The 2020 crash sent fear assets through the roof as explained in Peak Fear Hit Historic Record on Black Thursday. Stocks have been crashing, and one of the drivers was of course the once-in-a-history type of decline in interest rates (especially the speed at which the decline happened). The other driver, from an intermarket perspective, was crude oil. In any other instance that crude oil crashed we always had armaggedon style stock markets. Guess what, crude oil completed a decline that was in the making for 11 years! This is another important ‘exhaustion selling’ signal on our list, and the list is growing.

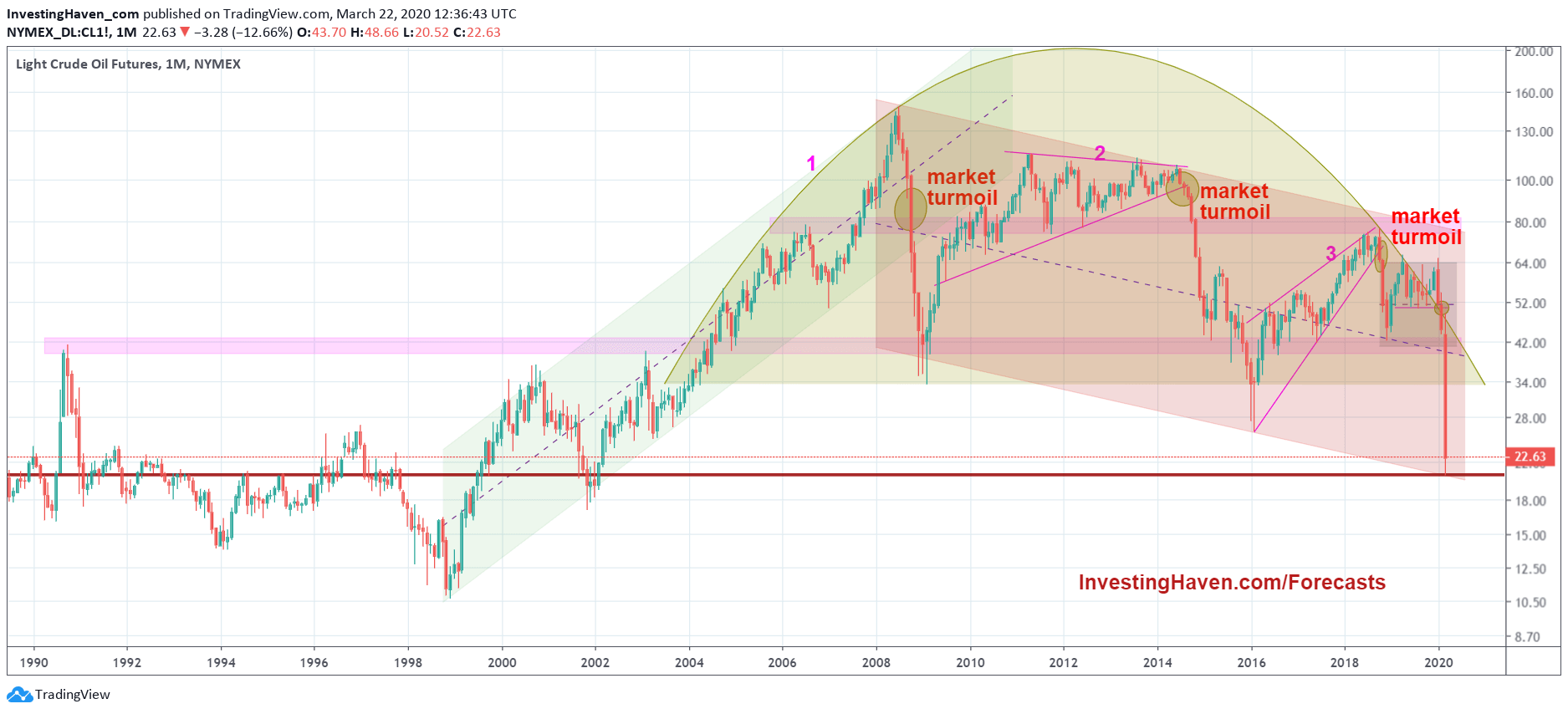

Could anyone imagine that the 2008 top in crude oil as well as the crash lows in 2015 would forecast this week’s crude oil lows?

The chart was able to forecast this, and the red falling channel on below chart visualizes this.

In hindsight it is always easy to make this point of course. Over here at InvestingHaven we have not been looking into the details of the crude oil chart because did not expect the energy sector to be an interesting sector to invest in.

However, the crash forecasting function that crude oil also performs is one we better paid attention to. Never again will we lose sight of this.

After analyzing the crude chart for a few hours we did find that the recent lows of this week (other than being scary) also suggest selling in crude oil is largely over.

- Crude fell to the lows of the 11 year bear market in the context of a giant rounding pattern.

- The current lows were once resistance, in the 90ies, and became support in the subsequent bull market.

Now crude may fall a bit lower, say into the 17-18 area, but we expect this to be the final drop.

With that we also expect crude oil’s pressure on stock markets to fade.

It’s one of the several signs that signal exhaustion selling, or at least exhaustion being near completion. Sounds strange? It shouldn’t because markets look a few months ahead into the real world economy and events. In a few months from now the worst of this Corona crisis will be over, and markets will react much faster.