In our latest silver prediction, we stated that $34.70 is a no-brainer target for spot silver. We also wrote extensively about the developing silver shortage. We are confident that these forecasts will work out well, all that’s needed is some patience for silver to move higher. The price surge in silver will likely happen at a time when the majority of the market is not positioned on the long side.

In this article, we update the findings from the Gold-to-Silver Ratio and Historic Silver Rallies.

The Gold to Silver Price Ratio

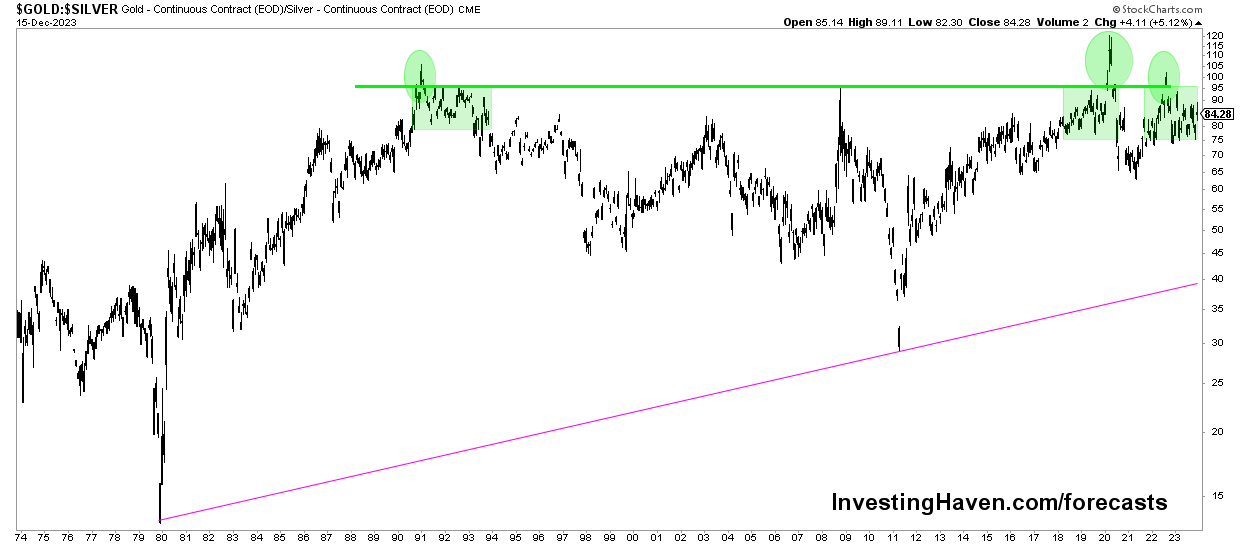

In our previous exploration of the gold-to-silver ratio and its historical implications, we emphasized the importance of the ratio entering the 80 to 100x range as a precursor to substantial silver rallies. Fast forward to the present, and the gold-to-silver ratio has been consistently above 75 points for the past three years, lingering in the 75 to 95 range.

Note that readers can track this ratio in real-time on this page.

Unprecedented Prolongation: A Rare Phenomenon

This prolonged elevation of the gold-to-silver ratio, a phenomenon witnessed only twice before — once from 1991 to 1994 and again from 2017 to 2020, raises intriguing questions. On both previous occasions, silver experienced notable upward movements shortly after the ratio surpassed 75 points. Now, as history seemingly repeats itself, the implications for silver in the coming years become a topic of intense interest.

Breaking the Mold: Silver Lagging behind Gold

What makes the current scenario particularly unusual is the extended period during which silver has lagged behind the price of gold with a factor higher than 75x. Silver, known for its volatility, typically reacts swiftly to changes in market dynamics. The present scenario, where silver seems to be biding its time in the shadow of gold, suggests that a resolution is near (potentially even imminent, however we try to avoid words like ‘imminent’ as we prefer readers to think as investors and allow for sufficient time for a market to start trending).

The Expected Resurgence to ATH: Sticking to the Forecast

Amidst these unprecedented dynamics, we stand by our forecast: silver hitting all-time highs in the not-too-distant future (which we express by ‘max 3 years from now‘). While we acknowledge that the path may not be a straight upward line — silver is notorious for its rollercoaster experiences and the tendency to shake out bulls right before a significant run — the overall trajectory points toward profitability.

Whether the coming surge in silver will get out of hand, and end with a blow off top in a similar way as back in 1980 remains unknown. We would not be surprised if 2026 will come with a blow off top in silver.

Looking Ahead: The Silver Investment of the Decade

As we navigate this juncture in the precious metals market, it’s evident that silver holds the potential to be one of the most profitable investments of this decade. The historical echoes of the gold-to-silver ratio and the current anomaly in silver’s lag suggest that a resolution is near. Investors, prepare yourselves for a silver resurgence — a journey that may be tumultuous but promises rewards for those who ride the waves wisely.