Commodities have been extremely volatile in 2020, the Corona crash year. We did not forecast the exact evolution of this market when wrote our annual market forecasts last year. However we did predict to be selective with commodities. And that’s exactly how investors were successful in the commodities space in 2020. Our 2021 forecasts are coming up but we want to cover the high level trend of commodities in this short update.

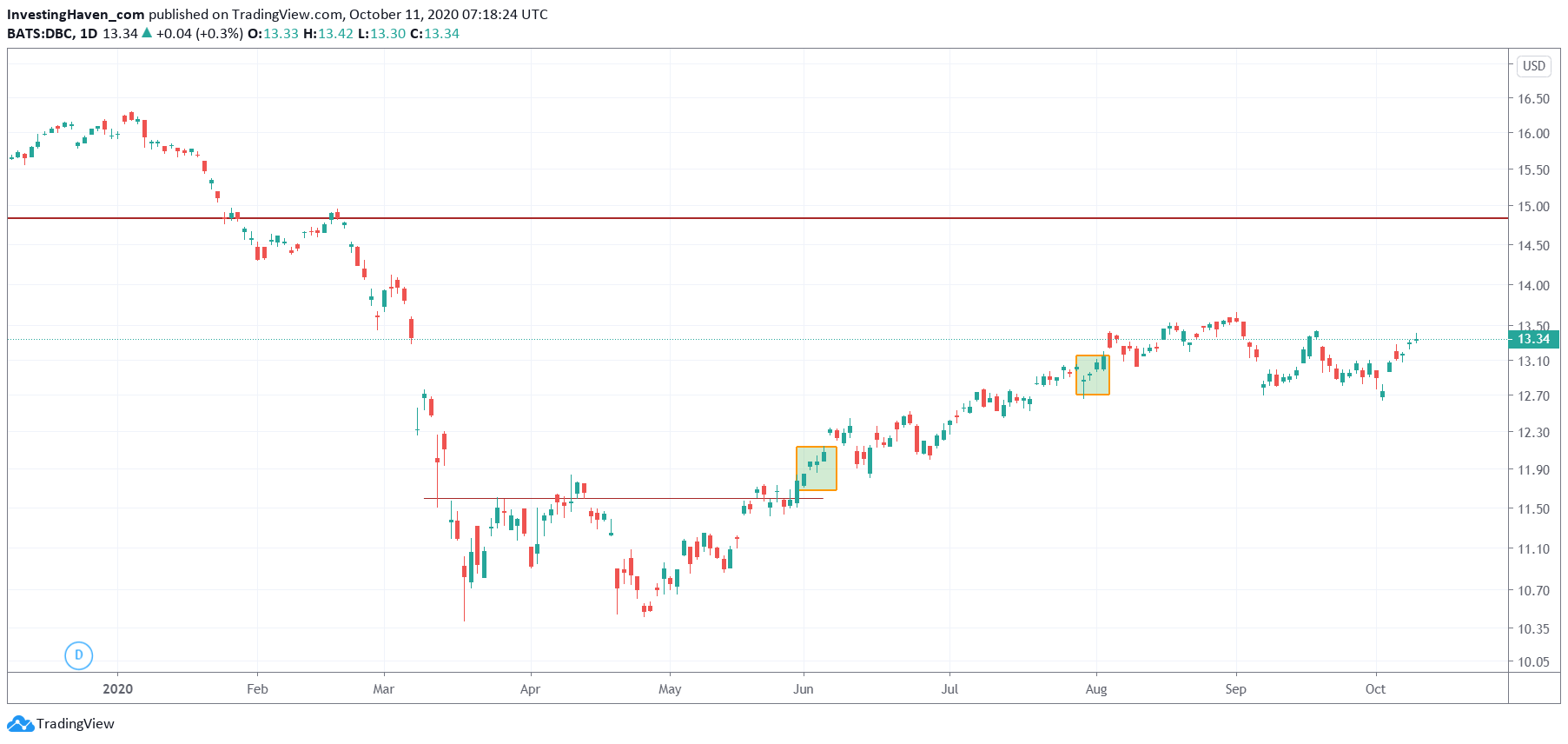

The pattern in commodities is reflecting the volatility. Not only do we see a fast decline in March, but also a pretty rough reversal that took more than 2 months (April and May).

The subsequent rally was pretty volatile, but there was an uptrend, for sure.

In the last 2 months it was again very choppy with a rough consolidation. This is the type of nerve wracking consolidation that puts both bulls and bears off guard.

