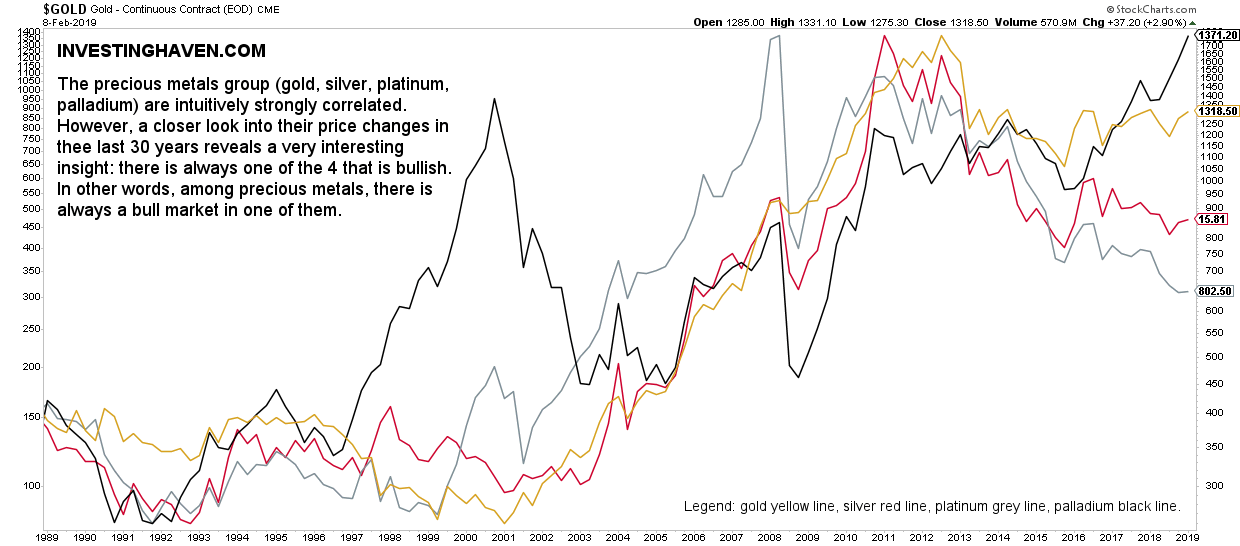

There is always a bull market in one or more of the 4 precious metals. That’s the conclusion from InvestingHaven’s research team, after analyzing changes in the gold price (GOLD), silver price (SILVER), platinum and palladium price (PALLADIUM) over the last 30 years. At least one of these metals is trending higher, even if gold is falling.

The chart below definitely categorizes as one of the coolest historical charts imaginable.

We show the 4 precious metals on one chart, log scale. The yellow line is the gold price, the red line is the silver price, the light grey line is the platinum price, and black is the palladium price.

Although there have been periods that multiple precious metals were rising simultaneously we also see periods in which just one precious metal was rising.

- The outlier has been palladium a couple of times in the past, primarily between 1996-2000 as well as in the last 3 years.

- Gold has a track record of leading silver from a bear market into a bull market. Silver tends to be a laggard, though has explosive power once it starts trending.

- Platinum is mostly correlated to gold, but we have seen a couple of instances in which it was rising as gold was weak or flat.

Never before have we seen this insight, not by the precious metals community nor by any other analyst. We are proud to offer great valuable and actionable insights to our readers. In all honesty we believe that the insight that there is always a bull market in one of the 4 precious metals is one of the best we have ever discovered and written!

How to play this precious insight about the precious metals group? Very simple, opening up an account with a bullion service provider that holds your metal in custody is the easiest thing to do. The strategy is to switch from one precious metal to another over time. Right now, for instance, capital should sit in palladium, but once palladium peaks it might be gold or platinum rising. Open an account with GoldMoney and buy/store physical metals >>