Commodities are on the move in 2018. One commodity in particular, Cobalt solution, has been moving quietly towards a breakout point. We believe cobalt reached a turning point and has a serious upside ahead based on multiple reasons. We will explore the reasons we are Bullish on Cobalt as a commodity and eCobalt as a potential play on the budding Bullish Cobalt market.

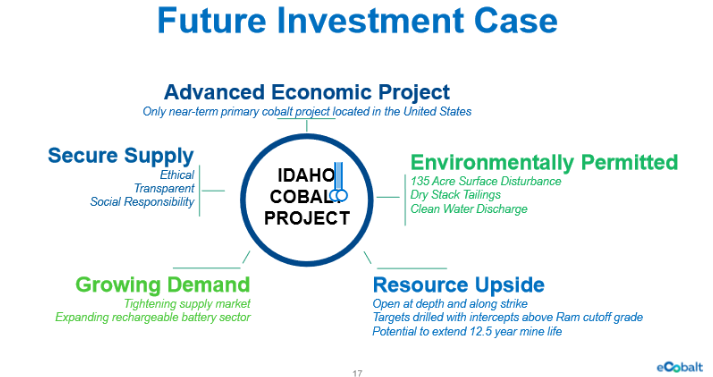

eCobalt solution, an environmentally permitted Cobalt mine with serious upside potential

eCobalt is a well-established TSX company aiming to provide clean cobalt products for the rapidly growing rechargeable battery and renewable energy sectors, made safely, responsibly and transparently in the United States.

eCobalt’s Idaho Cobalt Project (“ICP”), located in East Central Idaho within the Idaho Cobalt Belt, is the only near-term, environmentally permitted primary cobalt project in the United States. It is 100% owned by the Company’s wholly owned subsidiary, Formation Capital Corporation, U.S.

As a commodity, Cobalt has more upside potential based on the tightening supply in the market paired with the growing demand. Positive catalysts lining up for cobalt range from Apple in talks to buy Cobalt directly from mines, to GM challenging Tesla to build profitable electric cars , and BMW on the verge of multi year Lithium and Cobalt deal.

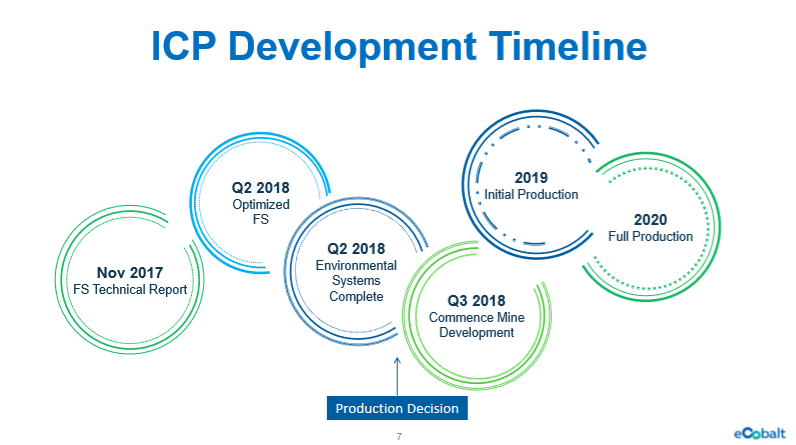

eCobalt Solution: Progress and production

The company is currently finalizing a new optimized feasibility study, building its production ready team and bulk sample shipped for pilot testing. The production is projected to start in 2019 and so far, the company has no debt. The risk associated is similar to risk associated with smaller caps and miners in exploration phases. There is no revenue yet, extreme volatility and vulnerability to sector / Industry performance and company news. For eCobalt, a key period is between Q2 and Q3 where the production decision will be made.

eCobalt Solution price Chart shows a spectacular Breakout, likely to continue.

After a 2 years consolidation period, eCobalt finally broke out and the price increased more than 6 folds. Impressive and given the current and future demand we foresee for Cobalt, Cobalt’s performance might outshine Lithium. According to Sprott:

“Lithium typically makes up a much smaller percentage of the overall raw material inputs than people think (as low as 2% by weight in some batteries, according to Elon Musk in this recent interview). In comparison, cobalt is used in significant quantities in the cathode component of batteries, which make up approximately 35% to 40% of the total material costs of a lithium ion battery cell2.”

Short term, the price could very possibly touch the top of the channel and continue in the ascending channel. If the demand in the sector really increases, we might see significant upside. However, we recommend caution given the market cap and given the fact that the production hasn’t started yet. This is a high risk high reward play so positions should b kept small.