It appears that gold mining stocks are a bargain. These 3 charts make it very clear.

In this article, we focus on two data points:

- The price of gold trend vs. gold mining stocks trends.

- The ratio of gold stocks to the gold price (gold miners priced in gold).

Both data points lead to the same conclusion: gold stocks are hugely undervalued.

Read our gold forecast and silver prediction.

Gold stocks get no respect

Let’s face it – hardly anyone wants to own gold stocks nowadays.

In a way, investors are ‘looking for bad news‘ as it relates to the gold mining space.

In a way, sentiment with regards to precious metals mining stocks is depressed primarily because those stocks move lower (sideways at best) amid rising stock indexes (Dow Jones, S&P 500, Nasdaq).

More importantly, what stands out, other than sentiment, is the epic divergence between a rising gold price, rising stock indexes, declining gold mining stocks.

Arguably, the most reasonable explanation is that gold stocks were hit by an accumulation of headwind effects: rising wages and crude oil prices (both are among their most important expenses), rising rates (most mining stocks have significant debt levels), opportunity costs (better to go for red hot AI stocks).

In taking a step back, this next chart tells a lot, the accompanying message as well:

Gotta love gold decisively making new highs completely off the radar.

The train is leaving the station and overwhelming skepticism is about to morph into a major opportunity.

Mining stocks still at distressed valuations are yet to reflect these changes. pic.twitter.com/BA5GJL7saJ

— Otavio (Tavi) Costa (@TaviCosta) March 2, 2024

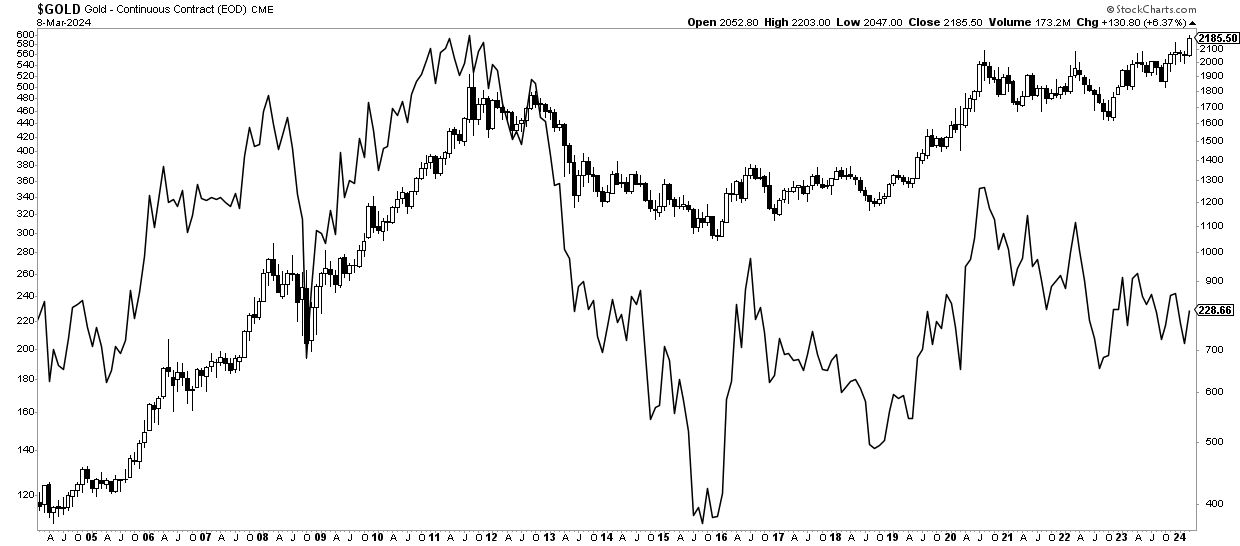

Gold price vs. gold stocks

The gold price has been on the rise in recent months.

At the same time, gold stocks have been declining.

The high level trends of both the gold price and the HUI gold miners index are shown below.

