could have far-reaching consequences for the market, especially if demand continues to rise at its current pace

September 6th, 2024 – Potential double counting in silver ETFs.

- Potential double counting in silver inventories reported by silver-backed ETFs like iShares Silver Trust (SLV).

- 100 million ounces of silver held by SLV, stored by JP Morgan Chase, might also be counted as COMEX inventory.

- If true, this would mean the actual available silver is lower than reported.

- Raises concerns about the severity of the silver shortage and calls for more transparency from ETF providers and regulators.

Notable findings from the silver market study

- The decline in silver physical investment, including silver bar and coin demand, was notable, falling by almost a third to a three-year low of 243.1 Moz.

- Several Western markets experienced significant declines in physical investment, attributed to cost-of-living issues, range-bound prices, and tax-related changes.

- Despite challenges in the physical investment sector, the industrial fabrication of silver is expected to continue growing, driven by the PV market and other industrial segments, contributing to a forecasted 2 percent increase in total silver demand for the upcoming year.

Silver’s dual nature continues to drive a silver shortage

Silver’s unique dual demand as both an industrial commodity and an investment asset plays a crucial role. While industrial demand remains relatively stable, investment demand, driven by market sentiment and price movements, holds the key to the silver market’s future.

An even more up to date report confirmed the silver shortage in 2023:

Global silver demand to reach 1.2 billion Ounces in 2024: The forecasted global silver demand for 2024 is an impressive 1.2 billion ounces, potentially the second-highest level ever recorded. This growth is primarily driven by strong industrial demand.

More evidence of an unfolding silver supply shortage

The latest data point to more evidence of the unfolding silver supply shortage:

Silver Shortage Confirmed: Mexico’s Silver Supply Has Dropped off a Cliff

By Jon Forrest Little

Silver is currently at one of its most undervalued levels in history, especially compared to gold, as the gold-to-silver ratio currently stands at 85.https://t.co/2oly7vpJDG

— SilverSeek.com (@SilverSeekcom) December 29, 2023

What this article brings up, as a question, is why the price of silver has not exploded to $50 at this point in time. There are likely two answers to this question:

- What has not happened yet, is about to happen sooner rather than later.

- Dynamics of price are completely distorted. It is clearly not supply/demand that is determining price, but something else. This ‘something else’ is futures trading, because it is futures market positioning that is clearly determining price more than supply/demand dynamics. This is what many tend to call ‘silver price manipulation’, i.e. the dynamics of positioning between commercials and managed money traders.

Sooner or later, dynamics in the physical market, driven by a supply shortage that is getting out of hand, will ensure that the price of silver will reflect the supply shortage.

Silver shortage insights from Sean Khunkhun

In a recent discussion, Sean Khunkhun, CEO of Dolly Varden Silver, explained the growing issue of silver shortage in the physical market. According to Sean, silver production has been steadily declining over the years. Annual production has dropped from 1.2 billion ounces to 850 million ounces, which is a significant reduction. This shrinking supply, combined with rising demand, has led to a 250 million ounce deficit every year for the past two years.

Sean emphasizes that every year, there is about 0.25 billion ounces of demand that cannot be met through new mining supply alone. While stockpiles, recycling, and other sources help fill some of the gap, they are still insufficient to meet the growing demand. Industrial demand, particularly in sectors like electronics and renewable energy, continues to increase, further compounding the problem.

One of the key points Sean highlighted is that silver is largely produced as a by-product rather than as a primary target. Only 28% of silver production comes from primary silver mines, with the rest being a by-product of other metals like copper and gold. This makes it much harder to increase silver production, as mining operations primarily focus on other metals.

Sean also discussed the challenges faced by silver mining in key producing countries such as Mexico, Peru, and Chile. In Mexico, for example, there are no new open-pit mines, which makes silver extraction increasingly difficult. In Peru and Chile, environmental regulations and government policies make mining operations more challenging, adding further complexity to the situation.

Ultimately, Sean pointed out that the global silver market is facing a 1 billion ounce supply gap, which is likely to persist as demand continues to rise. This shortage, combined with the difficulty in increasing production, could have a significant impact on silver prices and availability, especially for industries that rely on silver.

Below is the interview in which Sean explains the 2025 supply shortage narrative (as of 41m02s):

Silver price vs. physical silver market dynamics

While some may point out that last week’s silver price action was abysmal, we would recommend to focus on what really matters.

