When analyzing the gold market we pay special attention to junior gold mining stocks (GDXJ ETF). Why? Because junior gold miners tend to signal appetite for risk in the gold stock sector. Yes we hold a bullish gold forecast for 2020, yes we have a similarly bullish silver forecast … but this does not tell anything about timing. In the end timing is the only thing that matters when investing/trading.

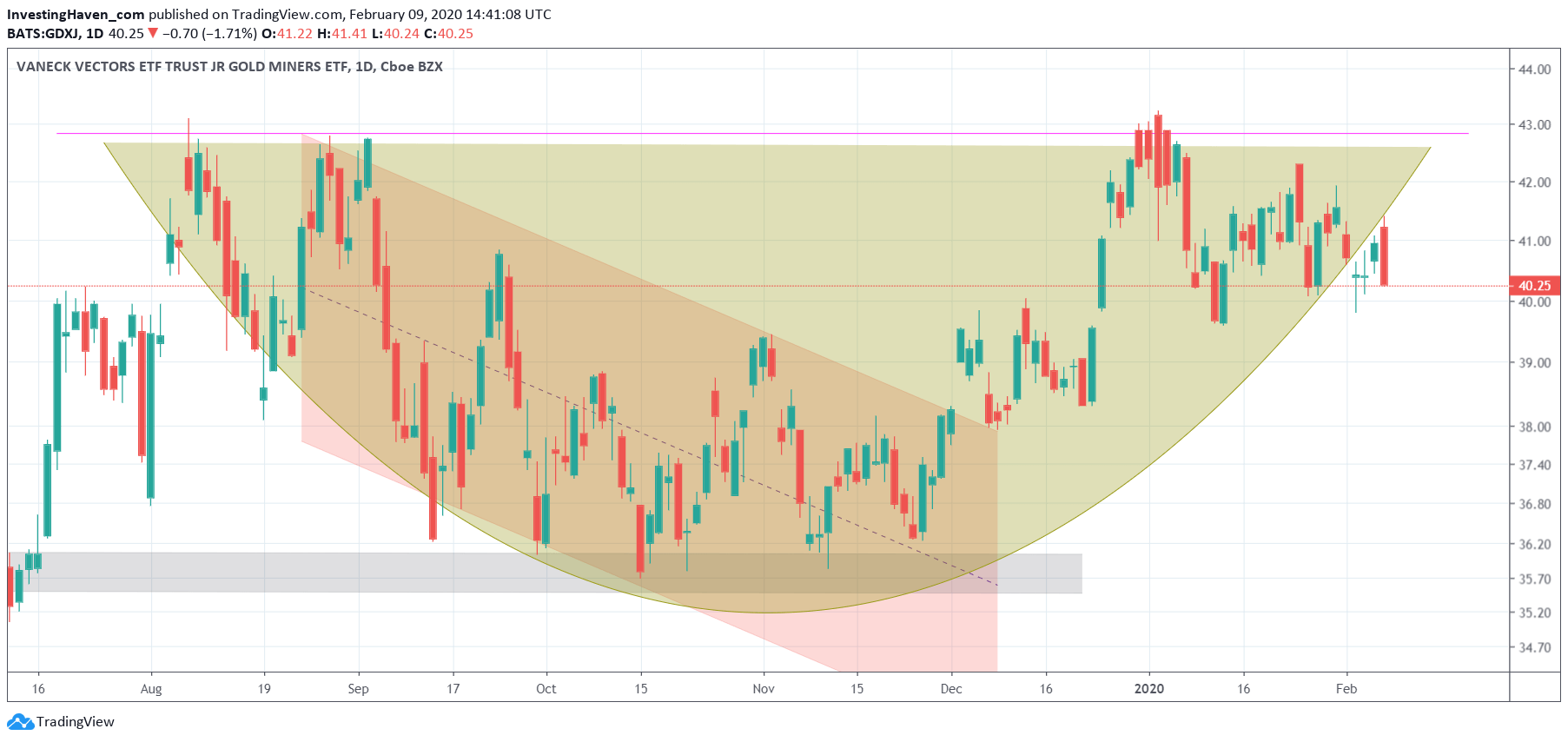

The GDXJ chart over 6 months makes an interesting point.

We easily identify this rounding formation which indicates a consolidation phase. In the last few days though this index declined, and has been testing the support levels of this 6 month pattern.

Look at the 4 most recent candles on this chart: they all live ‘outside’ of this rounding pattern but still touch it intraday.

There is a strong fight going on between bulls and bears in the gold market.

We believe that bulls have the benefit of the doubt. However, with the Euro Chart Raising A Red Flag we want to be very cautious.

That’s why we sold our gold mining position. That’s not because we don’t like that specific gold miner, also not because we believe this sector will not be bullish in 2020. It really is risk management that does not justify a gold mining position in the short term given the setup of the market.

THE most attractive market at this point in time is the gold market. We may rotate into gold miners.