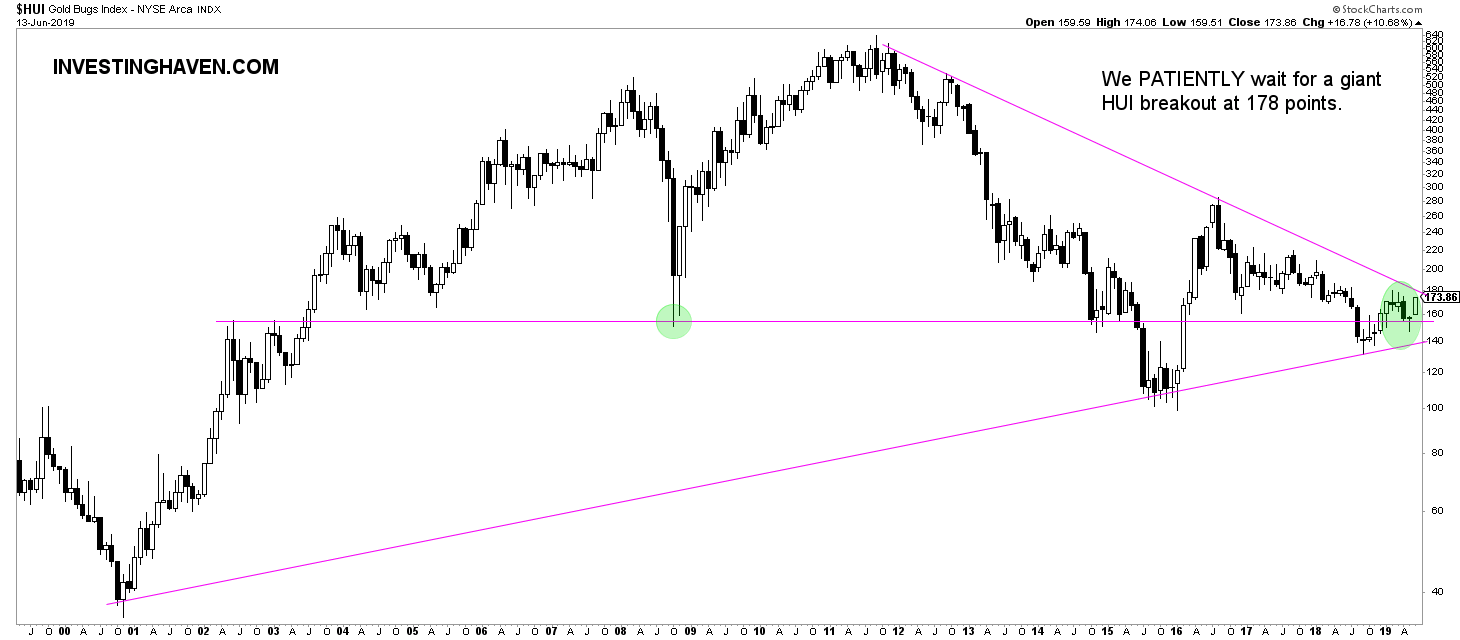

The gold and silver stock sector (HUI) is one massive pressure cooker ready to explode. Not often do we see a market under such a high tension. Make no mistake a confirmed breakout in precious metals will unleash a major bullish energy wave, especially in gold and silver stocks. We first need to see a gold price breakout (GOLD) combined with a gold and silver stocks breakout, as per our gold forecast. The rest will run automatically.

This article features 3 gold and silver stock charts. They are so gorgeous that we consider all 3 of them must-see charts!

Note that as we patiently wait for these massive breakouts to take place we continue to favor First Majestic Silver as a silver stock as part of our silver stocks forecast as well as these majors as top gold stocks.

First, the gold bugs index (HUI) on the long term is a massive triangle ready to explode. The odds favor an upside breakout. Note that this is a market trading at the same level as the depths of the 2008 crash. A breakout above 178 points (which is just 2 pct above current levels) will send a massive flow of capital to this sector. The upside potential is at a minimum 50 pct, best case 100% in a period of 6 to 12 months.

