There we go again: lithium stocks on fire since a few days, and now it is cobalt (both the commodity and cobalt stocks) joining the party. Graphite stocks are about to turn bullish. The price of nickel is about to break out to new ATH. In sum, green battery metals are on fire going into 2022. They started the year in a great way as said for instance in our our Green Battery Metals Forecast but also our Lithium Stocks Forecast, they are about to end the year in a great way.

Earlier this year we wrote a great piece which will create wealth for investors that read and understood this: Which Is The Biggest Investing Opportunity Of This Decade. We identified 5 sectors that will outperform this current decade, and we had a strong preference for green energy and green battery metals:

Fifth, green energy. The technology but more so the inputs into green energy. Think renewable energy for transportation but also at home. Think electric vehicles. Think renewable energy, in broad terms.

We continued our thinking and writing, a few days later we wrote this The Super Cycle In ‘Green Energy’ Metals Starts In 2021:

EV sales data suggest that 2021 is the year which will be a turning point. While many are talking about and expecting the metals boom since many years it is only since 2021 that the demand side is ready to put pressure on the supply side.

And these assessments are all very accurate.

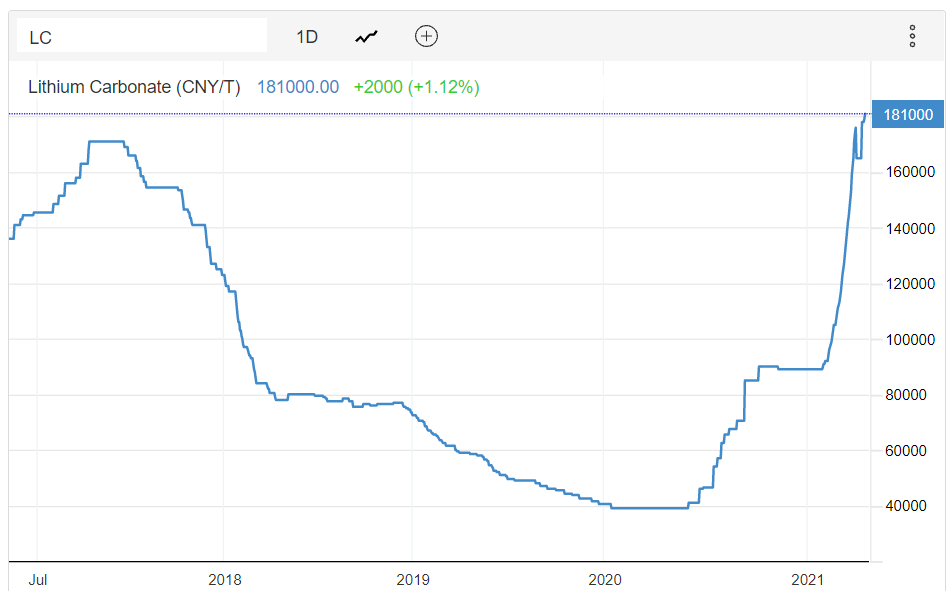

Look at the price of lithium: through the roof in 2021, and this clearly is not the end but more of a warming up (in the bigger scheme of things). Our best lithium stock tip in our Momentum Investing service (green battery metals tips for long term portfolios) is up more than 100% in the last 4 months.

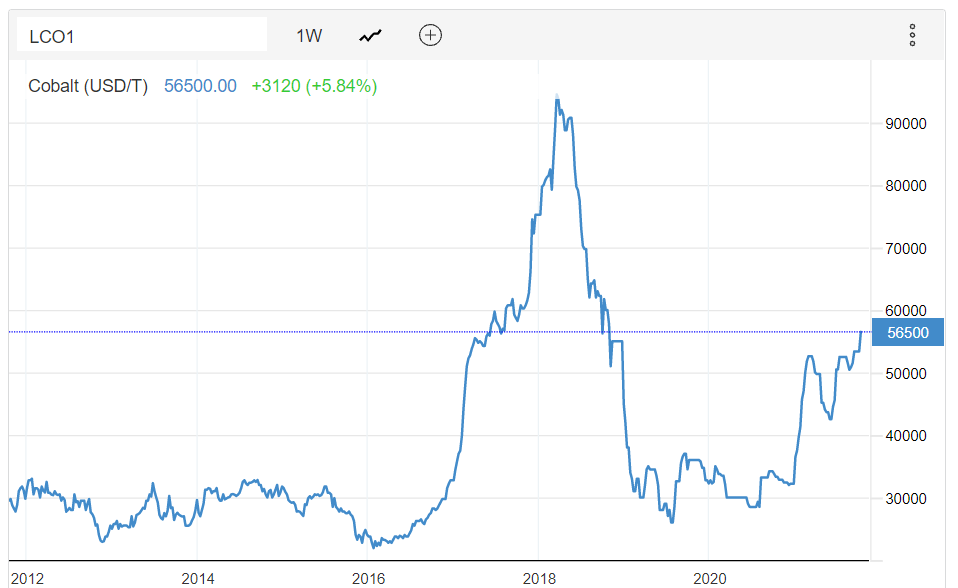

Cobalt had a great start of the year, slowed down considerably, but is continuing its uptrend now. In our Momentum Investing service (green battery metals tips for long term portfolios) we have 2 cobalt stock tips (one in Sydney, the other one both in Sydney and Toronto) that are set to move much higher. Cobalt stocks are starting to roar their engine, it’s just the beginning.

