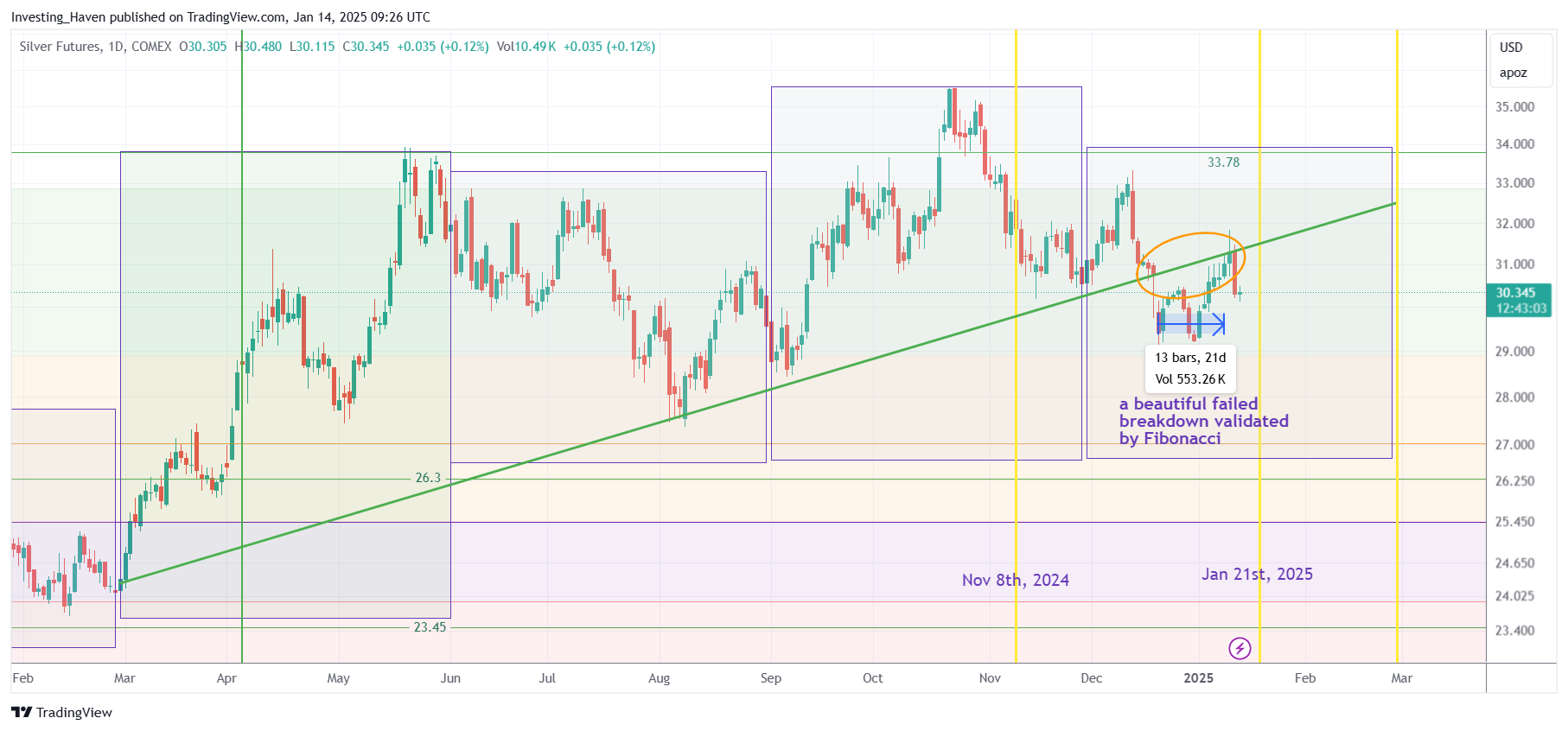

Silver broke down on December 18th. It recovered on January 9th, 2025, exactly after 13 trading days, a Fibonacci number. Silver’s failed breakdown is inherently bullish.

In this article, we focus on the silver chart. We combine time and price analysis.

In doing so, we find that silver’s recent weakness coincided with a failed breakdown, invalidated on Thursday, January 9th, 2025.

RELATED – Silver prediction 2025 & 2026

That’s potentially great news for silver investors, as silver’s failed breakdown has a legacy of leading to selling exhaustion by creating a turning point.

Silver’s failed breakdown – price

We look at the price axis of the silver chart.

- The 2024 rising trendline was violated on December 18th, 2024.

- The FOMC press conference combined with the rate cut decision pushed the price of silver strongly lower.

- In doing so, the rising trendline got broken down.

Strictly looking at price, silver is now in a long term consolidation, below the rising trend (still flat).

RELATED – When Exactly Will Silver Hit $50 An Ounce?

However, on January 9th, 2025, silver reclaimed the rising trendline. For now, the December breakdown got invalidated.

Silver’s failed breakdown – time

Does the failed breakdown matter?

It does, especially and specifically because silver reclaimed its rising trendline exactly on day #13, a Fibonacci number.

This really means, as a general principle that the breakdown invalidation was confirmed.

If a breakdown (or breakout) invalidates on a day that coincides with a number on the Fibonacci sequence, it strengthens the invalidation case.

With this in mind, we do know the following:

- Silver violated its rising trendline on December 18th, 2024.

- Silver remained below its trendline, without touching it, for 12 trading days.

- On day #13, silver touched its rising trendline again.

Failed breakdowns tend to be bullish. Why? Because a lot of selling pressure comes with the breakdown event. Let’s face it – the entire investing community takes notice.

Evidence – Silver Speculators Finally Giving Up While Gold Speculators Remain Unanimously Long.

But what matters most is whether there is follow-through or not.

What matters equally is whether important chart structures are reclaimed on a Fibonacci day.

Silver’s prospects in 2025

The silver chart remains bullish, long term though.

Short term, it’s choppy, and that’s fine.

The news is also choppy, so once again news is not helpful in understanding the direction.

Choppy setups are the pre-requisite for bullish outcome provided key support is respected.

While the fundamentals remain strong, the massive exodus of speculators is the best news, certainly when combined with the 50-year cup and handle reversal pattern on silver’s chart!