Commodities are breaking out, and we better don’t ignore it. Our 2021 forecast for commodities was bullish, and we said to focus on some select commodities. As the entire index is breaking out, it is clear that an investing portfolio deserves some allocation in commodities. We forecast that some commodities will do very well in 2021, some moderately well.

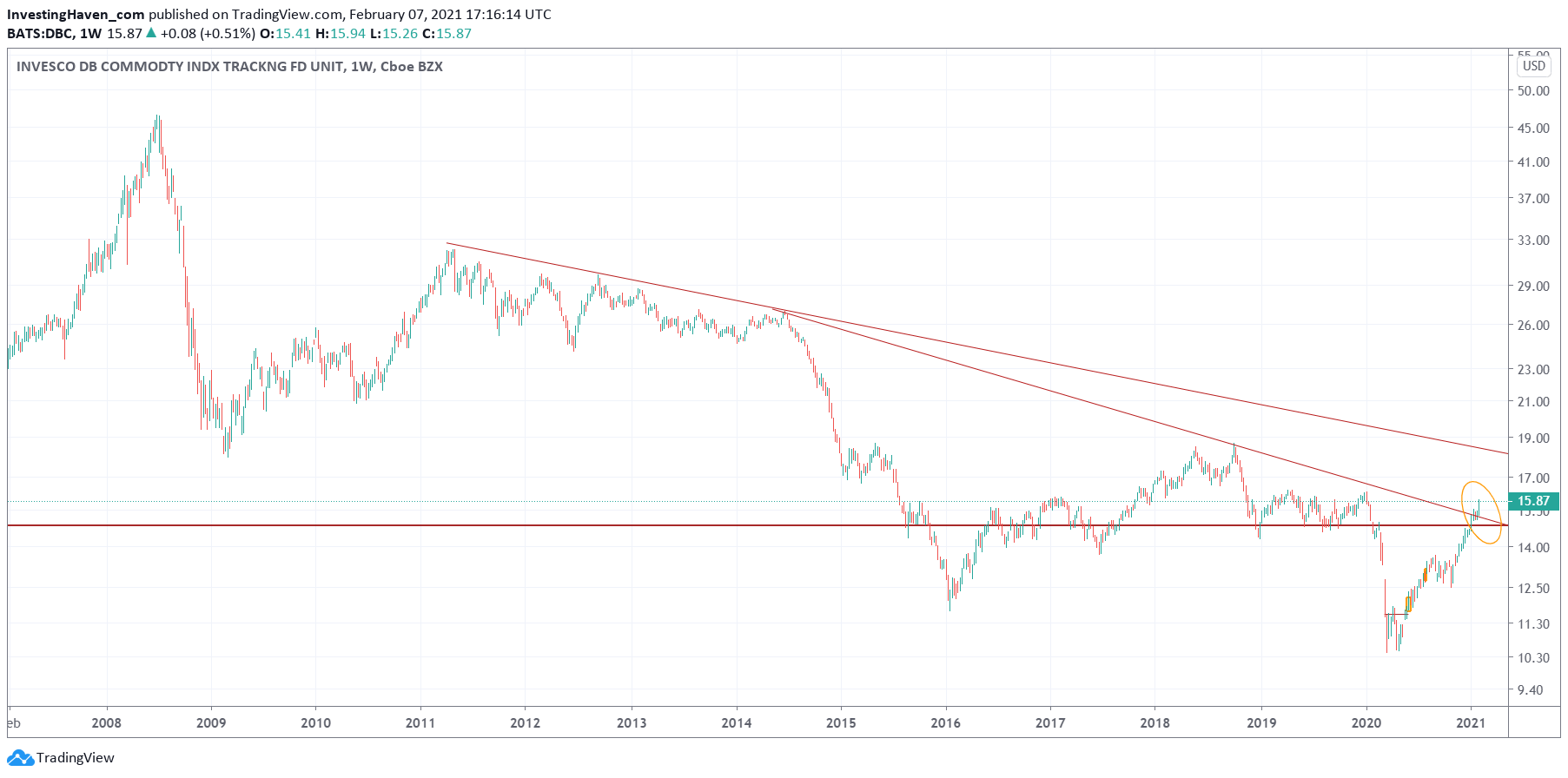

We feature the long term commodities index chart in this article: DBC, weekly timeframe.

Simplicity is often what works best when charting, and this chart is an illustration of this best practice.

A horizontal trendline that provided support in 2019 was broken to the upside recently, and now we see the 2014 downtrend (trendline) also broken to the upside.

It is crystal clear: this index wants to move 20% higher, and crush the highest and last falling trendline.

Whether the USD chart will break this trend is questionable. The USD shows strength, but this is likely on the short to medium term timeframe. It can create a healthy retracement in stocks, but not trigger a crash nor stop this solid new trend (bull market) in commodities.