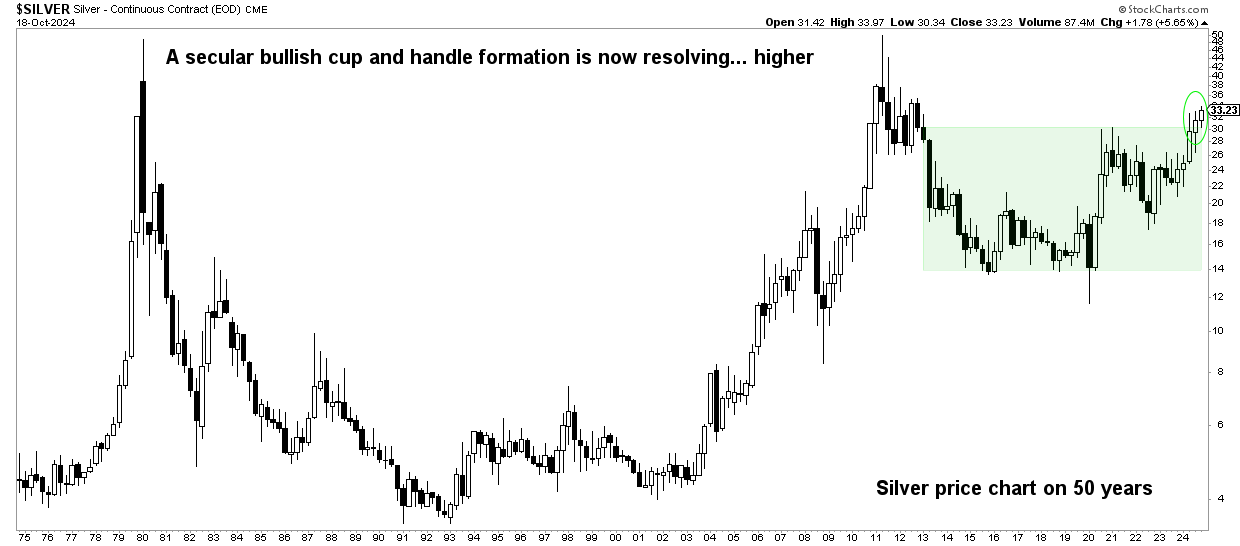

The price of silver has been flat for 3.5 years, since August of 2020. However, in March of 2024, the process of price appreciation kicked off, pushing silver into secular breakout territory. We recommend to focus on long term trends, not short term price moves.

Below is the monthly silver price chart. What we can clearly see is an epic secular breakout may be starting, in March/April of 2024.

November 11th, 2024 – The silver price chart on 50 years has this gorgeous chart pattern, a secular cup-and-handle pattern, over 35 years. This chart pattern has a high confidence bullish resolution. It looks like the secular silver chart is confirming the ongoing silver shortage even though there is some speculation on our end.

Is the silver price finally starting to adjust based the physical silver market reality which, notably, is for 3 consecutive years in deficit? Remember, commercials in the COMEX futures market desire less participation of speculators in order to drive prices higher, that’s exactly what also happened in the historic silver rally back in 2010/2011.

Silver shortage – the flipside of the story

It is wise to check the flipside of any story.

CPM Group voices criticism to the silver shortage story. Below is a video in which CPM Group invalidates the silver shortage thesis.

The key point in their thesis is that the physical silver market adjusts to price:

- When prices move down, like in the 90s, owners of physical silver tend to sell their silver because they are anxious that they will receive a lower price if they wait supplying it to the market.

- When prices move higher, like in 2004-2007, holders of silver tend to delay their silver selling decisions hoping to receive a higher price if they wait.

While this theory makes sense in a regular market. The world woke up to the reality that the silver works differently. Physical supply and demand do not determine price. It is arguably naïve to think this.

By contrast, the silver price is set on the COMEX futures market.

- A quick calculation to illustrate this: silver futures contracts net short, typically by commercials, often exceed 50,000 contracts. This corresponds to 250 million ounces of silver. As a reference, in 2023, per a recent market study, industrial demand was 654 million ounces.

The paper silver market is much, much larger than the physical silver market!

In other words, the silver futures COMEX market determines the silver price. This, in turn, affects decisions take in the physical market. Not the other way around, as the CPM Group argues.

Conclusion

Within these silver market dynamics, the looming silver shortage stands out as a ticking time bomb. Despite COMEX silver price setting, the law of supply and demand will eventually prevail. As we approach a true silver supply shortage, the silver market’s true potential awaits, ready to reshape the price setting dynamics and elevate silver to new heights.

In a nutshell, the silver shortage narrative is not just about market data; it’s a story of a market poised for a significant shift. The question now is: when exactly will this translate into the long overdue silver surge?