Early August, we updated our uranium market outlook for 2023 & 2024. We concluded that the uranium moved from potentially bullish to bullish. We clearly outlined leading indicators in the uranium market (spot uranium and URA) that had to exceed some levels, those levels were exceeded last week.

Two weeks ago, we wrote Spot Uranium Breakout Confirmed – A Bullish Turning Point:

In conclusion, the spot uranium breakout above $60 per pound is a momentous confirmation of our bullish uranium market outlook for 2023 and 2024. The breakout carries significant implications for the uranium sector, with the potential to spark a broader bullish trend. Investors in uranium-related assets, including ETFs like URA, should keep a close eye on spot uranium’s trajectory as it is likely to influence the performance of these assets. The uranium market appears poised for a potentially explosive uptrend, offering opportunities for those positioned to capitalize on this bullish turning point.

That’s exactly what we are following up with – the specific breakout levels in leading indicators of the uranium market (spot uranium and URA ETF).

We shared the specific values for both leading indicators when we wrote Uranium Market Ready To Stage A Breakout In 2023.

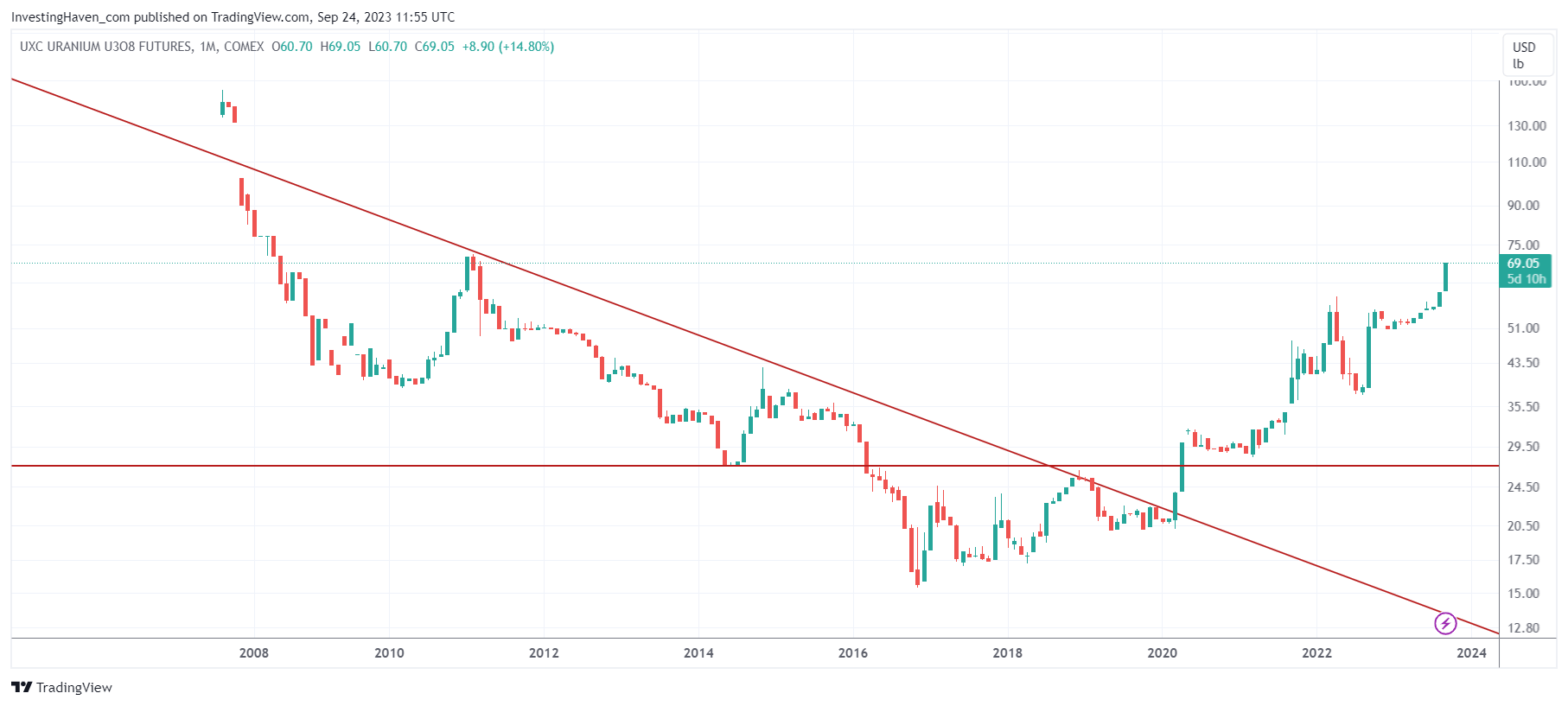

First, spot uranium has to clear $60 per pound. Below is the monthly chart that shows that spot uranium now trades at $69 per pound. The next resistance level is $72-75 per pound. On the other hand, once past this resistance level, there is no resistance whatsoever until price doubles.