Right now we may be seeing a constructive setup, with a nice bullish reversal over the last 6 weeks approx.

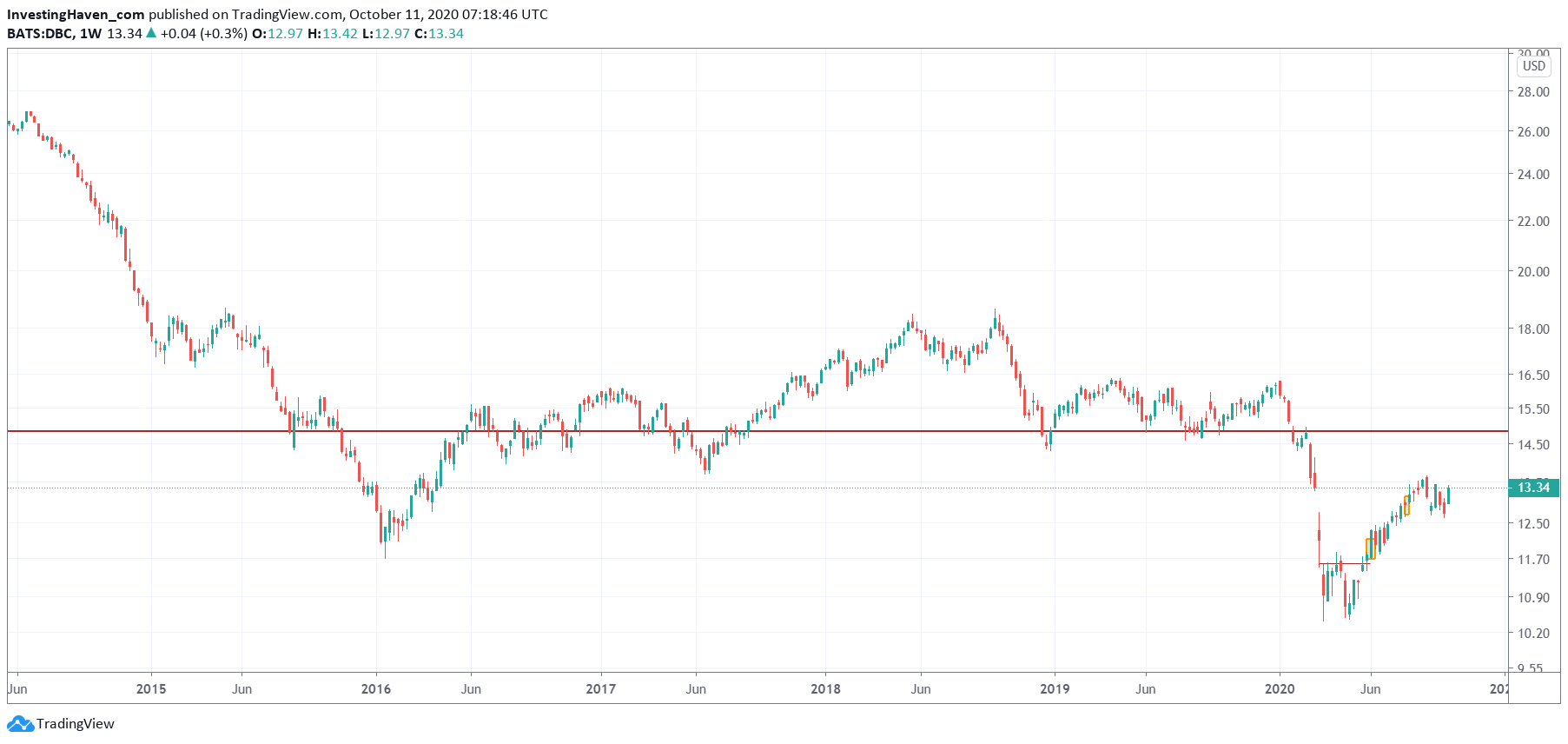

Looking at the big picture, the weekly chart, we see that commodities have some upside potential but not a lot until they hit good resistance.

The million dollar question is what will happen once DBC ETF hits 15 points.

How to play this?

On the one hand it is key for success to be very selective with the commodities investors choose. It requires some good analysis to find the most attractively looking commodities. And it’s a must to look across the board: softs, grains, base metals, rare metals, precious metals, energy.

On the other hand it is important to enter now, and not wait until DBC ETF hits resistance. That’s because volatility will pick up near resistance, and staying in a position becomes so much more challenging.