KEY TAKEAWAYS

- Hedge funds built an unusually large long position just before silver peaked.

- COMEX registered silver stocks fell by more than 33 million ounces, tightening supply available for delivery.

- Higher margins forced leveraged traders to sell, speeding up the decline.

- Should you invest in Silver now?

Speculators crowded into long positions as inventories fell fast. When leverage met higher margins, silver reversed sharply.

Silver dropped from a record high of $121.64 to about $81.65, a 33% fall in a short time.

The decline followed weeks of heavy speculation, falling exchange inventories, and rising leverage across the futures market. These conditions left prices exposed once pressure appeared.

RECOMMENDED: Top 3 Metals to Buy for the Clean-Energy Transition: Copper, Nickel, Silver

The COT Signal That Warns First

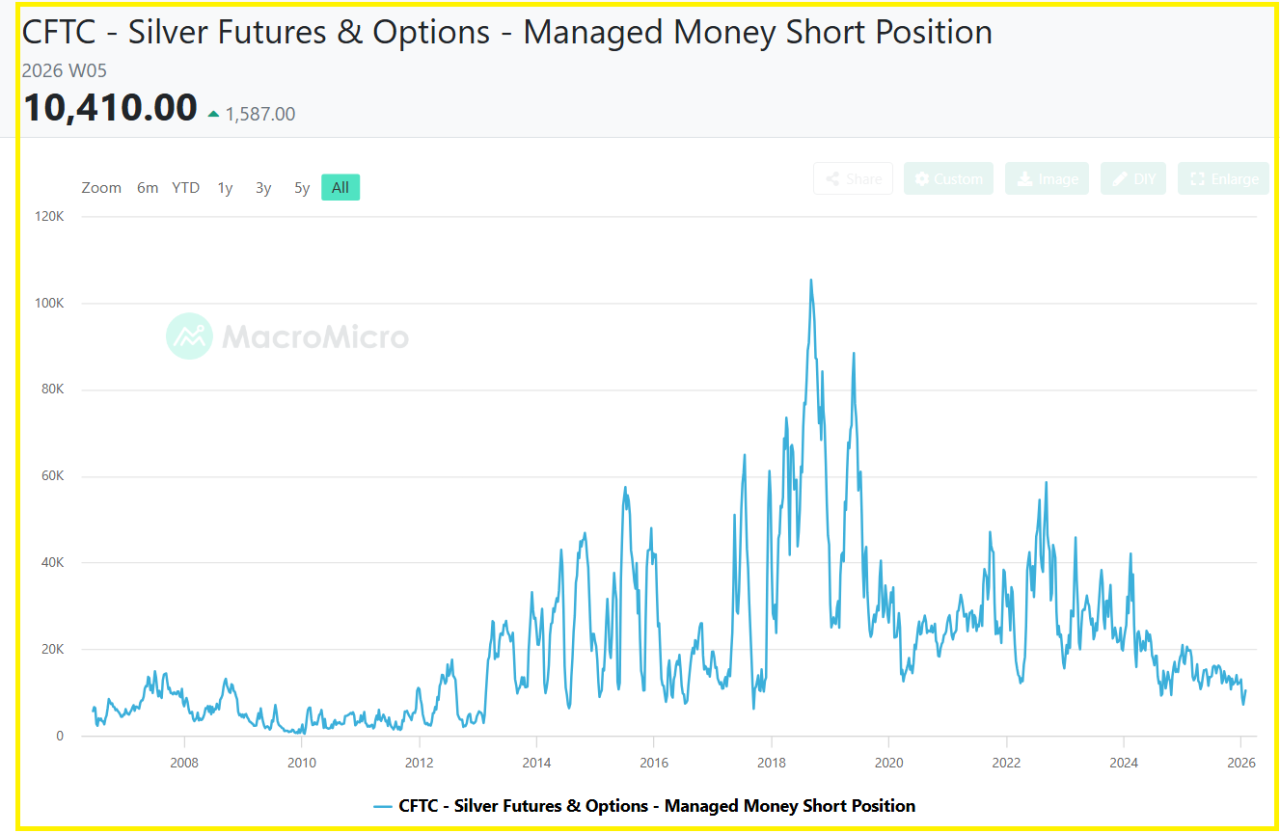

The clearest early warning for silver reversals comes from the CFTC Commitments of Traders report.

The key section is managed money, which tracks hedge funds and other short term traders. These traders use leverage and tend to move in groups.

In week 5 of 2026, managed money held a net long position of about 7,294 contracts.

That was a stretched level compared with recent months. When too many traders hold the same bet, the market becomes fragile.

Small changes in price or risk rules can trigger fast selling. Silver has a long history of sharp reversals after these crowded long positions form.

RECOMMENDED: Will Silver Hit $150 An Ounce?

Why This Indicator Signals A Reversal

The positioning signal lined up with stress in physical supply. In early January, COMEX registered silver inventories fell by about 33.45 million ounces, roughly 26% of the total available for delivery.

At the same time, open interest rose to around 156,637 contracts, showing that leverage kept building.

Prices soon reached $121.64. As volatility increased, the exchange raised margin requirements.

Many traders had to reduce exposure quickly. Selling accelerated, and silver slid to about $81.65.

The reversal followed the same pattern seen in past cycles, where extreme positioning breaks once risk tightens.

What To Watch Now

Weekly changes in managed money positions show whether selling pressure continues.

COMEX registered stocks reveal supply stress or relief while open interest shows if leverage is increasing or leaving the market.

ALSO READ: Silver Shortage Looms As EVs And AI Chips Consume Supply

Conclusion

Silver’s sharp reversal followed clear signals. Crowded speculative longs, falling inventories, and high leverage created unstable conditions.

The COT managed money data flagged the risk before prices turned lower.

Should You Invest In Silver Now?

Before you invest in Silver, you’re going to want to read our latest premium precious metals report

Read It Here: Latest Precious Metals Premium Alert

InvestingHaven’s Gold & Silver Premium Alert Service delivers clear, data-driven forecasts built on nearly 20 years of precious metals expertise.

What you get:

Weekly gold & silver trend analysis using leading indicators (CoT, USD, yields, COMEX data).

Turning-point forecasting across multi-timeframe charts.

Actionable insights on GDX, GDXJ, SIL, and SILJ.

Intra-week alerts only when markets move — no noise.

Designed for serious investors who want medium- to long-term guidance, not short-term trading hype.

Join today and get the gold & silver roadmap trusted by disciplined investors worldwide.