Our platinum price prediction for 2025 is mildly bullish. Platinum is forecasted to move between lows of $880 and highs of $1,250. Platinum will only exceed $1,250 in case of stronger than expected industrial demand.

RELATED – Platinum Price Seasonality Charts Suggest An End Of Year Rally Could Be Underway?

Platinum, often referred to as a “precious metal with industrial strength,” is expected to significantly lag the yellow metal (gold) and grey metal (silver).

Platinum has unique properties and market dynamics that make it a fascinating case for analysis. However, the chart and leading indicator don’t look overly fascinating when it comes to price expectations in 2025.

Ultimately, however, platinum should react to the upside at a later stage in a matured gold and silver bull market. That might be in 2026 or 2027.

Platinum has a track record of following gold and silver, during a precious metals bull market, but as the laggard.

In this article, we explore key factors influencing platinum prices in order to conclude with a platinum price prediction for 2025 based on various scenarios.

The state of the platinum market in 2024

As we approach 2025, it’s crucial to understand where platinum currently stands.

In 2024, platinum experienced a relatively volatile year with supply constraints driven by:

- Geopolitical risks and labor strikes in major producing regions like South Africa;

- Fluctuating demand from the automotive and jewelry sectors.

- Weakness in the green energy space and EV sector.

Those factors led to significant price movements.

The metal traded within a range, showing resilience but also facing headwinds from broader macroeconomic uncertainties.

Needless to say, as these factors may continue to influence the platinum market, we have to factor this in when analyzing the platinum price prediction scenarios for 2025.

Platinum supply and demand dynamics

Platinum’s supply Side

Platinum’s supply is heavily concentrated, with South Africa accounting for nearly 70% of global production. This heavy reliance on a single region makes the platinum supply chain highly vulnerable to localized disruptions.

In recent years, factors such as labor strikes, energy shortages, and regulatory changes have impacted production levels, leading to supply squeezes.

These issues are likely to persist into 2025, keeping supply relatively tight.

Platinum’s demand Side

On the demand side, platinum plays a crucial role in various industries.

The automotive sector is a significant consumer of platinum, primarily for catalytic converters in hybrid vehicles and the emerging hydrogen fuel cell market.

While the push towards green energy and decarbonization is expected to boost demand for platinum in hydrogen-related technologies, it is also clear that this green energy space has been tremendously weak in 2024.

Here is an illustration of an industrial trend that may potentially serve as a catalyst on platinum’s demand side – Hybrid cars throw lifeline to platinum metals:

- Demand for plug-in hybrids surges as EV take-up slows

- Some plug-in hybrids require more PGMs than petrol cars

- PGM market volatility could pick up if supply curtailed

Additionally, platinum is used in jewelry, electronics, and as a catalyst in various chemical processes, further diversifying its demand base.

Investment demand and green energy transition

Platinum is increasingly seen as a strategic investment asset.

Compared to gold and silver, platinum has a smaller market and often exhibits more volatility.

The green energy transition is a significant factor to watch. The use of platinum in hydrogen fuel cells and electrolysis processes is expected to grow as countries push towards carbon neutrality.

This shift could provide tailwinds for platinum demand in the coming years but only once strength returns in the green energy sector.

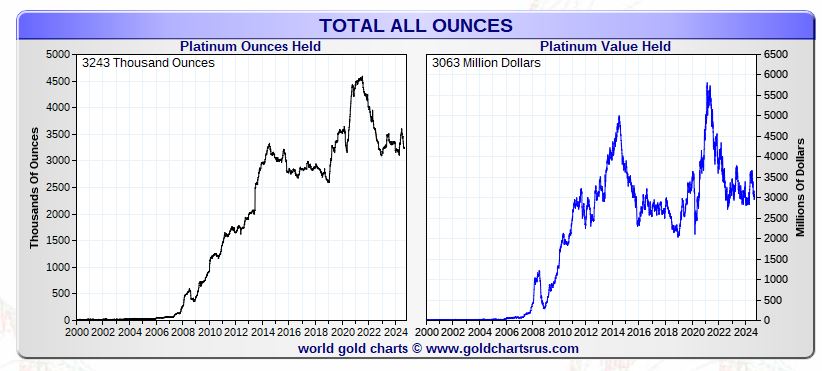

More important for now are trends in platinum exchange-traded fund (ETF) holdings.

