KEY TAKEAWAYS

- China’s export licensing limits refined silver shipments, reducing supply available to global buyers.

- Silver prices rose sharply, with higher volatility and strained liquidity across futures and ETF markets.

- Manufacturers and import-dependent countries are seeking new suppliers to manage rising costs and supply risk.

China tightened control over refined silver exports, reducing available supply. Prices jumped, volatility increased, and industrial buyers now face higher costs.

China has approved only 44 companies to export refined silver starting January 1, 2026.

The decision quickly changed market conditions. Silver prices jumped, trading became more volatile, and buyers rushed to secure supply.

With China playing a central role in refined silver production, even small policy shifts now move global prices fast.

RECOMMENDED: Is Silver A Good Investment Right Now?

China’s Export Rules Tighten Global Silver Supply

China’s new export rules restrict refined silver shipments to 44 approved companies, cutting the number of exporters sharply.

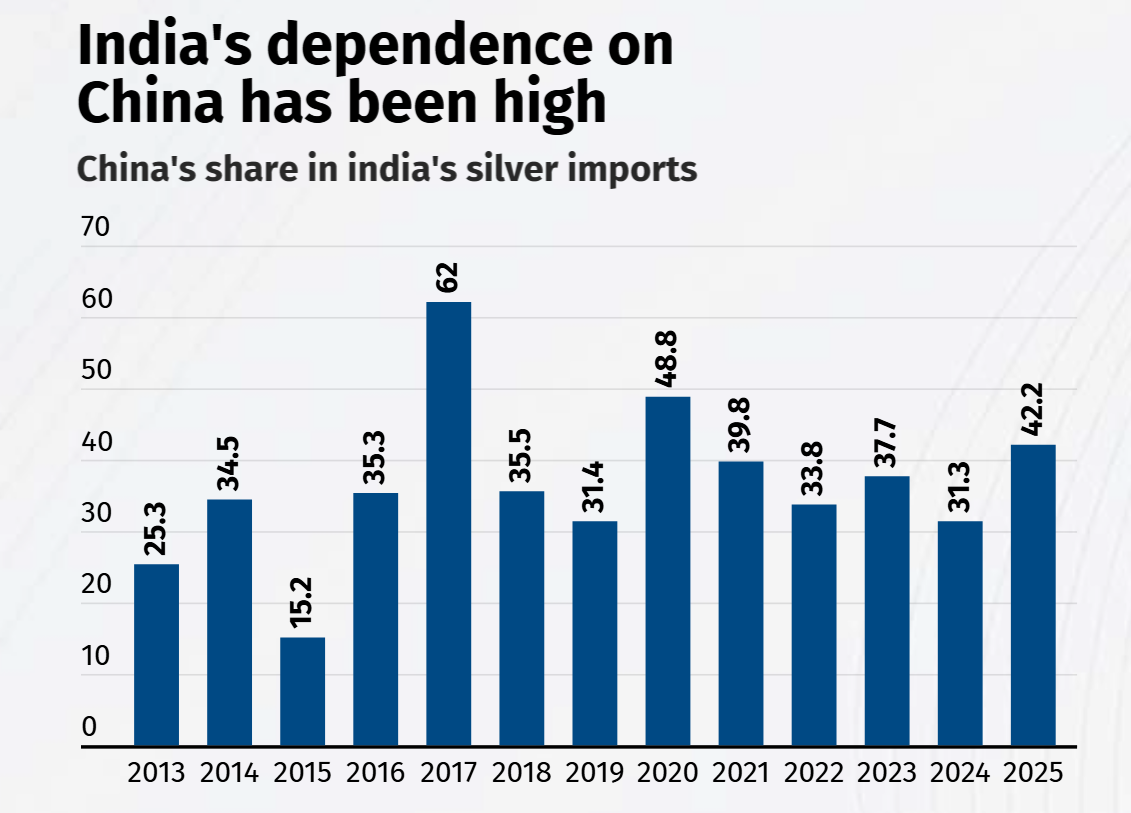

China accounts for about 40–50% of global refined silver output, so these limits matter immediately.

Many Chinese refineries produce silver as a by-product of copper and lead mining, which means output cannot increase quickly.

As a result, traders reported fewer spot cargoes and longer delivery times.

Inventory levels in major trading hubs fell, and buyers faced tighter contract terms as suppliers adjusted to the new rules.

RECOMMENDED: Will The Silver Price Ever Rise To $100?

Silver Prices Jump as Volatility Increases

Silver prices had already risen strongly in 2025, gaining about 160% YTD. The export announcement added fuel to the rally.

Spot prices climbed to above $75 per ounce in early January 2026 as trading volumes surged.

Volatility also increased across futures markets, and price swings widened during Asian and European sessions.

Some silver ETFs faced pricing gaps as futures and physical markets moved out of sync.

Brokers raised margin requirements, forcing traders to cut positions and adding to short-term price swings.

RECOMMENDED: A Silver Price Prediction For 2026 – 2030

Higher Costs Ripple Through Industry and Trade

Industries that depend on silver, including electronics, solar panels, and jewelry, now face higher input costs.

India, one of the largest silver importers, has started looking to Europe, Latin America, and recycled supply to reduce reliance on China.

Governments are also reviewing stockpiling and trade policies as silver gains importance as an industrial material.

These shifts will take time, keeping supply tight in the short term.

Conclusion

Silver markets are entering a period of heightened uncertainty.

With China controlling much of the supply, global buyers and manufacturers must adjust quickly, and price swings are likely to continue until alternative sources and contracts stabilize.

Looking for clarity in the gold & silver markets?

Our premium members already have it.

Check out our latest precious metals premium analysis: Where or When Will Silver Set A Top?

In this article we talk about the probability of Silver reaching $90, $150 and $200 and whether we believe it is a time to sell or hold.

You can read more about our Premium precious metal investing service here

If you are interested in becoming a VIP member and benefiting from personal charting requests and personalised AI prompting for precious metal investing you can see the options here