Dr. Copper is often referred to as a leading indicator for the global economy, able to forecast future economic trends. As copper is used extensively in industries such as construction, electronics, and transportation, its price trend is often seen as a reflection of the state and direction of the economy. In this article, we analyze the copper price chart to gain insights into the health and growth of the global economy, and how it relates to the doomsday predictions of experts.

Before deep-diving into the answer to this question, we recommend you read again the article we wrote the exact same day when the January bull run started (January 12th): Are Economic Experts Lying Or Confused Or Both? Moreover, we followed up, early March, with this article: Copper Says No Market Sell-Off In 2023. Are you Listening?

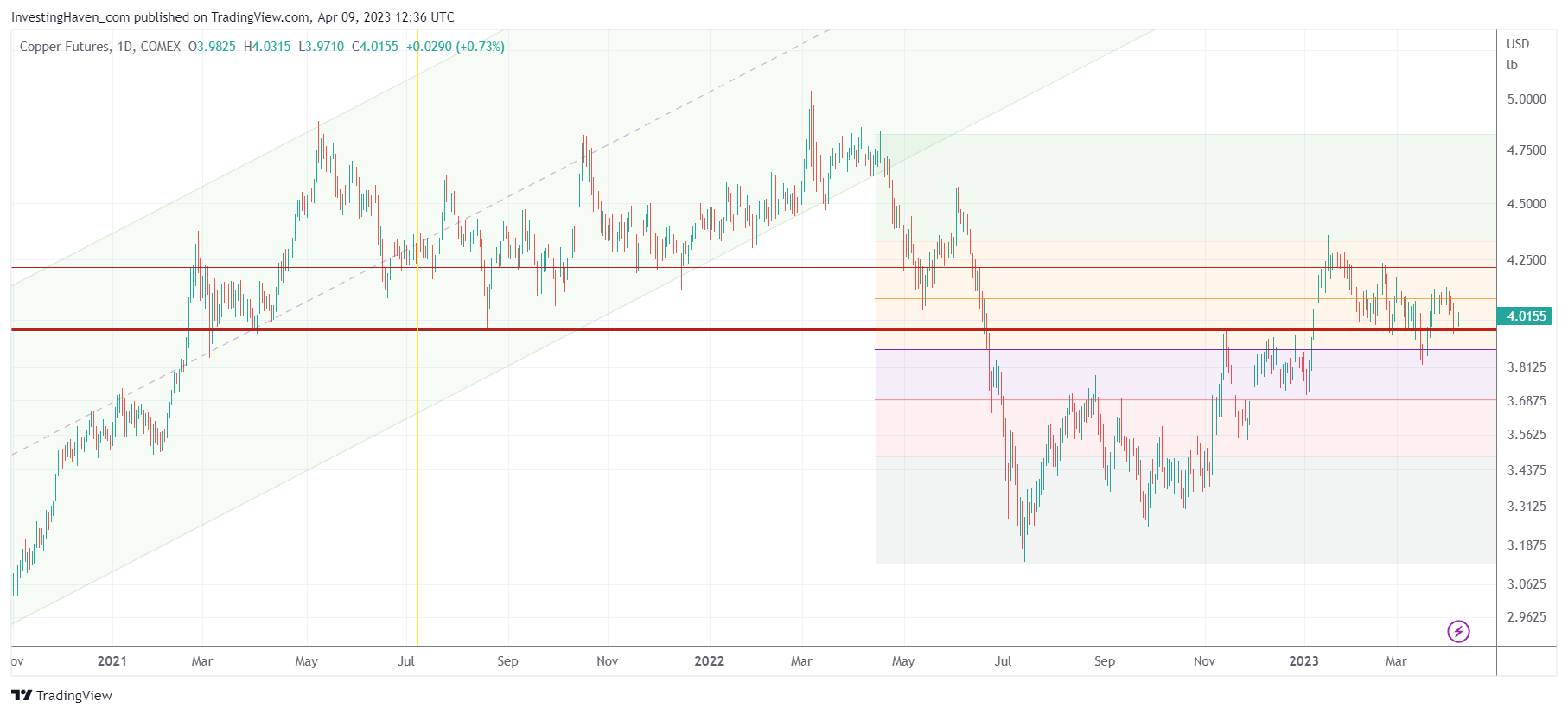

Taking a look at the daily timeframe of the copper price chart, we can observe that there was a nice uptrend in 2021. However, the uptrend broke in April of 2022, and since then, copper has been working on a reversal. It is not yet clear whether it is a bullish reversal or bearish reversal, but for now, it has characteristics of a bullish reversal.

One crucial aspect to note in this reversal is the importance of readings above the 50% retracement level. Such readings tend to create a bullish bias, and copper has been trading above the 50% retracement level since January 12th, 2023. In fact, it is flirting with the 38.2% retracement level (fine orange line) as of the time of writing.

This bullish outlook is in sharp contrast to the doomsday predictions of experts. Numerous articles mention experts, analysts, and other gurus which forecast a big decline in markets and a big recession. For example, an article in Forbes titled “Why We’re Headed For A Recession And What You Can Do About It” warns that a recession is imminent, and investors need to be prepared.

However, it is important to note that the copper chart is not the only indicator of the global economy, and these predictions are often based on a variety of other factors such as political events, inflation, and monetary policy. It is always important to consider multiple sources of information and analyze them in the context of the overall economic landscape.

In conclusion, while the doomsday predictions of experts are valid concerns, the message of the copper chart is in sharp contrast. The current trend and readings above the 50% retracement level suggest a bullish bias, indicating a potentially healthy and growing global economy.