As seen below, there is a very strong correlation between the price of platinum and platinum ounces held in ETFs, particularly since 2009. No surprise, in recent years total ounces held in ETFs are flat, similar to platinum’s price.

Platinum price correlation with the price of silver

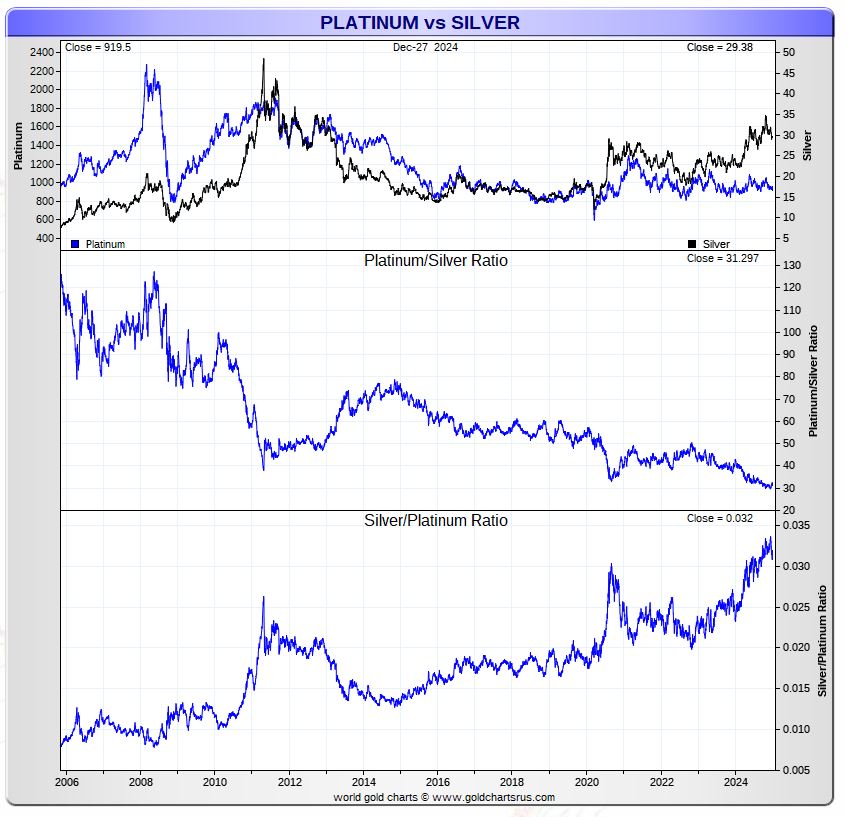

Platinum and silver, while both considered precious metals, often exhibit different price dynamics.

However, there is a historical correlation between the two, particularly during precious metals bull markets. Silver’s dual role as an industrial metal and a store of value can influence platinum prices.

Silver and platinum started diverging in 2024, as seen below, after they were strongly correlated between 2012 and 2023.

Our suspicion is that silver will need to stage a strong bull run before platinum will be ‘FOMOed’, and restore the decade long correlation.

January 3d – Platinum is weakening relative to silver. This relative underperformance may last for a little longer but history has shown that platinum will follow silver at some point in time. With a long term bullish silver prediction we believe platinum will also react to the upside although this may after 2025.

In 2025, if silver enters a strong bull market due to factors like inflation hedging, increased industrial demand, or speculative buying, platinum could benefit from a similar uptick in interest.

Monitoring the correlation between these two metals could offer valuable insights for investors considering platinum.

