The price of platinum (PLATINUM) stalled around $900 in recent days after we noticed that the platinum breakout was in progress two weeks ago. After our palladium forecast was invalidated it may be that platinum will become center stage. That’s because here is always a bull market in one of the 4 precious metals, as noted by InvestingHaven’s research team. Whether platinum will qualify as one of the 3 TOP investing opportunities of the year is not clear yet, it needs more work and a convincing break above $900.

Interestingly, Bloomberg published some data on the platinum market. It helped us understand that the supply/demand forces are supportive of higher platinum prices.

Platinum supply has outpaced demand for the past two years and the World Platinum Investment Council has forecast another global surplus this year of 680,000 ounces. However, that may change if the South African wage talks later this year break down and workers down tools for an extended period of time.

However, the flipside of this data point is that supply/demand helped to drive momentum in recent weeks, to the $900 breakout level.

As per Tsaklanos his 1/99 Investing Principles it is just 1% of price points on any chart that matter. The rest is noise.

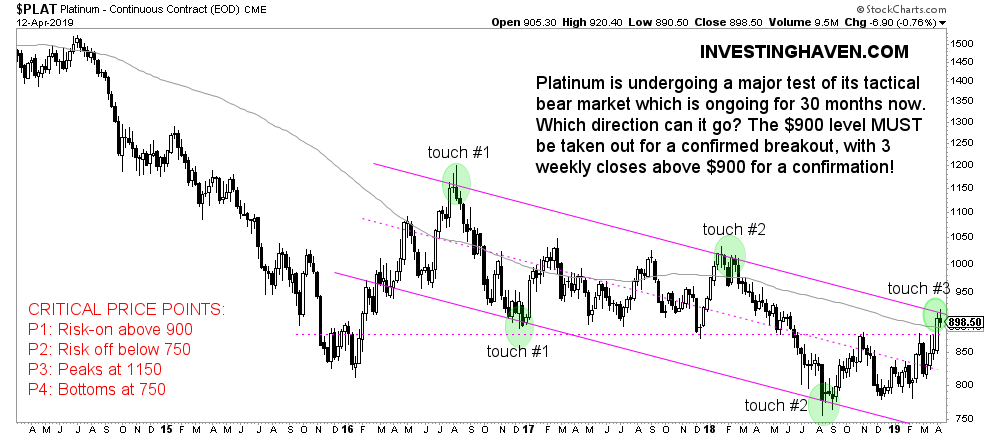

If we turn our attention to the platinum chart we notice the following 4 critical price points:

- P1: Risk-on above 900

- P2: Risk off below 750

- P3: Peaks at 1150

- P4: Bottoms at 750

So the platinum chart confirms the $900 level as THE single most important price point for platinum to turn bullish.

We want to see 3 weekly closes above $900 in order to become bullish on platinum. Platinum needs more work to get there, it is close but not there yet!