Once upon a time commodities were the hottest asset class. That’s before the big crash of 2008 hit. It was a time of breath taking rallies in gold, silver, copper, uranium, softs, and so forth. Last decade it was truly different: it was breath taking as well, but the crashes were main stage in the commodities space. We expect the coming years to be good for commodities, starting this year. We are about to write a market forecast 2021 on commodities, but in this article we share a teaser.

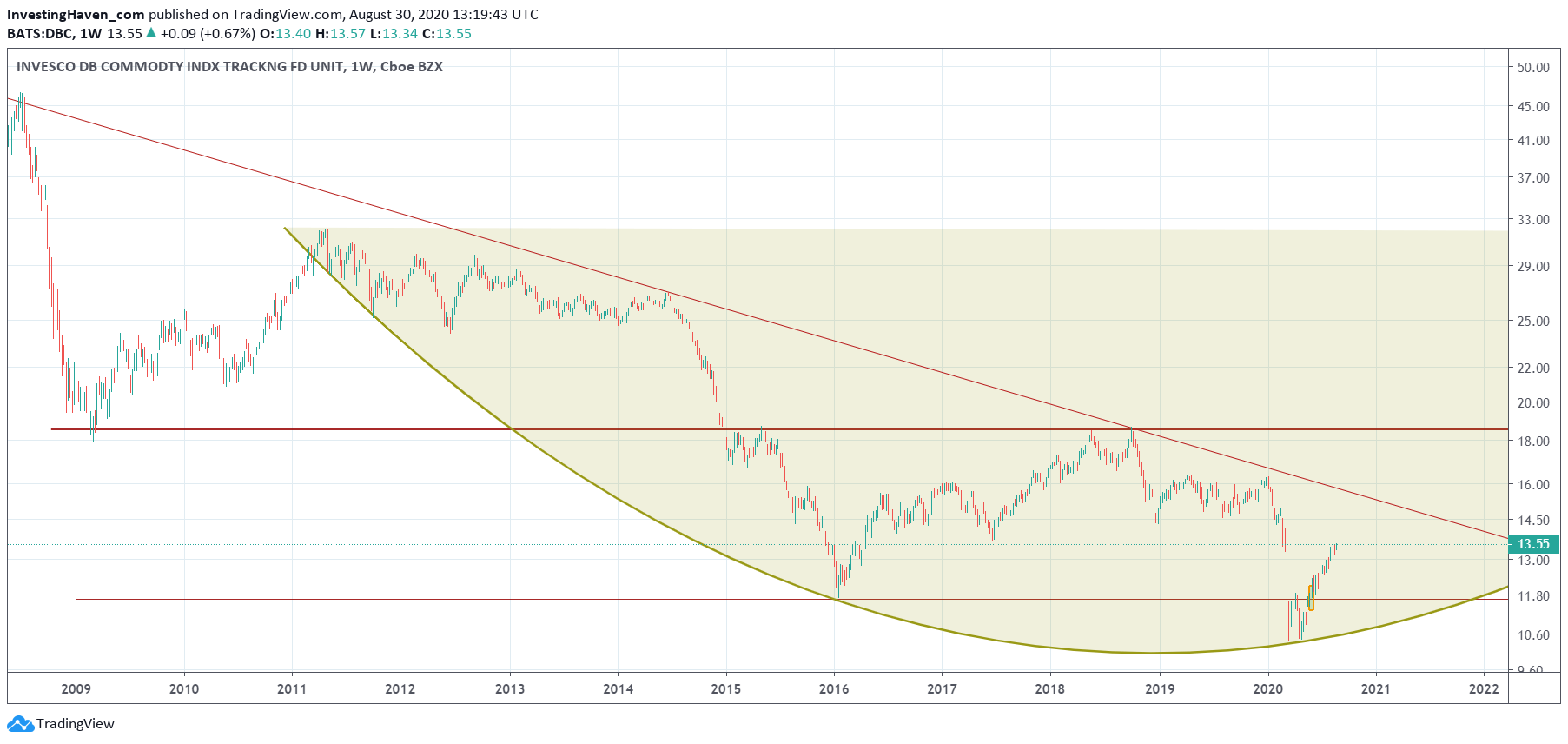

Let’s focus on one, and only chart in this article: the commodities index.

Below is the weekly chart since the 2008 sell off. We get the point that such a long term timeframe requires a monthly chart but we want to show one specific point here (it’s not about the details for the purpose of this conversation).

The two things that stand out on this chart:

- The giant reversals, the one below 19 points in the context of the larger one below 32 points.

- The falling trendline since the 2008 peak.

What’s the point we want to make with this? In the end we *only* look at 2 points on this chart, while there is so much more to discuss both on this chart as well as so many other commodities charts.

The point is simple: commodities are soon about to start a new uptrend as their long term basing process is near completion.

A select few commodities are already in a strong bull market, think of gold and silver. Palladium was ultra strong last year.

The way this will play out is simple: commodities will start rallying, one by one, but within the context of groups. Think of softs, metals, grains, etc.

This giant bounce post-Corona did bring a few commodities to higher than expected levels. Think of gold and silver, they did exceed our bullish targets as per our gold forecast and silver forecast.

Once the falling trendline is broken to the upside we will see an acceleration. That’s when you already have to be in a few select positions.