Platinum price charts

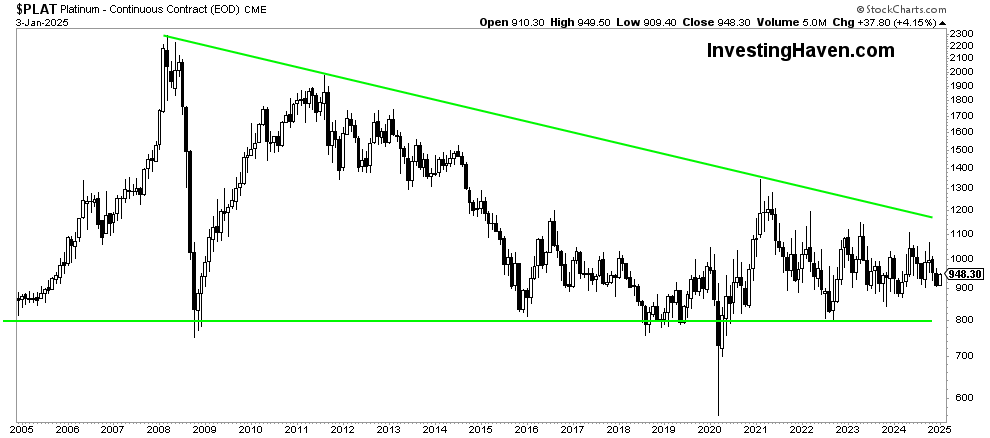

The secular platinum price chart has a long term triangle structure as seen on below chart.

The only positive attribute of this chart pattern is the higher highs in the last 2 years.

Until and unless $1,250 is cleared, there is no bull market in platinum.

January 3d – The long term chart pattern on platinum’s price chart starts looing pretty bullish. The triangle is bullish. It may take many months (even quarters) until the bullish nature of this pattern materializes. For a confirmed bullish breakout the following conditions need to be in place: platinum needs to move above the long term falling trendline, remain there for at least 3 months with closing prices above the falling trendline.

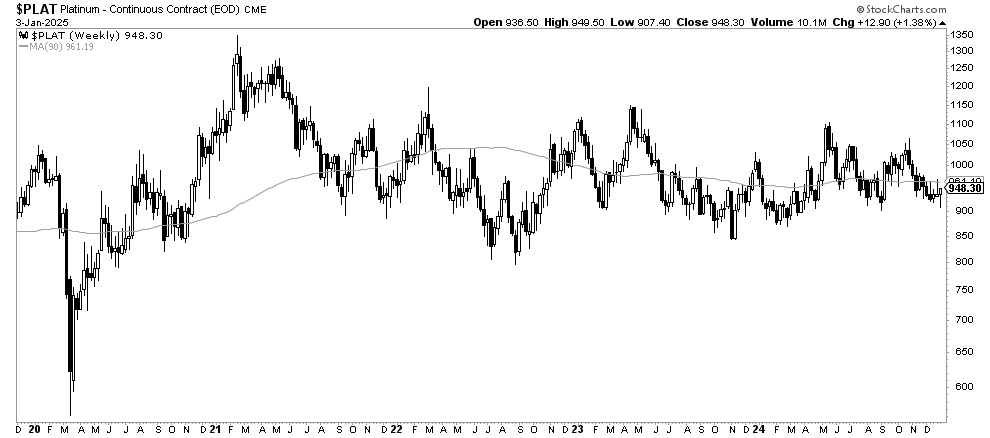

The weekly platinum price chart with its 90 week moving average illustrates our point made above.

January 3d – The consolidation on platinum’s weekly chart is orderly. In fact, this consolidation starts looking very bullish. When combining the data outlined above with the consolidation shown below, we conclude that any catalyst can spark a fire on the platinum chart. There has to be a demand side catalyst in 2025 though.

A platinum price prediction for 2025

Based on the factors discussed, we can outline several potential scenarios for platinum prices in 2025:

Sideways scenario

This is our expected platinum price prediction scenario. Platinum prices remain relatively stable, trading sideways. The market could see moderate growth in demand from green energy technologies. It will not be enough to cause a significant price surge. Probability: 45%.

Bullish scenario

Should the green energy space become attractive again from an investing perspective, platinum prices could rise to around $1,250 per ounce. This scenario assumes steady supply-side challenges. It also suggests a moderate increase in investment demand. Probability: 35%.

Very bullish scenario

In a highly optimistic case, a strong surge in demand could see platinum prices reaching $1,500 per ounce. Even in case the price of silver would rise strongly, which would be consistent with our silver forecast, we believe platinum will be lagging until 2026 or 2027. Probability: 10%.

Bearish scenario

Conversely, if demand growth weakens, platinum prices could drop below $800 per ounce. Probability: 10%.

Conclusion

Platinum’s price outlook for 2025 is shaped by a combination of supply constraints, growing demand from green energy sectors, investor sentiment, platinum ETF demand, and its correlation with silver.

The market presents several potential scenarios, ranging from sideways trading to a significant price rally or decline.

As always, investors should keep an eye on the evolving dynamics of the platinum market, especially its relationship with silver and its role in the green energy transition, to make informed investment decisions.