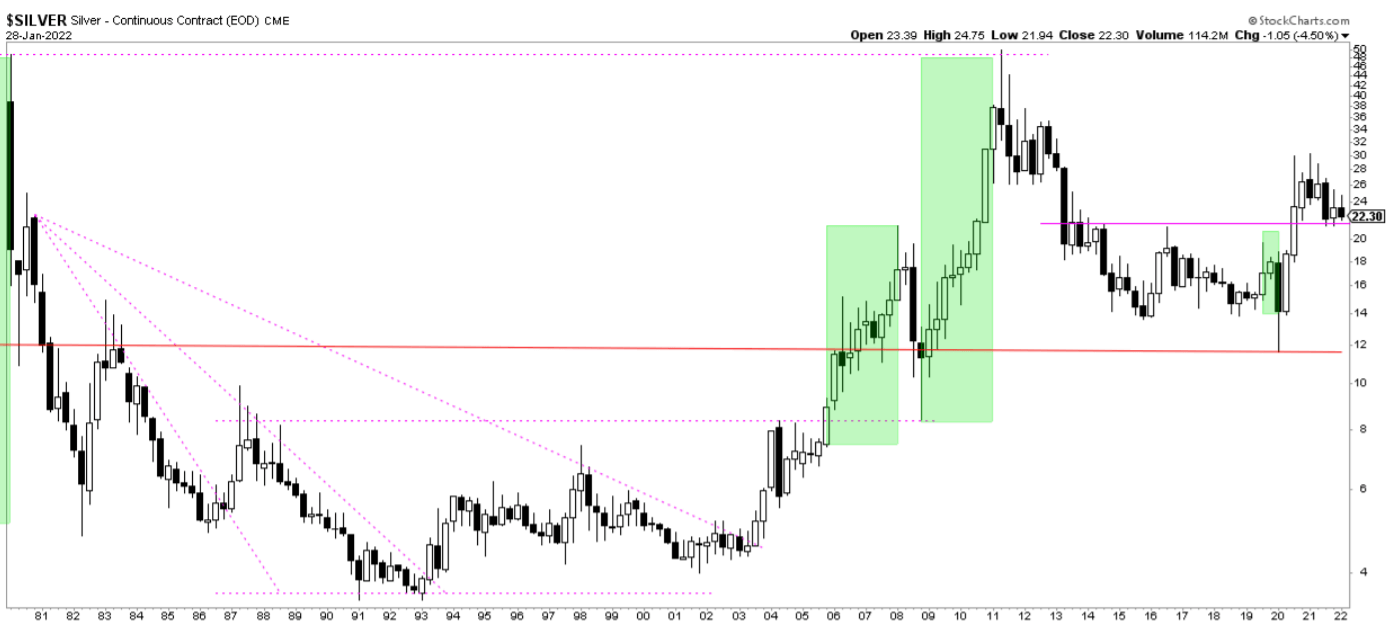

We said so many times, and we’ll keep on repeating: bullish silver long term. In our global trends chartbook, sent to our premium Momentum Investing members yesterday, there were only a few long term charts that really stood out. In the commodities space we are impressed by some agricultural commodities, in stocks we found a few bullish reversals in regions like Latin America and U.S. insurance, and then there was this monster bullish reversal on the longest term silver chart. Amazing, absolutely amazing, and it’s a matter of time until silver will be bullish again. We stick to our bullish silver forecast, and eagerly wait until the USD rally has run its course.

Admittedly, the first chart we will share is a very long term chart. One candle represents one quarter. It’s a very long term chart but the point remains valid regardless: this is a super bullish long term setup.

The very long term cup and handle reversal will eventually resolve to the upside.

Think about it, commodities are on the rise, all of them. Metals hit new highs, one by one, in the last 12 months. Silver is some 60% below ATH while it has the strongest bullish reversal setup of all commodities out there.

Arguably, silver IS the most bullish reversal chart ever.

As said, silver has to survive the USD impact. As the USD rises to 100 points silver must hold its recent lows.

Another reason why silver is not ready to start its bullish trend immediately, other than the USD impact, is the futures market structure. The net short position of commercials has to come down a bit more, see the blue bars on the 2nd pane on below chart.

As seen on the last pane on the above chart open interest in silver has been depressed. It is starting to show first signs of life.

All in all, the picture in silver is really clear: open interest starts rising which is happening right at a time when ‘nobody is interested in silver’ (a great contrarian signal), the USD has to run its course, the silver futures market structure has to improve a little bit. That’s when silver might be ready to bounce from its support level at 21-22 USD to move back to 28 USD, it’s long term resistance, as step #1.