Gold mining stocks to gold price ratio – long term

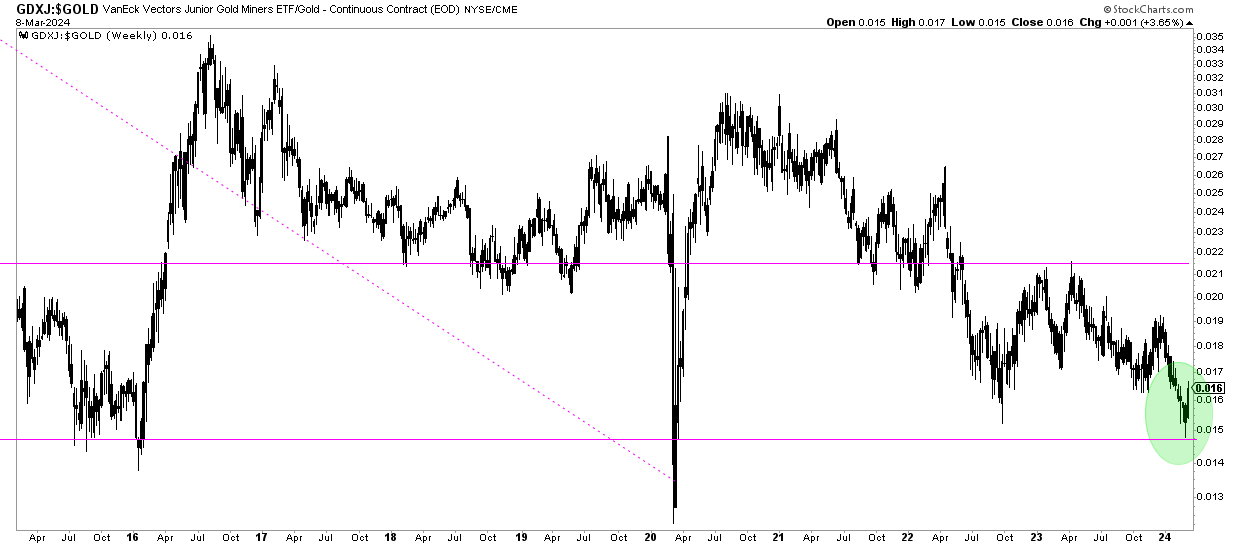

The ratio between gold miners and the gold price is what we need for more clarity.

That’s why we feature the ratio chart – a 9-year chart (below) and 20-year chart (lower).

First, the 9-year gold stocks priced in gold. We picked the more volatile group of gold miners – GDXJ (junior miners). What’s really interesting to note is that this ratio bounced sharply last week, right at the 2015/2016 lows and the 2022 lows.

In our mind, what matters is this: we have a very clear level to watch 0.015 points (GDXJ by the spot gold price). Readings below 0.015 points will be concerning.

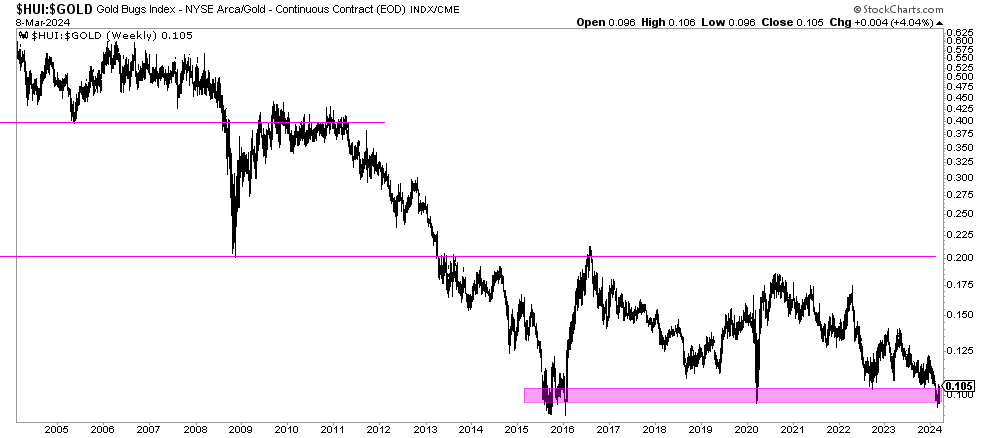

Historical gold mining stocks to gold price ratio

It gets even more interesting when zooming out.

The gold stock mining index HUI priced in gold hit a triple bottom (2015, 2020, 2024). The decline of this ratio since 2005 is extreme.

The triple bottom on this ratio chart, however, as a chart pattern, can also be very powerful – a bounce to 0.2 would be very normal.

One thing is a given – undervaluation in the gold mining space is extreme by all historical standards.

Similarly, a comparable ratio chart was shared on X a few days ago, confirming our observations and thinking:

The ratio of gold stocks to gold just dipped below 0.1 for only the 3rd time in ~50 years. pic.twitter.com/Wd66E3uSUg

— Jason Goepfert (@jasongoepfert) March 5, 2024

Precious metals miners undervalued

Gold mining stocks are a bargain.

But are they also worth buying?

Here is one data point that suggests that in each (but one) similar occurrence, in history, gold mining stocks reacted to the upside:

Gold mining stocks are showing some signs of life.

The % of miners with a rising 200-day moving average has cycled from fewer than 5% to more than 20%. The other times the stocks cycled like this, miners showed gains over the next 2-3 months every time but once, in 1997, which… pic.twitter.com/UH0V5jRhRH

— SentimenTrader (@sentimentrader) March 7, 2024

We believe gold miners are seriously undervalued, and worth picking up at these levels. That’s why we featured many more charts in today’s gold & silver premium update which we believe are worth your time and attention (log in required): Silver Continues To Exhibit The Most Bullish Leading Indicators + Unique Gold & Silver Mining Charts.