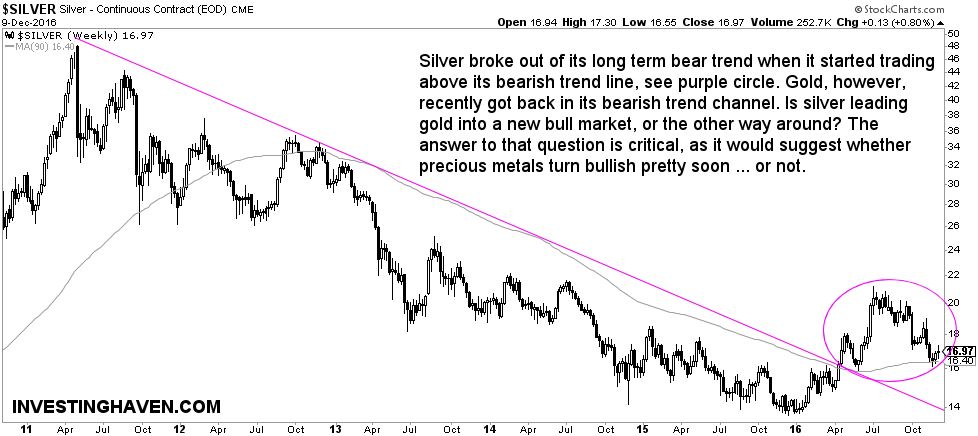

Silver did amazingly well in the first half of this year. In May, it broke out of its long term bear market trend, see first chart. It is still trading above its bear trend, as seen on the first chart in this article, while gold is trading below its bear trend as shown on gold’s long term chart.

The key question is which of the two metals is the leading indicator: silver or gold? The answer to that question is important as it determines whether precious metals are now in a long term bull or bear market.

As the answer to our question is not clear straight away, the clue is to zoom out and look at a longer term timeframe, until clear patterns become visible.

The 11-year chart of silver provides much more clues. Silver’s stunning rally this year was ‘stopped cold’ right at the 2008 highs ($21, see thick purple line on the chart below). Next to that, there is this 2011 peak which we can’t connect in any meaningful pattern.

For those two reasons, we believe silver is not the leading indicator. We think gold is more reliable in its chart setup, which, as seen in the article which we linked in the intro, shows that it is still in a bear market.

Silver is known to be a follower, but a very volatile one. Think of silver’s incredible rallies between 20005 and 2007, which only came 3 years after gold entered its long term bull market.