We have covered silver extensively in recent months. We remain firmly bullish silver, it’s fair to say that we are as bullish as ever before. Premium Momentum Investing members received our top gold & silver selection recently, we believe those stock tips will do very well in the coming months. In the meantime, spot gold is taking a break after a failed breakout attempt. We believe it’s a matter of time until gold breaks out. How are gold miners doing in the meantime?

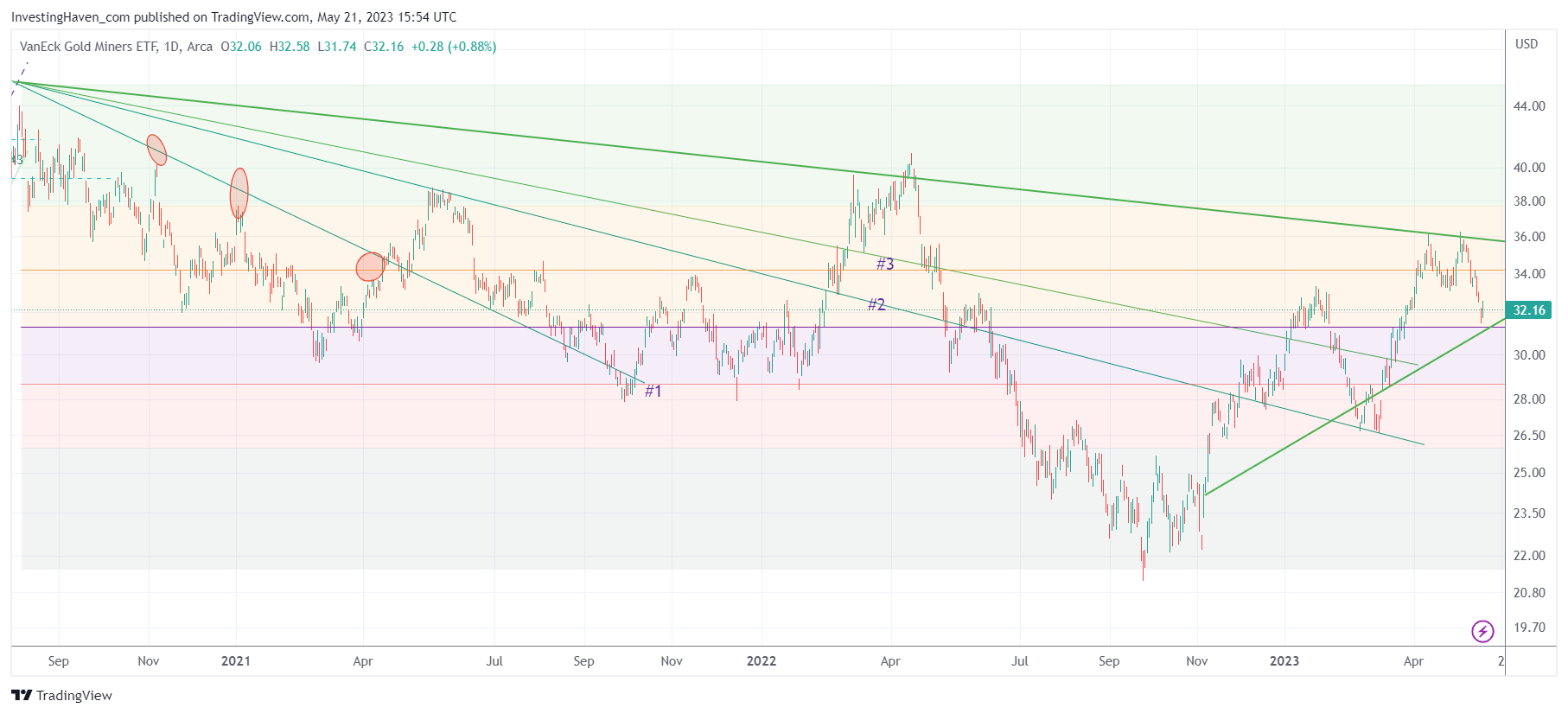

Earlier this month, we wrote Gold Miners: To Break Out Or Not? in which we featured the GDX chart. We mentioned that the dominant chart pattern of the GDX is a long-term bullish reversal. However, as with any chart pattern, it needs to hold to confirm its bullish nature. Let’s take a closer look at the key levels on the chart:

The long-term falling trendline in green is also being tested. It got rejected and resulted in a big downtrend last year in April. If it breaks through this trendline and holds above it, it would be a significant bullish sign.

If GDX succeeds in breaking out, it will be a secular breakout because it will have cleared all key retracement levels in case it moves higher from here. However, this is still an if, and we need to be cautious.

We concluded:

In conclusion, in case gold continues higher, the gold mining space will be on fire. Therefore, if you are considering investing in the gold mining sector, you should look for exposure to the strongest names in the ETF.

Two weeks later we have a confirmation that the secular breakout (attempt) did not succeed. As always, in any market, if a pattern provides resistance price falls back to support, a process that tends to go fast (accelerated price moves).

Here it gets interesting: the current price level in GDX, as seen on the daily chart featuring the multi-year reversal (since the August 2020 top) is hitting double support: the crucial 50% retracement level AND the 2023 rising trendline (green rising line).

Stated differently, if gold bulls will step in and over-bid sellers, we will likely have a bullish outcome. That’s because the area between the multi-year falling and 2023 rising trendlines (both green trendlines on the chart) is narrowing.

As with any volatile market, we reasonably expect a failed breakdown. GDX may fall for a few days below the crucial 31.25 level, similar to the failed breakdown in March. We stay focused on 5 day price action.

These are plenty of reasons why the next 2 to 3 weeks coincide with a make-or-break period for gold miners. We continue to believe that silver will be leveraged play on gold, that’s how our Momentum Investing portfolio is positioned.

We shared the two strongest gold stocks and one very promising gold junior with our Momentum Investing members earlier this month: The ‘Safest’ Gold & Silver Chart Setups.