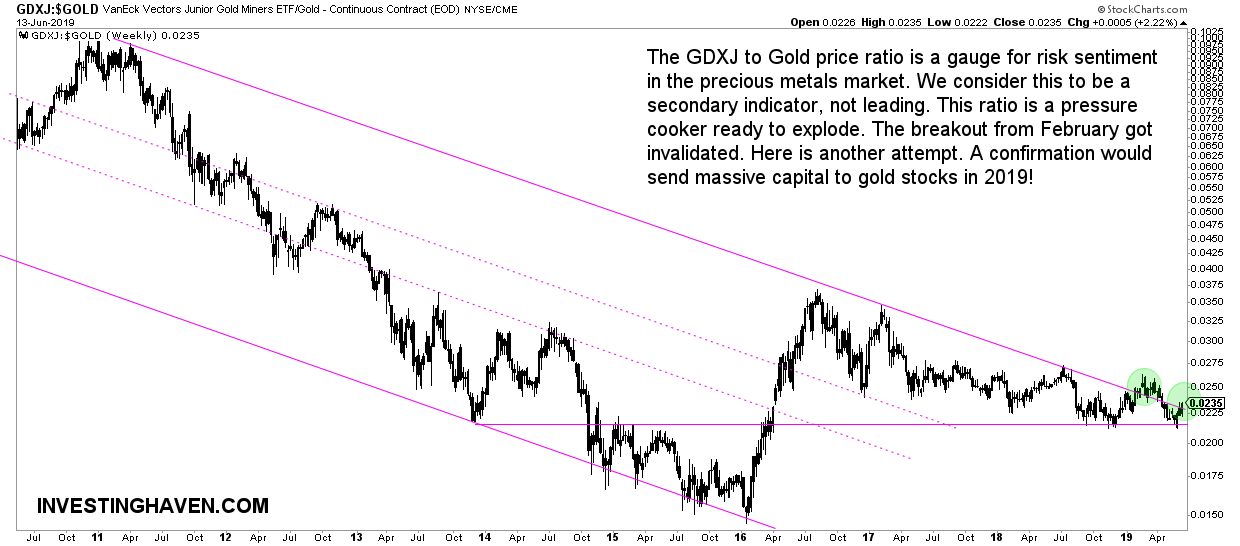

The second chart is the junior gold stock index GDXJ against the gold price. This is a ratio chart, so it is a secondary indicator for us, not a leading indicator. It is a risk sentiment indicator in our view.

Regardless, it confirms the findings from other precious metals charts: explosive upside potential.

Note how there was a first breakout in January/February of this year, which got invalidated soon after. Right now, there is another breakout attempt. Combine this with a HUI breakout (see above) and a gold price breakout (see What Happens If Gold’s Price Rises 2 Pct And Breaks Out) and you will get an explosive result.

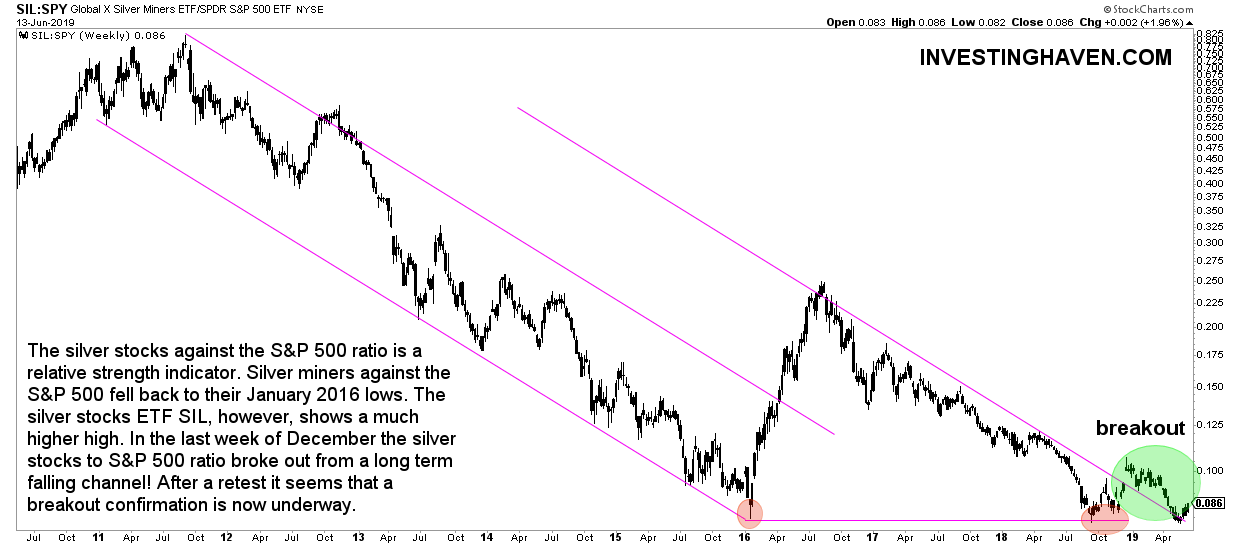

The third chart is the silver stocks index SIL against the S&P 500 (SPY). Again, it’s a secondary indicator, but it confirms all our other findings.

Note that the breakout took place in Jan/Feb but did not really got invalidated. It rather backtested the breakout point. This is the ‘real deal’ because any move higher from here will confirm silver stocks outperforming broad markets. That would be enormously powerful, for sure combined with gold and silver price strength.