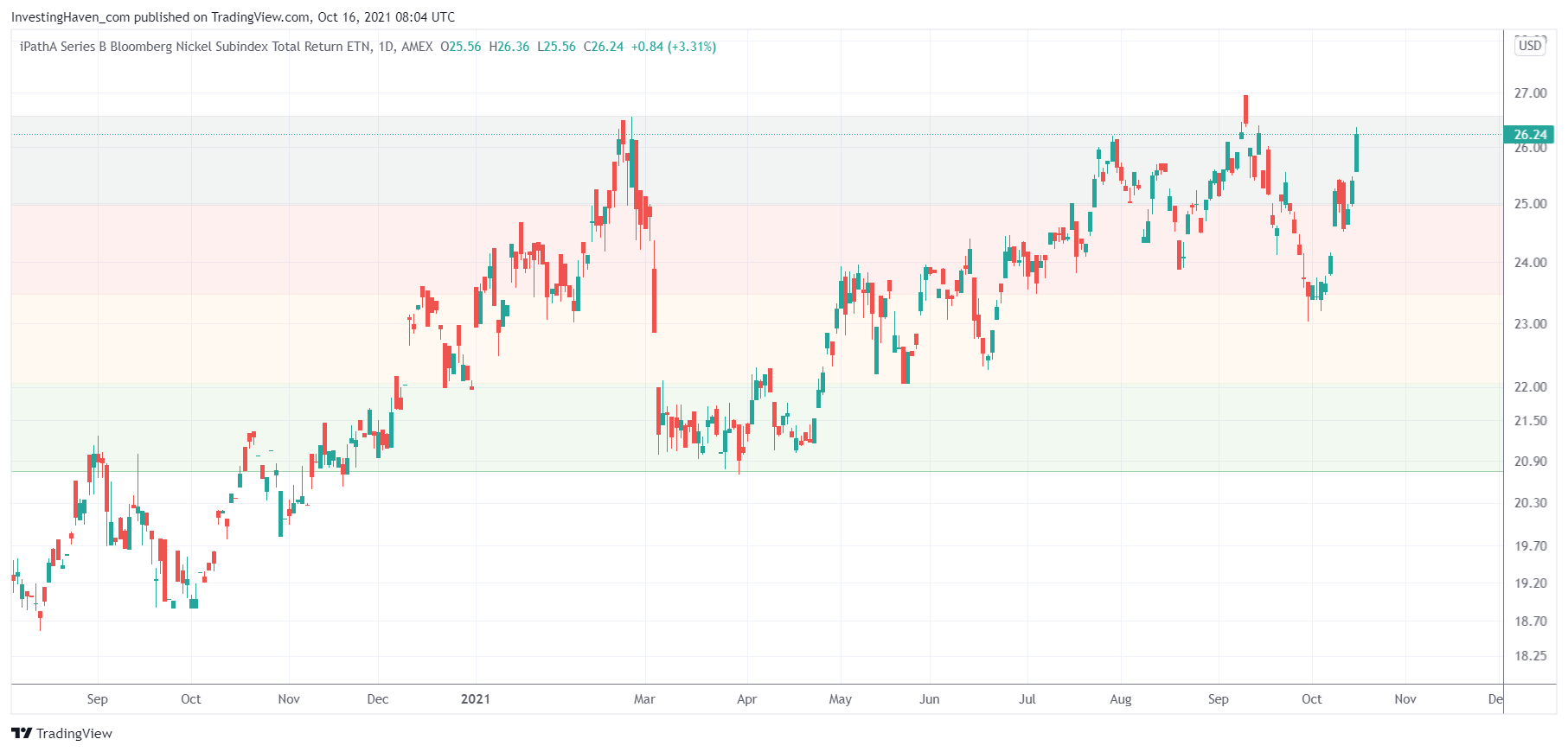

The price of nickel (another strategic metal or green battery metal) is clearly is a strongly bullish mode.

The problem with nickel stocks is that they are not as solid as lithium and cobalt stocks. So we don’t feature nickel stocks in our Momentum Investing green battery shortlist.

What about the other strategic or green battery metal: graphite?

Very simple, there is no spot market for graphite, so we can’t include a chart. Moreover, graphite prices were pretty weak over the summer but are right now starting to turn green on a 7 days basis. Graphite stocks should turn bullish soon, and we saw the first encouraging signs on Friday. Our green battery metals stock list features 2 graphite stocks in Sydney (not elsewhere available).