There are signs of rising inflation. Intuitively, investors may think of investing in precious metals because of their correlation. But is this correlation strong enough to invest money just on some inflation expectation news? We review Martin Pring’s inflation indicator, and how it relates to precious metals prices. It may provide additional support for our bullish gold forecast 2019 (GOLD) and silver forecast 2019 (SILVER).

Primarily this video published on Yahoo! Finance caught our attention. We will explore if and how inflation is correlated to precious metals prices in this article to understand if a precious metals investment is justified at this point in time.

Inflation rising into 2019

Prices for a lot of things in everyday life are going up. Especially CEOs are flashing a warning about this. The CEO of Coca Cola, which seems very well positioned to get these early signs, is one of them. That’s because of transportation costs as well as prices of ingredients.

There is more evidence of consumer price inflation. In the consumer space many product prices have increased in recent 12 months. A McDonalds Big Mac went up 4.7% against a year ago, Starbucks rose their price of a freshly brewed coffee with 8.9%, one of the popular Domino’s pizza went up 5.9%.

This interview suggests that the inflation trend is towards the 2% that the U.S. Fed, and other central bankers, are aiming for.

In general, at InvestingHaven, we do not attribute a lot of value to everyday news headlines. However, CEOs of leading companies, combined with other empirical evidence that was given in this video, seems a very reliable indicator to us.

Higher precious metals prices in 2019

It is easy to correlate inflation with higher precious metals prices. However, as most things in markets, the more obvious the higher the risk. That’s because if everything was predictable we would only have winners in markets. By definition markets need an equal dollar value of winners and losers (though the number of losers largely outpaces winners, as markets are a winner-takes-it-all place).

That’s why it is imperative to always validate your assumptions with facts and figures.

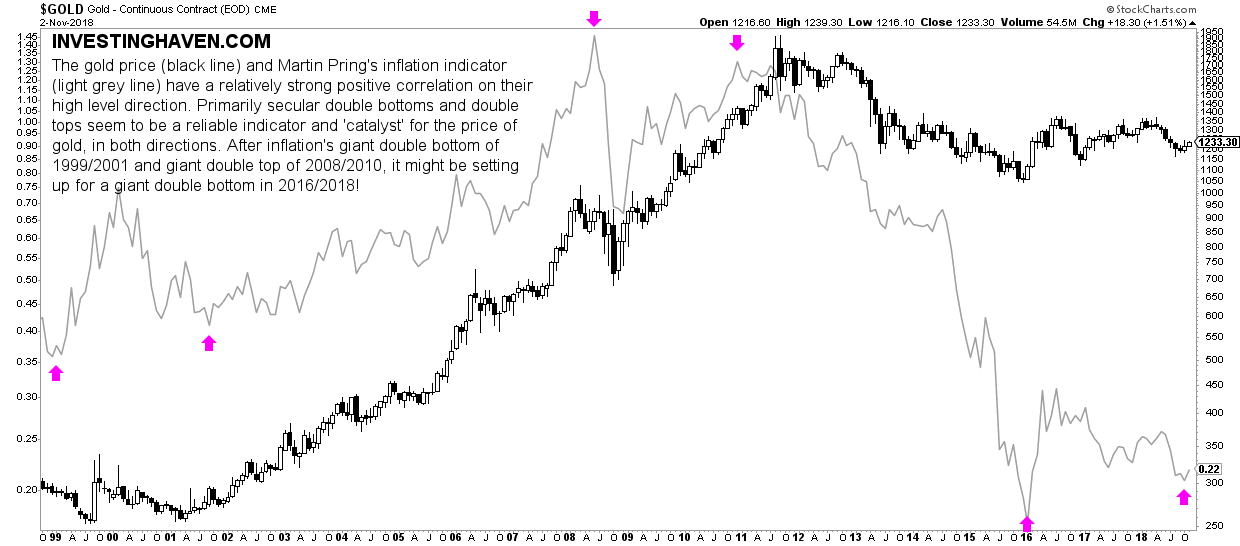

Likewise, the correlation between precious metals prices and inflation must be checked against each other. That’s what we do on below chart. It should precious metals prices overlaid by Martin Pring’s inflation indicator.

This is the key finding from this chart:

The gold price (black line) and the inflation indicator (light grey line) have a relatively strong positive correlation on their high level direction. Primarily secular double bottoms and double tops seem to be a reliable indicator and ‘catalyst’ for precious metals prices, in both directions. After inflation’s giant double bottom of 1999/2001 and giant double top of 2008/2010, it might be setting up for a giant double bottom in 2016/2018!

It is this last sentence that is key: “After inflation’s giant double bottom of 1999/2001 and giant double top of 2008/2010, it might be setting up for a giant double bottom in 2016/2018.”

The chart indicates the major double bottom in 1999/2001 (with a higher low) and the major double top in 2008/2010 (with a major lower high).

In a somehow similar fashion the 2016 major bottom may be a higher low against the 2018 bottom. With the inflation data point outlined above there is increasing evidence of a major inflation bottom which will certainly support precious metals prices in 2019. We consider this an additional confirmation on our bullish precious metals forecasts for 2019.