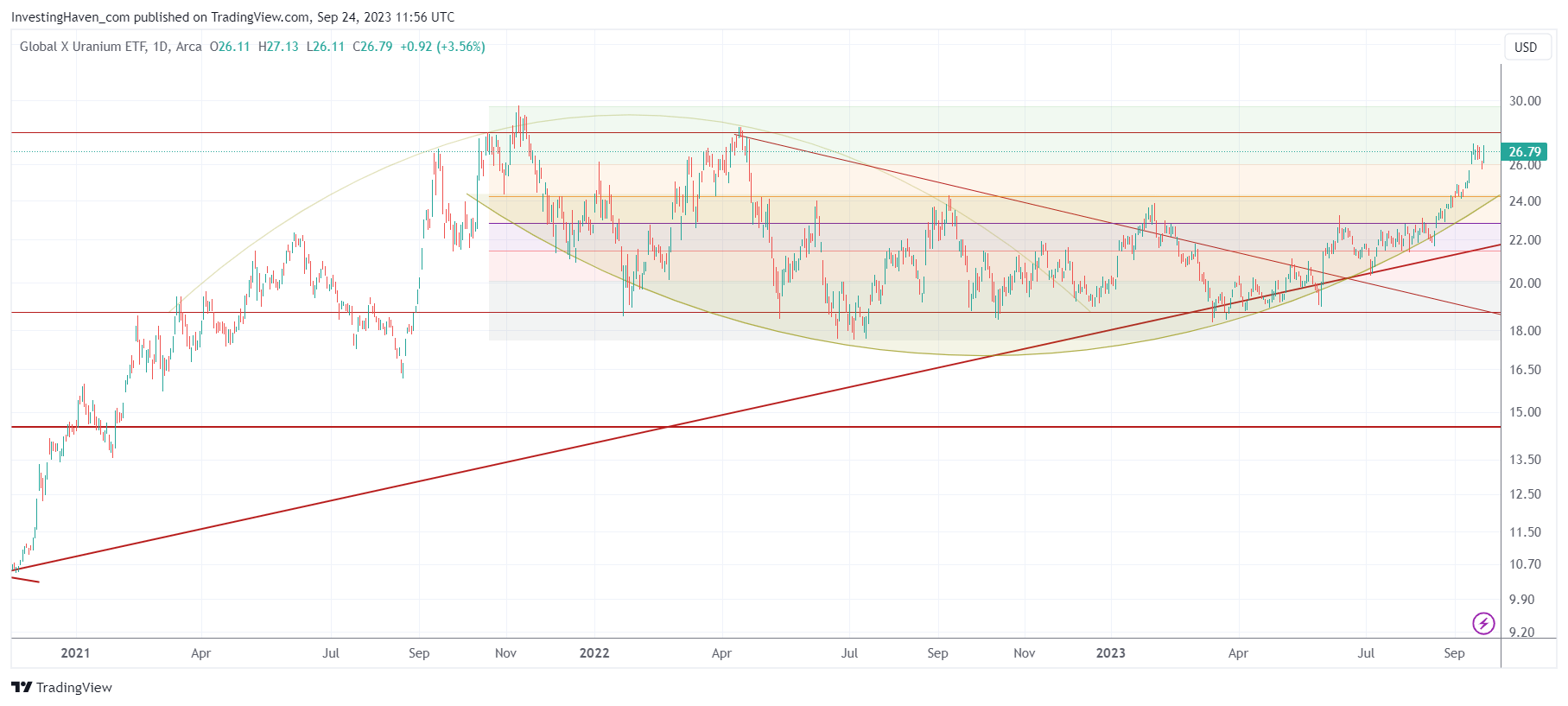

Second, URA ETF had to clear 24 points. That’s what it did about a week ago. Breakout confirmed.

The next resistance level comes in at 29 points. Once above 29 points, it’s a “clear sky play” with tons of upside.

Forecasting how exactly the market will behave at the next resistance level is an impossible task. It is one thing to forecast a direction, it is another thing to understand the reaction of the market when a specific market hits overhead supply.

All we do know is that (a) the spot uranium resistance level is a soft one (b) the long term URA ETF has plenty of upside potential, it’s not even remotely close to its former highs.

Is the breakout in uranium confirmed? Yes, the leading indicators defining the dominant trend in the uranium market confirmed the breakout. While those leading indicators will meet some resistance in the coming weeks, right above current levels, we expect resistance to be taken out, sooner rather than later. How the market exactly will behave when hitting overhead supply is impossible to forecast, so the market may need longer before exceeding the next resistance levels.

We published 6 uranium top picks. If you’re eager to uncover the potential of these top 5 uranium stocks and stay ahead of market trends, consider becoming a premium member so to access the top picks, both uranium and one other sector, in this guide which is only available to Momentum Investing members Alternative Energy – Top Stocks Selection >>